A dramatic twist rattled Wall Street on Friday when Iran Retaliated against an Israel Attack with a barrage of missiles, igniting chaos over Tel Aviv and Jerusalem. Explosions and sirens shattered investor confidence. sparking fears of a wider Middle East Conflict.

Defense Stocks Gain Amid Escalation

In contrast, Defense Stocks soared on expectations of increased military spending. Lockheed Martin, RTX Corporation, and Northrop Grumman each rallied over 3% as investors hedged bets on prolonged tensions.

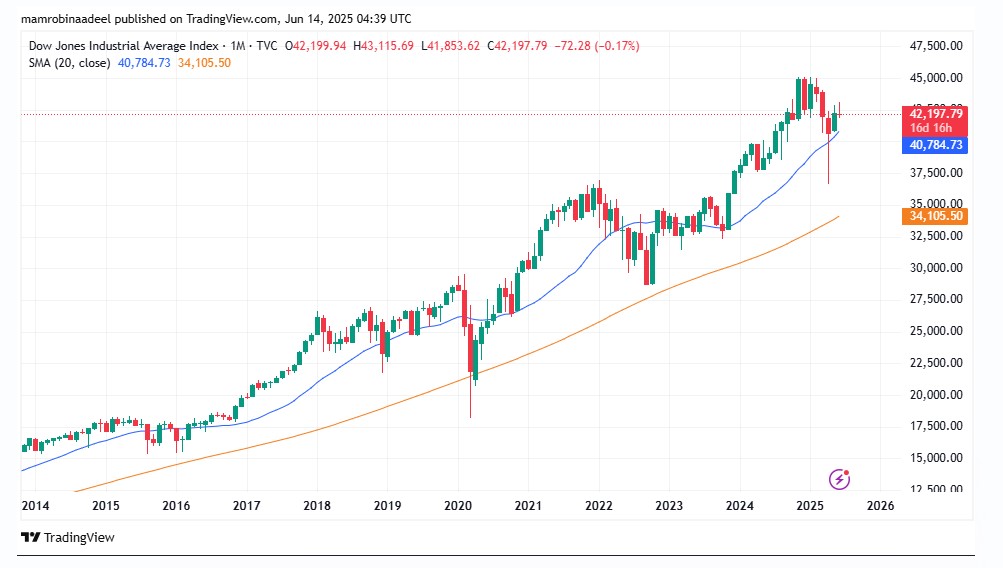

Major Indexes Post Heavy Losses

The escalating Israel-Iran Conflict hammered major US indexes. The S&P 500 shed 1.13% to close at 5,976.97, the Nasdaq sank 1.30% to 19,406.83, and the Dow Jones Industrial Average suffered the worst, plunging 1.79% to 42,197.79. For the week, the S&P 500 dipped 0.4%, the Nasdaq slipped 0.6%, and the Dow fell 1.3%.

Tech Giants Diverge on AI Optimism

Amid the geopolitical storm especially retaliatory attacks from Iran, Oracle defied the downturn, surging 7.7% to a record high for the second consecutive day. as investors cheered its bullish AI Forecast. Meanwhile, Adobe fell 5.3% amid doubts over its pace in adopting AI Technology. Market darlings Nvidia and Apple joined the slide. down 2.1% and 1.4% respectively.

Financial Sector and Cryptocurrencies Stir Waves

The Financial Sector in the Wall Street weakened further with Visa and Mastercard both dropping over 4%. after news broke that major retailers are exploring Cryptocurrencies to bypass traditional payment systems. This added another layer of uncertainty for payment giants already under pressure.

Oil Prices Surge, Airlines Dive, What’s the Wall Street Reflected?

As the threat of supply disruption loomed large, Oil Prices surged nearly 7%, dragging Airline Stocks deep into the red in the Wall Street. Delta Air Lines plunged 3.8%, United Airlines tumbled 4.4%, and American Airlines dropped 4.9%, bruised by fears of soaring fuel costs.

Investors Brace for Federal Reserve Decision

Despite the global jitters, some relief came from tame inflation data and stable jobless claims. bolstering hopes that the Federal Reserve will keep rates unchanged in its upcoming meeting. Yet, all eyes remain glued to the intensifying Middle East Crisis. and its unpredictable fallout on global markets.