WTI Crude Prices for oil expand on the previous week’s positive bounce from $72.40 to $72.35/barrel. Representing the smallest mark before the seventh of July. Then acquire some execution positive impetus for an additional consecutive session today

Key Points and Considerations

WTI rises for another day in a row, recovering deeper after hitting a many-month trough.

Prospects for future OPEC+ output cutbacks prove to be a crucial element offering strength.

Concerns that a further worldwide recession will reduce demand for fuel may limit the gains.

The WTI is presently trading around $76.437, higher about 1 percent today, although any major appreciation remains distant.

According to reports in the press, OPEC+ may explore greater supply cutbacks to sustain prices at its forthcoming summit on the 26th. This is viewed as a crucial element supporting the oil. In addition, two of the largest producers. S. Arabia & Russia, are anticipated to prolong output cutbacks into the following year. This follows OPEC’s unusually elevated 2024 demand for oil increase prediction within its quarterly update.

However, the (IEA) forecasts weaker 2024 growth in demand and predicts an inventory surplus during the Q1. Furthermore, concerns that an ongoing worldwide economic crisis will reduce gasoline consumption. Which might keep underpin Crude oil costs and limit additional advances. Bullish traders should exercise cautious in light of the latest technical fall under the 200 (D-SMA).

| Name | Price | Chg. | Chg. % | ||

|---|---|---|---|---|---|

| WTI Crude Oil | 76.69 | +0.65 | +0.85% |

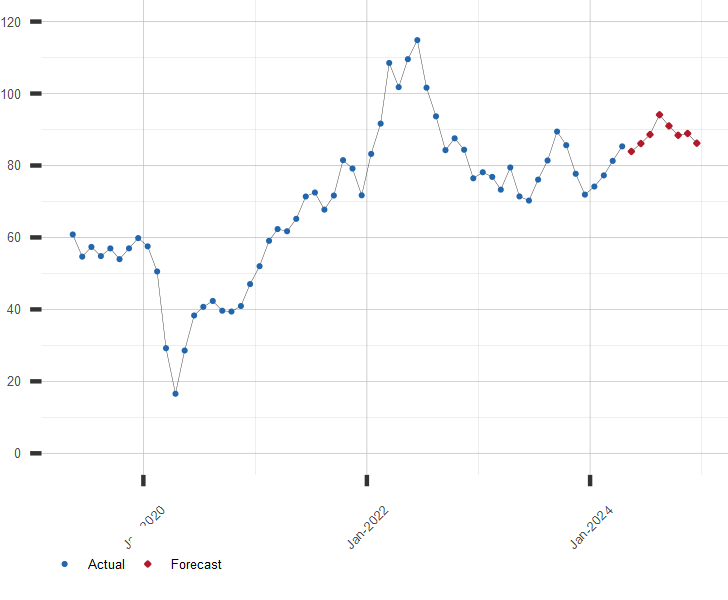

Crude Oil Forecast Graph

Estimate US dollars per Barrel for the cost of oil. Estimated Readings are included.

Source: Financial Forecast Center

China is restocking its oil reserves.

In the month of October, China’s refineries moved to pulling to accumulating oil stockpiles at a rate of more than 500,000 bpd.

The China’s refineries started adding oil to stockpiles at a pace of 560,000 barrels per day in Oct. while output decreased but importation increased. This has been the refineries’ conduct for the majority for the year. The Chinese oil refineries boosted stockpiles for 7 of the 10 full months from the beginning of 2023. That took off stockpiles for the remaining three. The overall shifts in stockpiles during the 10 months beginning January total 680,000 barrels per day on aggregate.

Investors may also hesitate from making strong directed stakes. Preferring to patiently wait for the unveiling of the FOMC minutes from the meeting on Tue. Seeking clues regarding the route for subsequent rate hikes. The prognosis will have a significant impact on the short-term price trends of the US dollar. Including the performance of Greenback-denominated products. As a result, it is wise to await robust continuation purchasing prior to concluding that crude oil prices have hit a short-term low.

Source: EIA

Support and Resistance Levels

S3 66.937 S2 72.359 S1 72.359 R1 88.032 R2 94.238 R3 94.238

Technical Trends

| Name | Type | 5 Minutes | 15 Minutes | Hourly | Daily |

| WTI Crude | Indicators: | Strong Buy | Neutral | Strong Buy | Strong Sell |

| Summary: | Strong Buy | Neutral | Strong Buy | Strong Sell |