WTI Crude oil price reaches a fresh yearly high while falling on Monday. WTI seen falling from the earlier gains in the Asian Market top of $91.60

Crude oil WTI currently trading at $90.782

WTI Oil Key Salient Considerations

Crude Oil (WTI) sets a new annual peak before retreating.

The dollar’s value is in a holding pattern prior to the US Fed’s rate announcement.

The main danger from Saudi Energy Ministry will influence the price of crude.

Declining crude stocks, along with the continuance of OPEC+ cutbacks, caused a crude price surge that shows no evidence of abating.

China’s fresh stimulus efforts have further fueled optimism. Amid expectations that this Asian powerhouse is well on its way to reviving its economy.

WTI Oil gained for a third week in succession on Friday, boosted on the rising disparity among supply and demand. In addition to China’s newest industrial production data, that revealed quicker-than-estimated expansion during August.

In the meantime, the US dollar is in for a challenging week. despite a relatively quiet schedule till Wednesday. The US central bank (Fed) will announce its interest rate resolution on that particular day. While investors anticipate regulators to keep rates same. In this environment, The US dollar is projected to remain stable till Fed’s Powell makes his post-decision address.

Our View on Current Scenario

The optimistic elements that underpin the oil market’s upward momentum include China’s stimulation scheme. Solid US economic indicators, as well as OPEC+’s continuous supply reduction.

Prices for petroleum are not witnessing the customary taking profits after the 3rd- week of rises. while an immediate petroleum demand forecast is boosted by strengthening US & Chinese economic figures.

The market for oil will remain restricted for a bit a longer time. However, we are likely to observe a new spark to propel oil into triple-digit territory.

In the two weeks leading up to the 12th of September. The managers of portfolios increased their optimistic betting. For oil prices in reaction to the prolongation of production limits by Saudi & Russia. The sum of the gross long in Brent as well as WTI – the disparity between optimistic and bearish positions – surged to a new 18-month top. Amid purchasing fueled by the US crude oil benchmarks.

Trend – Bullish- Target : 94 Pivot – P 90.99

PIVOT POINTS: S3 90.25 S2 90.62 S1 90.806 R1 91.176 R2 91.36 R3 91.73

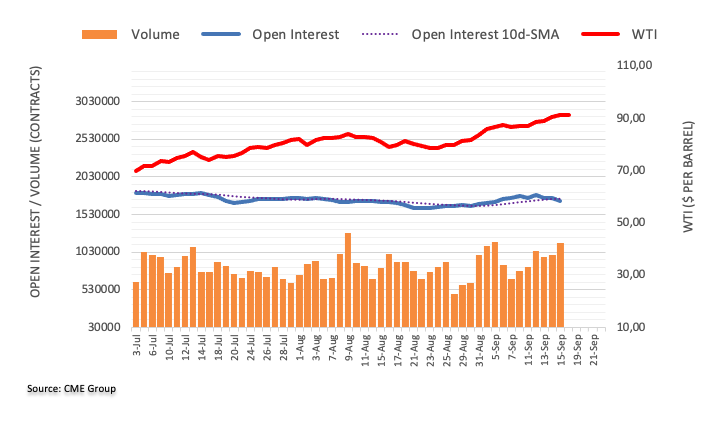

Crude oil Open Interest Graph