WTI Crude Oil is approaching $87.00 per barrel. Pay attention to EIA Crude Oil data. Saudi oil production is expected to be nearer to 9 million barrels per day

WTI Crude Oil Key Points and Considerations

WTI futures are trading down before of the EIA Crude Oil reserves data.

API The crude oil stockpiles in the United States fell far faster than expected.

Saudi oil production will rise nearing 9 million barrels per day by 2023.

The bleak economic scenario that China faces may restrict the upward trajectory of oil.

This week, Saudi Arabia & Russia agreed to keep their output limits in place until the conclusion of this year. The reductions are one million and 300,000 bpd, accordingly.

The supply crunch looks to be achieving its goal of driving up prices in the short term. Yet it may have unforeseen implications in the longer term should energy costs rise dramatically over time.

Apart from the possibility for customer demand damage, the Fed makes it plain that it is unwavering in its battle against inflation. Since the rising cost of energy continually causes to increased gas prices. This may help to maintaining prices greater over a longer period than is normally the scenario.

WTI Crude oil and Markets Eye EIA Report

The US crude oil benchmark, (WTI), has ended a 2-day gaining run. Throughout the initial hours of trading of the European day on Thursday. The daily spot price traded down at $87.20. The price of oil rose as a result of continuing declines in American crude oil stocks as well as supply cuts by OPEC+. members.

The (API) reports reported US crude oil stockpiles fell by 5.521 million barrels of oil. Much above estimates of a 1.429M drop. The drop from the prior week totaled 11.486 million bbls.

The (API) data for the time frame ending Sept1st revealed another dip of -5.52 million barrels. It is significantly lower than the expected -1.429 million predicted. Which came on account of the previous enormous decline of -11.486 million.

Market participants will be monitoring for the US (EIA) weekly petroleum situation report late today. The market anticipates a drop of roughly 2 M

The next-month Bloomberg Nymex WTI crack premium has shrunk during the previous week. And the contract selling at as little as US$ 29.11 per barrel during the night, following reaching US$ 44 in August.

The crack spread measures the cost of gasoline in regard to crude oil pricing and represents refiner margins of profit.

The Russian Connection

The Russian Deputy PM, who is additionally said that the country intends to limit the export of oil by 300,000 bpd for the rest of 2023.

The optimism of investors is subdued due to continued worries regarding China’s deteriorating economic position. With the persistence of commerce disputes among Beijing and the nation of America. Adhering to US Commerce Secretary Gina Raimondo’s remark that no changes to the US tariffs are expected.

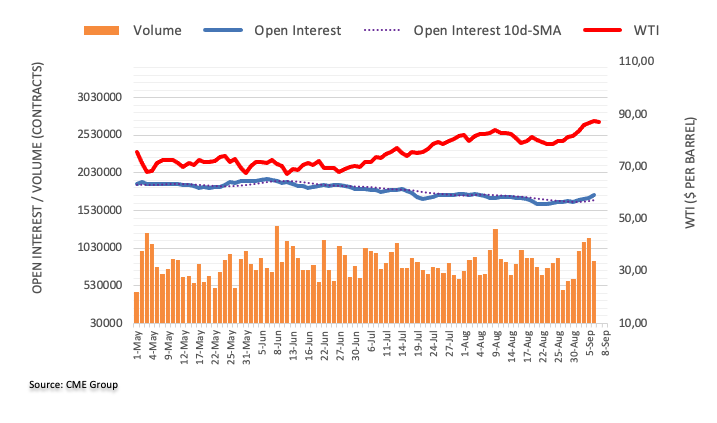

Crude Oil Open Interest

According to early CME Group data, trading in crude oil futures exchanges increased by in excess of 40K contracts on Wednesday. The volume, on the other hand, fell significantly by roughly 308.3K agreements following 5 successive daily turnarounds.

WTI maintains its initial objective on $90.00. Prices for a barrel of WTI returned to the $88.00 level on Wednesday, despite modest advances. The increase was prompted by rising open interest. It suggests that more gains are possible, especially with the near objective at the critical rounded point of $90.00/ barrel.