WTI continues advances beyond $91.00 as a result of OPEC+ delivery curbs. Crude oil extends its golden run. Still up. Correction due.

WTI Oil Key Points & considerations

Crude oil prices have extended their run of victories which started on the 8th of September.

Oil prices are rising as a result of OPEC+ supply cutbacks.

The bleak economic condition in China could restrict the upside of the price of oil.

WTI Fundamental Analytics

As tightened supply mixes with the probable resumption of Chinese demand progress. Here seem to have little relief in view for the present oil price increase or the optimistic reasons fueling it.

OPEC Reaffirms Its Positive Picture for 2024

OPEC confirmed its optimistic projection for 2024 oil consumption. Expecting it to climb by 2.25 million b/d owing to a faster economic turnaround in key nations. Amid elevated interest rates and higher inflation, and worldwide growth in GDP expected to be 2.6 percent in 2024.

The US crude oil standard, (WTI), is trading upward at $91.20 during the European afternoon on Tuesday. WTI pricing have extended their run of wins that commenced on the eighth of this month.

Crude oil prices are rising as a result of Saudi Arabia & Russia’s restrictive supply forecasts. The bleak economic condition within China, on the contrary hand, could restrict the upside of prices for crude oil.

EIA and API Data Will Confirm Oil’s Bullishness

Furthermore, the (IEA) issued a study this week predicting that OPEC+ crude oil output cuts will result in a significant supply imbalance. Most likely in the final quarter of the year, beginning in Sept. The availability gap is projected to exert a substantial influence on the market for crude oil, possibly pushing upward the cost of oil.

The following week will bring the publication of significant information which will have an impact on the USD-specific WTI oil price. That comprises the release of Crude Oil Storage statistics for the period ending the 15th of September.

Furthermore, the United States will release initial S&P Global PMI figures for Sep on Friday. These occurrences make the ability to have a significant impact upon the WTI prices. Therefore ,energy traders will attentively analyze the info in order to locate trade possibilities in the WTI the marketplace.

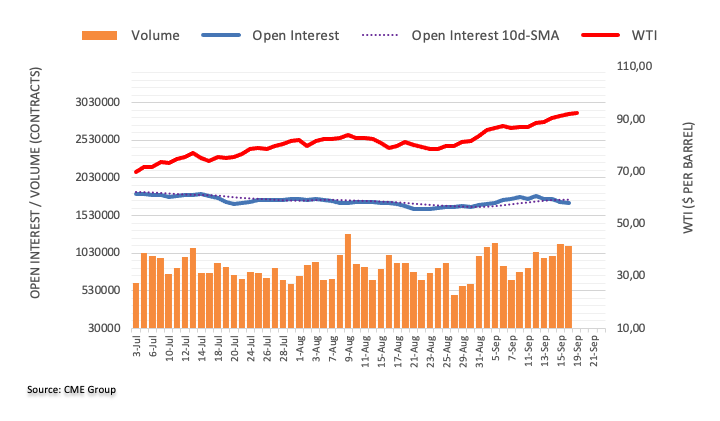

Crude Oil Futures Open Interest

According to CME Group’s flash statistics for the oil futures exchanges. Investors cut their open interest holdings for another trading day on Monday, this time by near 5.6K contracts. Volumes fell by roughly 23K transactions as a result.

Sep 19 – WTI Technical Indicators

| Name | Value | Action |

|---|---|---|

| RSI(14) | 58.407 | Buy |

| STOCH(9,6) | 53.820 | Neutral |

| STOCHRSI(14) | 47.091 | Neutral |

| MACD(12,26) | 0.180 | Buy |

| ADX(14) | 33.818 | Buy |

| Williams %R | -32.941 | Buy |

| CCI(14) | 123.1466 | Buy |

| ATR(14) | 0.2536 | Less Volatility |

| Highs/Lows(14) | 0.0914 | Buy |

| Ultimate Oscillator | 55.453 | Buy |

| ROC | 0.572 | Buy |

| Bull/Bear Power(13) | 0.3160 | Buy |

|

Buy: 9 Sell: 0 Neutral: 2 |

||