WTI Crude revisits session dips at $88.20/barrel as the U.S. dollar strengthens. Traders anticipate higher prices for crude.

WTI Key Points and Considerations

After hitting a 2-week bottom, The oil’s crude futures recovered part of their intraday deficits.

Notwithstanding the fall in drill count, traders anticipate higher prices for oil to support a rise in US crude oil output.

The Fed’s aggressive approach has raised US bond rates, increasing the US dollar

WTI crude US oil rig count falls

WTI crude oil prices recover portion of their earlier damages. falling down at $88.20 / barrel during Tuesday’s European trade. Moscow has decided to relax its gasoline export embargo, which was imposed originally to stabilize its own market. This action is likely to reduce the squeeze on the price of crude oil.

Furthermore, Saudi Arabia & Russia and OPEC, the world’s 2 largest oil suppliers, have contributed to the rise in WTI crude oil pricing. The two nations issued a mutual prolongation for their oil output restrictions through the end of 2023.

The price of crude have climbed by approximately 30 percent since the middle of the year. primarily to restricted supply. deducting 0.5 percent from the worldwide GDP increase in the H2 of the year.

The economic instability in China, the globe’s largest crude buyer, is influencing mood towards crude oil demands. Nevertheless, recent macroeconomic data indicated economic stability, which might give small backing to crude oil

Over the week ended on September 22, the number of drilling rigs for oil and gas fell to 630. This is the smallest number before February of 2022. Particularly, the total number of US oil rigs fell by 8 to 507. which is the most until Feb 2022. Whilst gas rigs fell by 3 to 118.

Notwithstanding the fall in rig count, rising oil prices are expected to fuel a spike in US crude oil output.

According to (EIA) predictions, US crude output would climb from 11.9 million barrels of crude / day in 2022 through a peak of 12.8 M bpd in 2023. As well as a peak of 13.2 million bpd within 2024. Markets fear and rising US Treasury rates are supporting the (USD), placing a strain on (WTI) prices for oil.

Current WTI Trading Price:

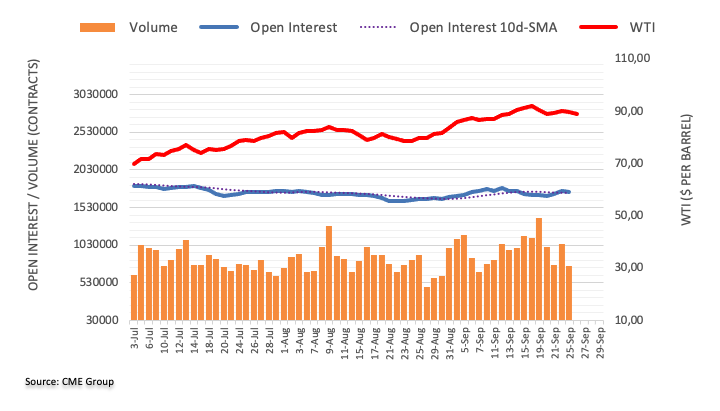

WTI Crude Open Trading Open Interest

According to CME Group’s flash statistics on oil futures. investors trimmed their open interest holdings by about 4000 lots at the start of this week, undoing 2 straight daily increases. After Friday’s construct, volume maintained pace and dropped by near 283.3K future contracts.

Technical Indicators

| Name | Value | Action |

|---|---|---|

| RSI(14) | 58.564 | Buy |

| STOCH(9,6) | 37.134 | Sell |

| STOCHRSI(14) | 0.000 | Oversold (Caution) |

| MACD(12,26) | 1.850 | Buy |

| ADX(14) | 36.772 | Sell |

| Williams %R | -63.373 | Sell |

| Name | Value | Action |

|---|---|---|

| CCI(14) | -33.4303 | Neutral |

| ATR(14) | 1.8679 | Less Volatility |

| Highs/Lows(14) | 0.0000 | Neutral |

| Ultimate Oscillator | 40.521 | Sell |

| ROC | 2.371 | Buy |

| Bull/Bear Power(13) | -0.2100 | Sell |

| Buy:3 | Sell:5 | Neutral:2 | Indicators Summary:Sell |