Current UK Economic Landscape

The UK economy is in a state of cautious optimism, with recent data indicating a mixed but generally improving picture. The latest forecasts have upgraded the 2025 GDP growth projection to approximately 1.3%. However, this growth is a delicate balance, supported by public spending while being weighed down by persistent inflationary pressures and a significant downgrade in business investment. The overall trajectory suggests a slow but steady path.

Recent economic performance through Q3 2025 has shown resilience. The economy largely stagnated in July and August, growing only 0.1% month-on-month in August after a flat July. This moderation was a tale of two sectors: robust services provided a critical anchor, while a 1.3% contraction in production and a widening trade deficit highlighted ongoing external pressures.

Inflation and the Labor Market

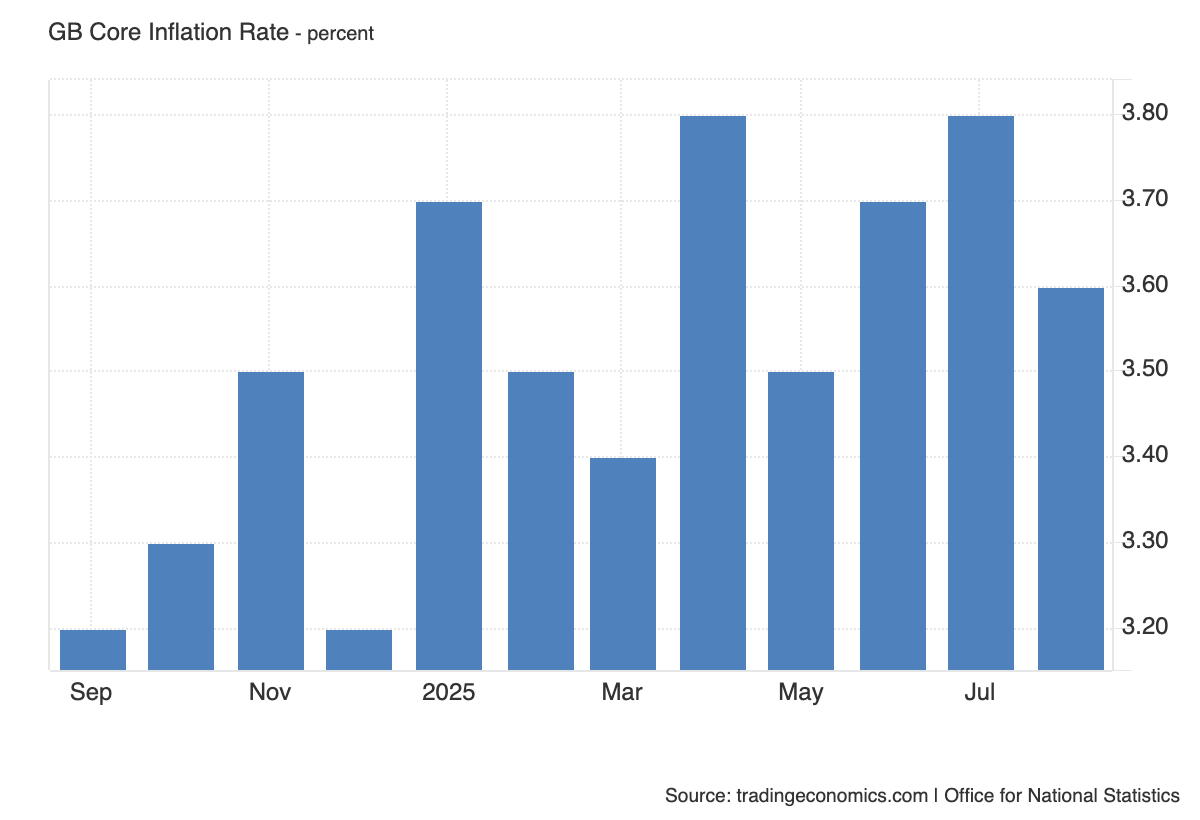

UK inflation, as measured by the Consumer Prices Index (CPI), remains a significant concern. The September reading was 3.6%, well above the Bank of England’s 2% target, and core inflation remains even higher. This stickiness is rooted in domestic factors, primarily a tight labour market and elevated wage growth.

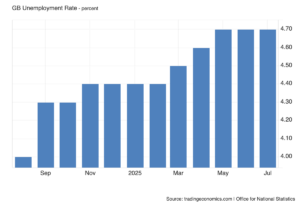

The most recent employment trends show a mixed but generally cooling labour market. The unemployment rate has seen an uptick, rising to 4.7% in the three months to July 2025, its highest level since August 2021. Despite this, wage growth remains robust, with average regular earnings growing at 4.8% in the May to July period. This creates a challenging paradox for the BoE: the economy is showing signs of slowing, but the core inflation metrics that guide their policy remain elevated. The number of job openings has also been in a sustained decline, falling for the 38th consecutive period, a clear indicator of a weakening labour market.

Monetary Policy and the Bank of England

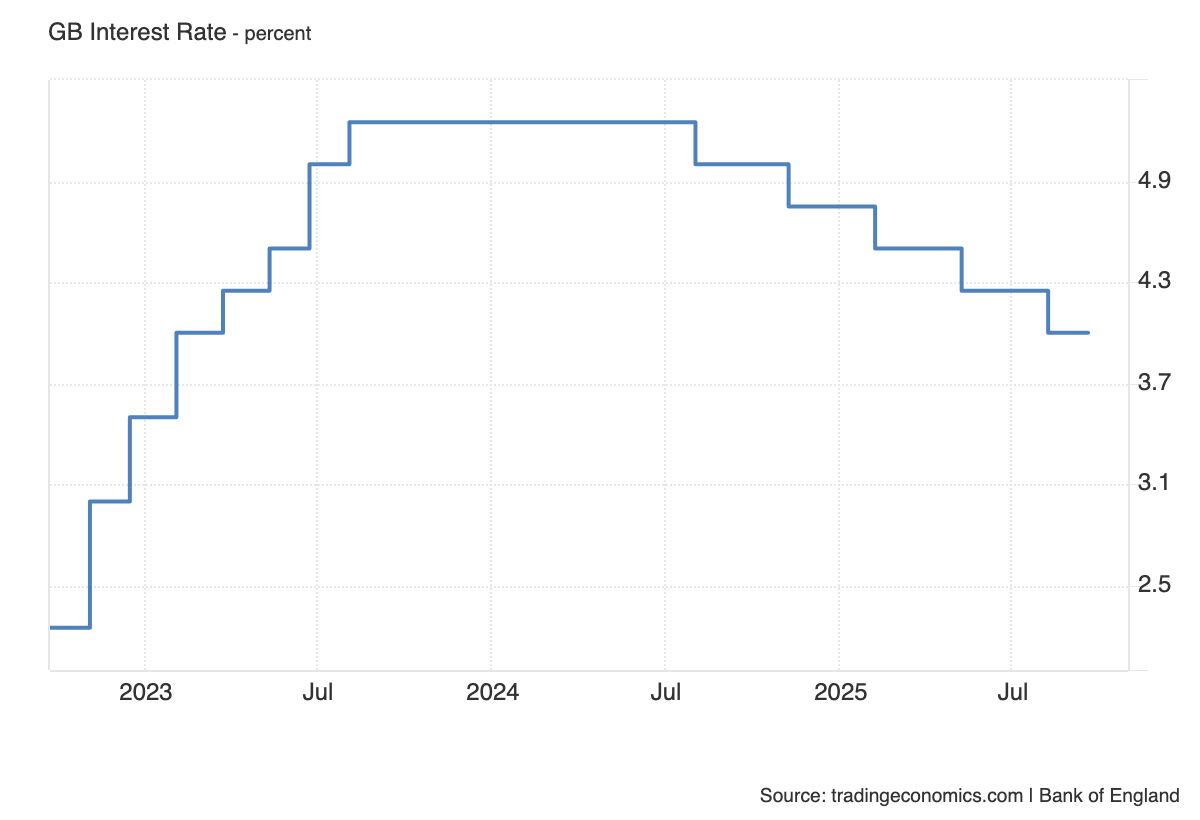

The Bank of England‘s stance is a “gradual and careful” withdrawal of monetary restraint. In its recent September 2025 meeting, the Monetary Policy Committee (MPC) voted to maintain the Bank Rate at 4%. The decision was not unanimous, with a 7-2 vote split, where two members favoured a 25 basis points reduction. This split highlights the ongoing debate within the committee and signals that the hawkish consensus is beginning to fracture, providing a leading indicator of a potential policy shift. The BoE has also underscored this measured approach by slowing quantitative tightening.

The consensus for the BoE’s November 6th meeting is a hold on the Bank Rate. Markets are pricing in a 60% chance of a hold, which reflects the weight of incoming data. A hold will be considered a reaffirmation of the BoE’s caution, bolstering the pound’s appeal, while a surprise cut would signal heightened concern about the economy’s fragility. The final significant component before the November meeting will be the CPI data from October 15th.

British Pound (GBP) Outlook

The outlook for the British Pound is heavily contingent on the balance of domestic economic factors and global currency dynamics. The year-to-date gains of around 7.9% in GBP/USD are primarily due to monetary policy divergence, as the Bank of England (BoE) has maintained a more restrictive stance than other major central banks. This makes the GBP an attractive currency for yield-seeking traders.

GBP/USD (British Pound vs. US Dollar)

The GBP/USD pair is a prime example of how monetary policy divergence drives currency values. The pair’s upward momentum is a direct result of the contrasting strategies of the world’s two most influential central banks.

The US Federal Reserve (Fed) initiated its rate-cutting cycle in late 2024 and followed with another cut in September 2025, bringing its policy rate to a range of 4% to 4.25%. The Fed’s shift towards an easing stance reflects a focus on “risk management” and concerns over a potential weakening in the labour market. In stark contrast, the BoE has held its rates steady, as sticky wage growth and persistent inflation continue to pose a threat. This has created a wider interest rate differential in favour of the pound because it offers a more attractive yield. This dynamic attracts capital from investors seeking higher returns, which in turn boosts demand for the pound and supports its value against the dollar.

For the GBP/USD pair to maintain its upward momentum, two key conditions must be met: the UK’s labour market must continue to demonstrate resilience through sustained wage growth, and the Fed must continue its easing path. However, traders are watching for any signs of a significant downturn in UK wage data or a more hawkish tone from the Fed, either of which could lead to a sharp reversal.

The near-term bias is bullish. As the pair has already broken above the key 1.3400 level, this signals a continuation of the uptrend toward new highs. The next significant resistance level to watch is near 1.36. A break below the 1.34 support level, triggered by a dovish tilt from the BoE or stronger-than-expected US data, could signal a deeper decline toward 1.32.

GBP/EUR (British Pound vs. Euro)

The relationship between the British Pound and the Euro is also driven by the relative policy paths of their central banks. The ECB has been in a more aggressive easing cycle, cutting its key rates in June 2025 in response to a more pronounced slowdown in Eurozone growth and a relatively weaker inflation picture. The ECB’s latest decision in September was to hold its rates, which stand at 2.00% for the deposit facility, 2.15% for the main refinancing operations, and 2.40% for the marginal lending facility. The BoE, by contrast, has maintained its policy rate at a higher level of 4%.

This divergence creates an interest rate differential that makes the GBP more attractive on a relative basis. The pound is likely to remain supported against the euro as long as the UK’s economic data, particularly its resilient labour market and sticky inflation figures, continue to outperform those in the Eurozone.

However, the outlook is not without its risks. While a further rate cut in December is on the table, the ECB’s recent decisions suggest a “wait-and-see” approach. Should Eurozone economic growth surprise to the upside or inflation rise unexpectedly, the ECB could shift its stance, narrowing the differential and putting pressure on the GBP/EUR pair. Conversely, any signs of significant weakness in the UK economy could push the BoE to cut rates more aggressively, closing the gap and weakening the pound against the euro.

GBP/JPY (British Pound vs. Japanese Yen)

The GBP/JPY is a classic “carry trade” pair, where investors borrow in a low-interest-rate currency (the Japanese Yen) to invest in a higher-yielding one (the British Pound). This strategy thrives on the significant interest rate differential between the two countries. The Bank of Japan (BoJ) exited its negative interest rate policy with a hike in January 2025, bringing its policy rate to 0.5%. However, it remains the most dovish of the major central banks, a contrast to the BoE’s rate of 4.0%. This significant gap in yields makes the pound highly appealing.

This pair remains in a strong uptrend, benefiting from both a resilient GBP and sustained weakness in the Japanese Yen. The Yen’s weakness is a direct consequence of the BoJ’s reluctance to tighten monetary policy more aggressively due to sluggish economic growth. The GBP/JPY pair’s recent move above 200 signals a continuation of this policy divergence trade. Traders are now watching for a move toward the 205 level. This is a clear case where the UK’s policy dilemma of a cooling economy versus high wages is completely overshadowed by the massive policy divergence with the BoJ.

GBP vs. Other Cross Pairs (CAD, AUD, NZD)

For commodity-linked currencies like the Canadian, Australian, and New Zealand dollars, the analysis becomes more complex, incorporating factors beyond just interest rates. The performance of the pound against these currencies is a tug-of-war influenced by commodity prices and global growth sentiment.

GBP/CAD (British Pound vs. Canadian Dollar)

The GBP/CAD pair is a classic example of this dynamic interplay. While the BoE is holding its policy rate at 4%, the Bank of Canada (BoC) has recently been in an easing cycle, cutting its benchmark rate to 2.5% in September 2025. This interest rate differential is a key support for the pound. However, the Canadian Dollar (CAD) is strongly influenced by global economic health and its close relationship with the U.S. economy, as well as being a petrocurrency that correlates with oil prices.

The GBP/CAD pair’s performance is a constant fluctuation. A resilient U.S. economy and a surge in oil prices support the CAD, while the pound benefits from its higher interest rate. A significant drop in oil prices or a downturn in the U.S. economy could weaken the CAD, giving the GBP the advantage. Conversely, a surge in oil prices or a quicker-than-expected BoE rate cut would favour CAD.

GBP/AUD (British Pound vs. Australian Dollar)

The Reserve Bank of Australia (RBA) is also in an easing cycle, with a recent rate cut to 3.60% in August 2025. This has pushed its policy rate below the BoE’s, creating a favourable interest rate differential for the pound. However, the AUD’s value is also heavily influenced by China’s economic performance, as China is Australia’s largest trading partner and a major consumer of its raw materials, such as iron ore.

This pair is a contest of relative interest rates and commodity dynamics. While the BoE is more cautious than the RBA, a strong rebound in China’s economy or a rally in iron ore prices could strengthen the AUD and put pressure on the GBP/AUD pair. The AUD is considered a “cyclical” currency, meaning it tends to perform well when global growth and risk appetite are strong.

GBP/NZD (British Pound vs. New Zealand Dollar)

The Reserve Bank of New Zealand (RBNZ) has also been actively easing its policy, with its Official Cash Rate (OCR) recently lowered to 3.0% in August 2025. This makes the GBP’s yield of 4.0% look attractive in comparison. Like the Australian Dollar, the New Zealand Dollar (NZD) is a commodity-linked currency, but its primary drivers are global agricultural prices (especially dairy) and overall risk sentiment. The GBP/NZD pair is likely to remain in an uptrend as long as the BoE maintains its rate advantage over the RBNZ.

Trader’s Perspective

Strategic Insights for Trading GBP

Mindfulness of Headline Risk: The GBP is highly sensitive to unexpected news. This headline risk can stem from economic data releases (like GDP or CPI), political events, or statements from central bank officials. Since these events are often unpredictable, a trader must be prepared for swift and sometimes irrational market movements.

Tactics: To mitigate this risk, traders should use tools like options to hedge their positions or place carefully calculated stop-loss orders to protect capital from sharp, adverse swings. It’s about accepting that some volatility is unavoidable and planning for it in advance.

High-Conviction Trades: In a complex market, identifying trades with a strong, fundamental basis is key. The strength of the GBP against the Japanese Yen (JPY) is a prime example of a high-conviction trade. The massive monetary policy divergence between the BoE and the BoJ creates a powerful “carry trade” dynamic that is unlikely to reverse in the near term. This offers a more stable opportunity amidst the volatility of other GBP pairs.

The November 6th BoE Meeting: This upcoming meeting is the most important event on the calendar. The market has largely priced in a “hold” on the bank rate at 4%, but not fully. This leaves room for a significant market reaction.

The most likely scenario: A hold decision will be viewed as a confirmation of the BoE’s cautious stance, which would likely lead to a swift move higher in the GBP as the remaining dovish expectations are removed from the market.

The less likely, but impactful, scenario: A surprise rate cut would signal a heightened concern from the BoE about the economic outlook, leading to a sharp weakening of the pound. The market would be forced to re-evaluate the entire UK economic narrative.The professional trader’s job in this environment is not to predict the exact outcome of these events but to anticipate the range of possible reactions and position accordingly. It’s a game of risk management and strategic patience.

Long-Term Forecast

As the effects of the BoE’s monetary policy and broader global trends unfold, we expect key economic indicators to evolve.

GDP Growth: After a period of subdued growth in 2025, the UK economy is expected to see a gradual pickup. Forecasts project growth to be in the range of 1.1% to 1.4% in 2026, strengthening to 1.5% to 1.7% in 2027. We anticipate a pickup in consumer spending that will drive this recovery as inflation cools and the labour market remains relatively stable.

CPI Inflation: The fight against inflation remains the BoE’s top priority. The consensus is that inflation will continue to fall, albeit on a “bumpy path”. It is projected to fall to around 2.6% to 2.9% in 2026 and reach the BoE’s 2% target in the second half of 2027. This disinflationary process is expected to be fuelled by a cooling labour market and a moderation in wage growth.

Unemployment: The labour market is expected to loosen slightly, with the unemployment rate forecast to peak at 4.9% in 2026. This is considered a necessary part of the disinflationary process. However, the rise is expected to be relatively modest, with a slowdown in hiring being more likely than large-scale layoffs. The rate is then projected to fall back to around 4.6% to 4.8% by the end of 2027.

Bank Rate: The Bank of England’s policy rate is expected to gradually decline from its current level of 4%. Forecasts suggest the rate will fall to around 3.5% in 2026 and settle in the 3.0% to 3.5% range by 2027. This easing of monetary policy will be a key factor in supporting economic growth and business investment.

| Indicator | Q4 2025 | 2026 | 2027 |

| GDP Growth | 1.2% | 1.1-1.4% | 1.4-1.7% |

| CPI Inflation | 3.6% | 2.7-2.9% | 2.0-2.1% |

| Unemployment | 4.8% | 4.9% (peak) | 4.7-4.8% |

| Bank Rate | 3.75-4.00% | 3.5% | 3.6% |

Final Thoughts

UK’s economic journey in the coming years is one of slow but steady normalisation. The central challenge remains the balance between managing inflation and supporting growth. The “dilemma” that has defined the market for the past year will continue to be a key driver for the pound, making it a currency that requires a highly tactical and data-driven approach. While the path back to a stable, low-inflationary environment is not without its risks, the consensus suggests the UK is well-positioned to navigate these headwinds and achieve a soft landing.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult a professional advisor before making investment decisions.