European market futures are up. Credit Suisse and the German CPI are both interested in As traders took recent German inflation data and the corporate earnings season, European stock markets are anticipated to open slightly higher on Thursday.

The DAX futures contract in Germany traded 0.7% higher at 02:00 ET (07:00 GMT), the CAC 40 futures in France advanced 0.5%, and the FTSE 100 futures contract in the United Kingdom increased 0.3%.

The German consumer price index for January, that had been postponed for technical reasons, increased by the more than predicted (1percent for the month) but less than anticipated (8.9%) on an annual basis (only 8.7%).

European Markets looking for inflation cues

Markets in Europe and the United States have been looking for indications that inflation is reaching its peak so that central bankers may begin to scale down their escalating interest rate increases.

The European Central Bank indicated a rate increase of the same magnitude for the next month after increasing interest rates by a 0.5 percentage point the other week.

According to ECB policymaker Klaas Knot, sustaining the present tempo of rises into May “may very well stay justified” if fundamental inflationary pressures do not significantly weaken.

European Markets Re-thinking US Fed comments

On Tuesday, Jerome Powell, the head of the Federal Reserve, adopted a less tough stance than anticipated. However, several of his colleagues, notably Fed Governor Christopher Waller, were eager to underline Wednesday that the central bank is still in the middle of its cycle of rate hikes, saying “still need farther to go” to combat inflation.

The quarter-end results period is still in full swing in Europe.

The scandal-plagued Swiss lender Credit Suisse (SIX: CSGN) is expected to be in the news after recording its second consecutive annual decline with a deficit of CHF7.29 billion (CHF1 = $1.0881), the worst figure since the financial crisis of 2008.

The second-biggest bank in Switzerland reported a net loss of CHF1.39 billion for the 3 months that ended in Dec, a 33% decrease from the same period last year.

The second-biggest steel producer in the world, ArcelorMittal (AS:MT), announced a 4th core profit of $1.26 billion, lower from $5.05 billion a year earlier, but stated that it anticipates a 5% growth in steel exports on in the year.

Additionally, quarterly reports from companies like AstraZeneca (LON:AZN) and Unilever are planned (LON:ULVR).

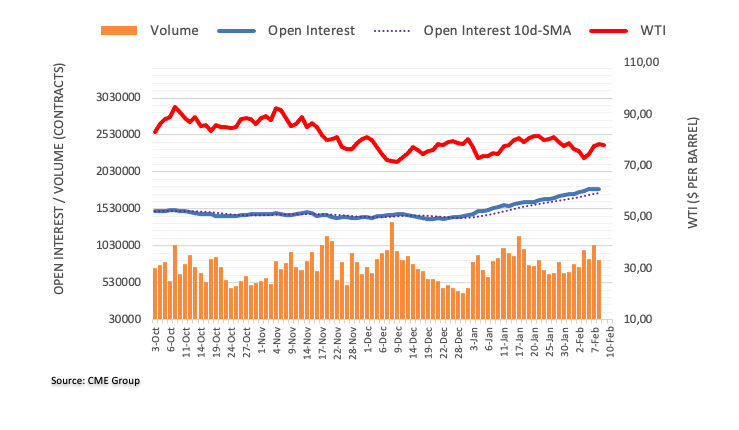

The price of crude oil steadied

Although U.S. crude stocks reaching its highest level for months and stoking concerns about weakening demand in the biggest economy in the world, crude prices held steady Thursday near the two tops.

According to the Energy Information Administration, crude oil reserves in the United States increased by 5 million barrels last week, reaching their highest level since June 2021.

U.S. oil futures had risen slightly to $78.48 a barrel by 2:00 ET, whereas the Brent price had increased by 0.1percent to $85.16.

Earlier, After Wall Street Crashes on Rate Hike Concerns, Asian Shares were mixed

In Asia on Thursday, shares were neutral as Wall Street gave up a portion of its early gains due to the ongoing ambiguity around interest rates and inflation.

Tokyo, Seoul, and Sydney had a fall in benchmarks, while Hong Kong and Shanghai saw an increase.

After receiving a series of conflicting quarterly earnings, Wall Street declined on Wednesday. The retreat came in response to remarks made on Tuesday by Federal Reserve Chair Jerome Powell, who indicated that despite a particularly strong employment report issued by the United States on Friday, the central bank would not be forced to adopt a more aggressive approach to raising interest rates to control inflation.

Disney Shares Climb on Earnings

After reporting unexpectedly positive operating results for the first quarter of its financial year, the entertainment giant Walt Disney saw a 5.5percentage – point increase in after-hours trading.

After reporting unexpectedly positive operating results for the first quarter of its financial year, the entertainment giant Walt Disney saw a 5.5percentage – point increase from after session trading.

About 3% of the entertainment company’s worldwide staff would be affected by the job layoffs.