WTI Crude recovered the $90.00 barrier as supply is expected to get tighter. Oil adds ground for one more day in succession.

WTI Crude Oil Key Points

WTI gathers momentum for another day in a row at $91 .136.

The higher-for-longer rate story in the United States limited the upside for WTI prices.

Saudi Arabia and Russia’s voluntary limitations in oil supply raise oil prices.

Market participants will be watching the EIA weekly Crude Oil Inventory prior to the US consumer price inflation report.

At this point on Wed, the US crude oil the standard, (WTI), has traded at. $91 .136. WTI regains ground it lost. Amid forecasts of limiting supplies exceed worries about a bleak economic forecast dampening demand.

After the Fed’s move to hold rates of interest constant and make hardline statements this past week. The elevated-for-extended rate story in the United States limited WTI price gains. The fact is important to note that high rates of interest increase the cost of borrowing. That may weaken the economy and reduce the need for oil.

Furthermore, the strengthening of the (USD) adds to the drop in oil prices since stronger currency renders oil more-costly for owners of other currencies, thus lowering consumption.

Concerning the statistics, the (API) said on Wednesday reported US crude oil stocks increased by 1.586 M bls for the seven days ended the 22nd sept. Compared to the prior estimate of 5.25 million bls reduction.

The unilateral oil production curbs by Saudi & Russia, the globe’s both major oil producers. On the contrary, have lifted WTI pricing following the two countries declared prolonged oil extraction restrictions. Saudi oil production is expected to get nearer to 1.3 M bpd / by the end of the year of 2023.

WTI Crude Oil Excessively Stretched the Futures Trading

Approximately, 183 M barrels of oil and gasoline futures have been purchased by speculators in the past four weeks.

The proportion of positive to negative beters upon oil & fuels has nearly doubled to over 8:1.

Crude markets could be due towards a prices adjustment.

For the past 4 weeks, investors in oil has been devouring futures for the 6 largest transacted crude & gasoline derivatives in this market. That’s simple to understand the reason: the increase was sufficient for Saudi & Russia to release a prolongation.

Yet, investors are currently making so many positive bids that the price of oil, are on track towards a n adjustment.

Continuing on, investors in oil will look to the EIA weekly Crude Oil Inventory for the period concluding the 22nd for guidance. The US (GDP) Annualized for the Q2 will be issued on Thursday. followed by the Core (PCE) on Friday. Such changes might have a considerable influence on the USD-controlled WTI pricing. Oil speculators will employ the data to discover potential trades near WTI levels.

Crude current Traded Price

| Futures & Indexes | Last | Change | % Change | Last Updated |

| WTI Crude | 91.53 | +1.12 | +1.24% |

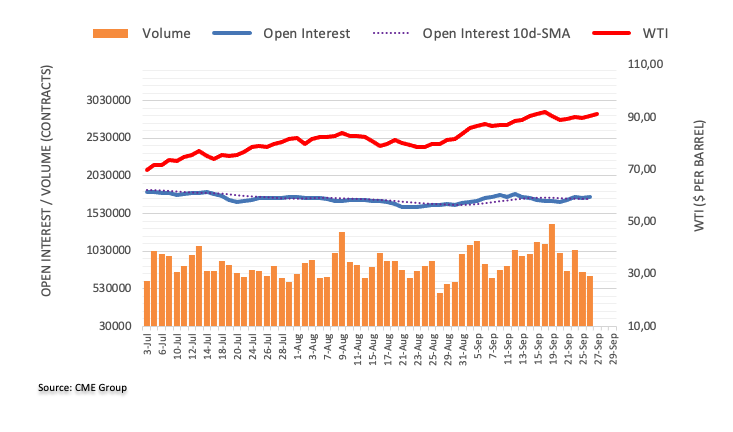

WTI Open Interest

Taking into account updated CME Group data for the oil futures exchanges, open interest. It continued to rise and increased by roughly 8.4K deals. Excluding the prior day drop. The volume, on the opposite conjunction, fell for another day in a row. At this point by about 61.2K futures contracts