The EUR/USD is currently exhibiting a period of market indecision. The recent surge in the EUR/USD lacks the certainty of a genuine trend reversal. This consolidation is characterized by significant volatility and a delicate balance between buyers and sellers. They are waiting for a clear catalyst to commit to a directional shift. Our analysis will provide a comprehensive outlook by examining the technical structure across multiple timeframes.

Overall Market Structure: Daily Analysis (D1)

On the daily chart, the pair’s price action shows a lack of a sustained trend, indicating a dynamic equilibrium. Bullish attempts to push the price higher have been met with swift counter-selling, suggesting weak follow-through and a cautious sentiment. Two critical zones clearly define this consolidation:

- Resistance Zone (1.1680–1.1700): This range is a formidable supply zone that has repeatedly capped bullish momentum. A confirmed breakout above 1.1700, with a notable increase in volume, is needed to signal a change in market structure and open the path to 1.1750–1.1800.

- Support Zone (1.1550–1.1600): This range serves as a critical demand zone. A decisive and sustained close below the 1.1550 level would trigger a bearish shift, potentially accelerating a move toward the key psychological level of 1.1500.

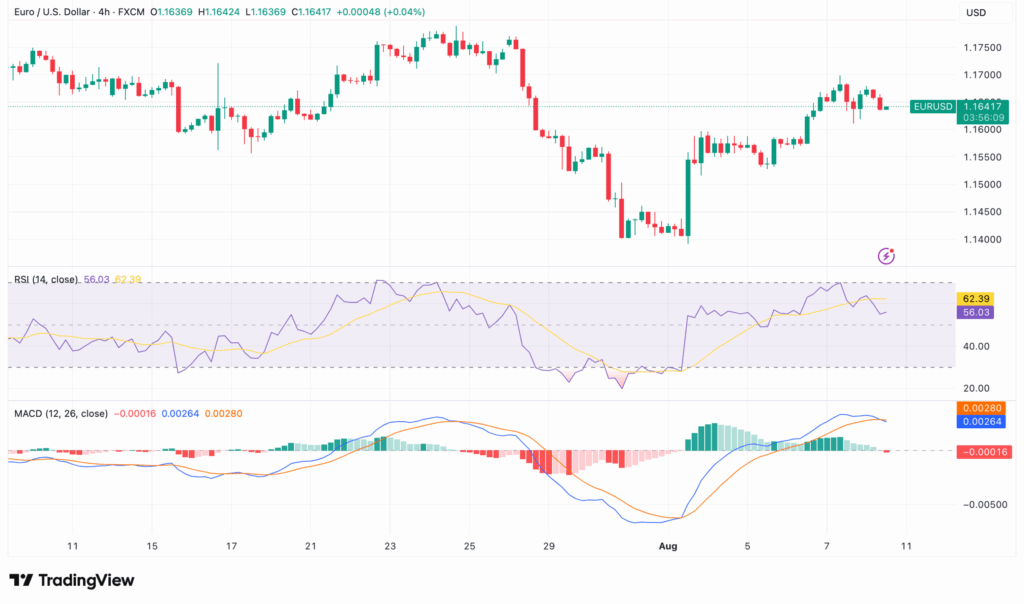

Intraday Price Action: H4 & H1 Analysis

H4: Consolidation and Indecision

The pair is locked in a classic consolidation pattern on the 4-hour chart, oscillating within a tight horizontal range of 1.1600 to 1.1680. The support zone around 1.1600 has attracted buying interest, while the resistance around 1.1680 has capped all bullish attempts. Key technical indicators such as the RSI and MACD are neutral, reinforcing the notion that the market is in a state of equilibrium.

H1: A Cautious Upward Drift

The 1-hour chart shows a mild upward drift, characterized by higher lows but lacking the conviction of a strong rally. This is a phase of gradual accumulation rather than aggressive bullish dominance. The short-term Exponential Moving Averages (EMAs) show a slight bullish alignment, and the RSI is just above 50, hinting at marginal buying pressure. An immediate intraday support level is at 1.1620, while immediate resistance is the upper boundary of the H4 range at 1.1680.

Summary & Conclusive Outlook

The EUR/USD remains contained within a well-defined consolidation phase between 1.1600 and 1.1700. The overall tone is neutral, though short-term intraday dynamics show a slight bullish bias as long as 1.1620 holds.

The key to a new directional trend will be a confirmed breakout from these boundaries. Traders should watch for:

- A Bullish Breakout: A push above the formidable 1.1700 resistance, validated by strong volume and fundamental news, would be a strong signal for a move towards 1.1750–1.1800.

- A Bearish Breakdown: A decisive failure to hold above 1.1550 would invalidate the consolidation, triggering a bearish shift with a potential target at 1.1500.

Until such a breakout occurs, the most prudent approach will be range-trading strategies. This involves buying near support and selling near resistance with disciplined risk management. Traders should be prepared for sudden volume shifts and to validate any breakout signals. Look for confirmation on both technical and fundamental data to avoid false signals.

The provided video, “EUR/USD Technical Analysis: Potential Shift in Dollar Strength,” discusses a similar scenario of potential shifts in dollar strength and is relevant to the topic.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult a professional advisor before making investment decisions.