European stock futures decline on Powell’s hawkish stance. Following the steep declines on Wall Street overnight. Following Fed head Jerome Powell’s warning that interest rates could rise more quickly than anticipated.

European stock markets are anticipated to start lower on today

The DAX futures contract in Germany traded 0.1 percent weaker at 02:00 ET (07:00 GMT). The CAC 40 futures contract in France fell 0.1%, and the FTSE 100 futures contract is traded mostly unchanged.

The weaker close on Wall Street yesterday. With the benchmark Dow Jones Industrial Average falling nearly 600 points or 1.7%. is expected to give European stocks their impetus.

Beginning his 2 testimony to Congress, Federal Reserve Chair Jerome Powell said in prepared remarks “The latest economic data have come in stronger than expected. Which implies that the overall level of interest rates is likely to be greater than originally expected.”

European stock markets weigh Powell and Christine Lagarde

We would be ready to speed up rate increases if the statistics as a whole suggested that tightening was necessary sooner, Powell continued. These remarks suggested a greater probability of a 50 basis point increase in March.

Later in the session, President of the European Central Bank Christine Lagarde is set to deliver a speech at a meeting of the World Trade Organization in Geneva.

Her remarks will be closely examined for indications of future monetary policy. Particularly since she hinted at a 50 basis-point increase over the weekend.

In Jan, the industrial output in Germany grew by 3.5% month over month

German industrial output increased by 3.5 percent on the month in Jan. A rebound from the revised 2.4% fall the prior month. While retail sales in the euro zone’s biggest economy fell 0.3% in the same month. An improvement from the 5.3% slump in December. Later in the afternoon, revised 4th GDP data for the eurozone are also expected.

Crude oil declines

Her remarks will be closely examined for indications of future monetary policy, particularly since she hinted at a 50 basis-point increase over the weekend.

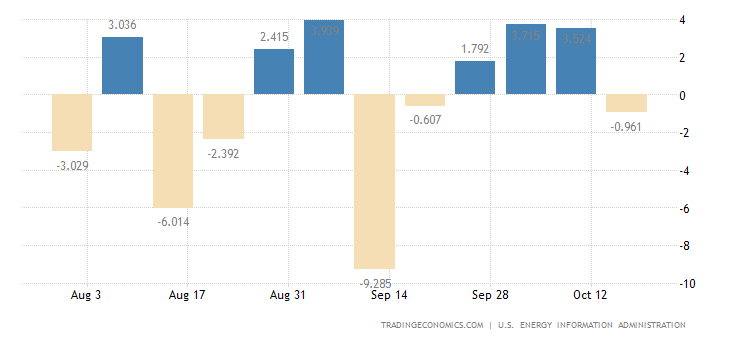

Crude prices were largely stable on Wednesday, as a surprise drop in U.S. oil stocks helped counteract Fed chair Powell’s hawkish remarks.

American Petroleum Institute statistics show that during the week ending March 3. The US crude stocks decreased by about 3.8 million barrels.

This would be the first drop after 10 straight weeks of builds. If confirmed by the certified data released later on Wednesday. It would indicate a contraction of supplies in this crucial market.

The price of gold futures also decreased by 0.1% to $1,817.60/oz, and the EURUSD moved 0.1% weaker at 1.0539.