WTI crude trades down at $76.697/ barrel over the European session on Thursday. Prolonging the declines for the 3rd straight day. Petroleum costs are falling owing to a higher-than-anticipated weekly growth in American petroleum stocks.

WTI Crude oil Key Points

Oil prices fell as a result of a weekly increase in US crude stocks.

EIA Crude Oil Reserves Move increased to 3.6 million from 0.774 million before.

The price of crude was impacted by a small slowing at China’s oil refineries.

EIA numbers beat forecasts

WTI is trading about $76.607 / barrel down during the European session today. deepening drops for a third day in a row. Oil prices are falling as a result of a beyond forecasts weekly growth in American petroleum stocks. The Energy Information Administration Crude Oil Inventory Adjustment for the span concluding the 10th of November. Which increased to 3.6 million from 0.774 million the previous week, compared to 1.793 million predicted.

Furthermore, signals of decreased demand from China are impacting the bearish atmosphere around the price of oil. During October, the Chinese oil refinery output fell slightly compared to the preceding month’s peaks. According to the National Bureau of Statistics, the Chinese total refining efficiency. While still significant at 15.05 million bpd, Which is down somewhat over the month of September high of 15.48 million barrel/day.

Crude oil prices fell for the 4th week in a row, as traders accounted for a lower risk factor associated with the Gaza war. Furthermore, the unpredictability of US Fed rate of interest have increased the strain on the market for oil. The Federal Reserve’s warning that it may hike rates again. Notwithstanding current data showing a drop in price increases, has added to the uneasiness.

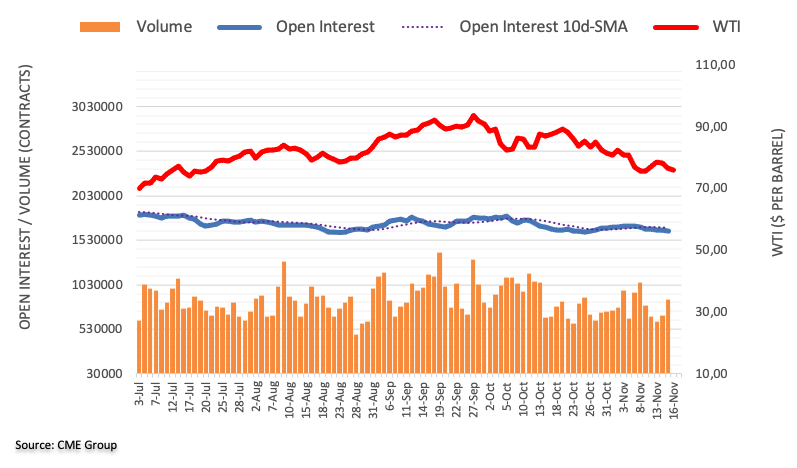

Crude Oil Investor Open Interest Positions

Assessing updated CME Group data for the oil futures exchanges. The open interest continued to fall for another day. At this point by approximately two thousand contracts. The volume, especially on the other hand, grew for the second day in a row, currently by roughly 186,200 deals.

Support and Resistance Levels

S3 66.937 S2 74.901 S1 74.901 R1 89.757 R2 94.238 R3 94.238

Latest modified: November 16, 2023