US economy to get a harsh vs. soft landing issue forthcoming. Economic debates provoke worries about volatility. A third possibility, known as “no landing” in the narrative.

As, the argument over whether the Fed might be able to manage a (softer economic landing)—Bringing lowering inflation without a significant cyclical bump—or a (hard touch down)—hiking too much and driving the economy towards recession.

US economy landing in ‘if’, there is no landing

In the event of a “no landing,” the American economy doesn’t contract. It continues to rise beyond trend. And the Federal Reserve is compelled to boost rates quite sharply than anticipated. As well as maintain them high for a longer period of time.

US economy risk assets are unlikely to thrive in the current state of uncertainty brought on by this scenario.

Since it raises doubts concerning inflation from the Fed, the ‘no’ landing event runs the potential of reviving the “volatile market activity we witnessed in 2022.

US landing could be a Blow out

According to Morgan Stanley, the “blowout”. Jan employment report was a major factor in igniting “conversation surrounding the prospect of a ‘no landing’ event.”

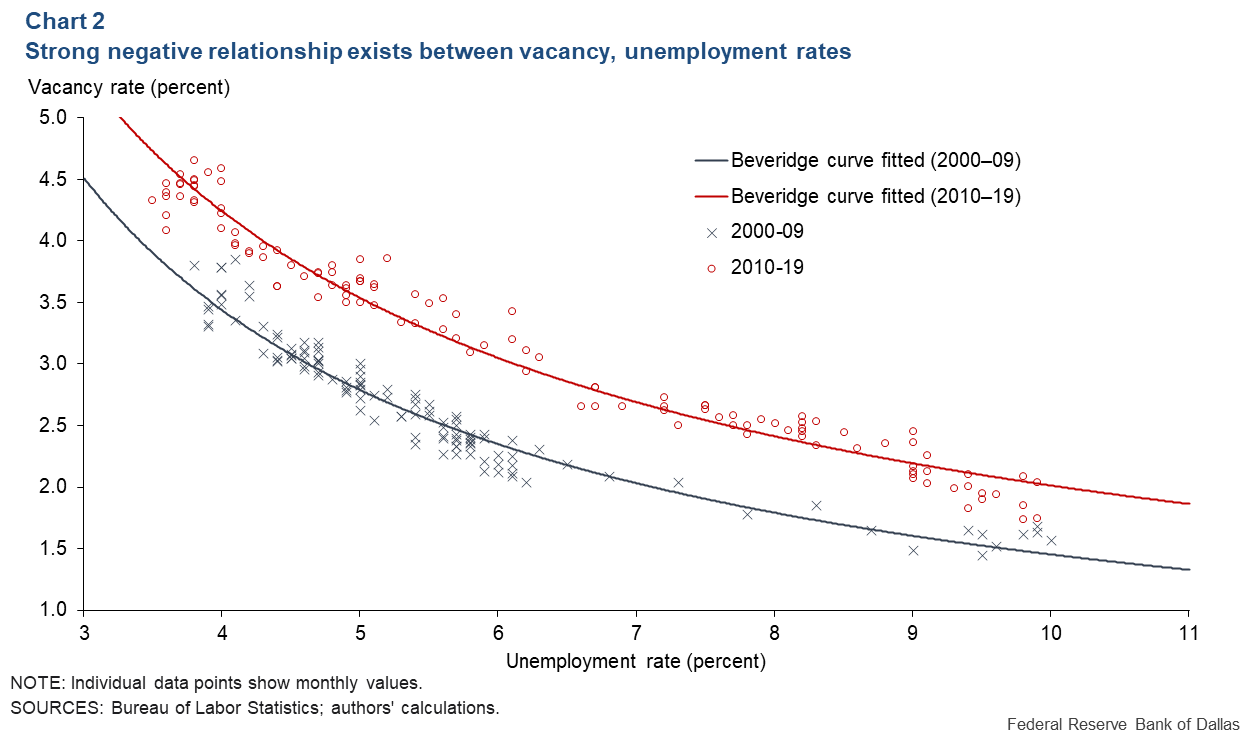

The latest employment data, which showed strong labor growth and a reduction in the jobless rate to 3.4%, a 5-decade low. Delivered a blow to betting on a short-term downturn.

Though, it also signaled concerns about upside risks to inflation. Which would probably lead the Fed to continue raising rates and maintain a tighter monetary policy for a longer period of time.

If US economy is more resilient will have impacts?

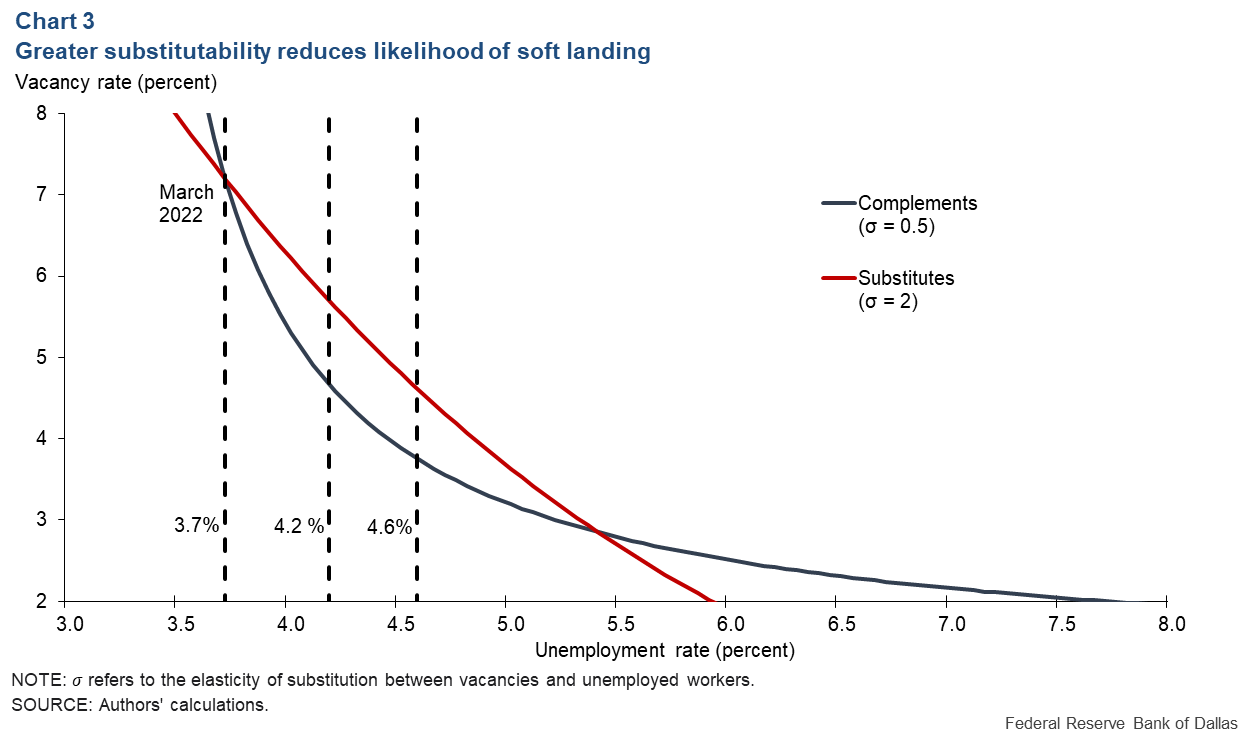

The Fed has to chase the economy more as it becomes more resilient, Morgan Stanley stated. But it remained committed to its base scenario for a smooth landing.

The chances for a rate increase in May are increasing, and markets are presently factoring in at minimum one more 1/4point increase,

However, former Treasury Secretary Lawrence Summers stated in a Bloomberg appearance. That there is a possibility that “this tightened cycle is hardly just about more or two more, or 3 more 25 basis-point rises. Rather, perhaps more practical.” Summers was referring to potential risks for inflation.

Markets continue to fancy the ‘Fairy Tales’

Despite the S&P 500’s recent trembling, investors still trust in the “fairy tales” or “gentle landing” view. Which has enabled risk assets have a great start to the year.

The US Fed is currently preaching about deflation, but if rising inflation occurs in the coming months, they may need to adjust their messaging once more, which will hurt its fame.

A “no landing” event, while not entirely obvious. Most closely mimics a gentle landing, according to Morgan Stanley. Who also noted that their long-standing prediction that the US economy would undergo one this year has gained consent.

These discussions show that the term isn’t precisely specified and often glosses over the ramifications for policy, although it most closely resembles a smooth landing.

US Fed on Sticky Path

The Fed’s reputation would be at danger and new uncertainty would be generated by a stickier track on inflation. During a time where markets have gambling versus the Fed. Albeit without less vigor than in previous months.

The US Federal bank has been careful to emphasize that the disinflation process has started. Though, the recent consumer sentiment data is positive

There are already hints that the disinflation, which is mostly being driven by the goods sector, may only be temporary.

According to Cox Automotive, used-car prices unexpectedly increased 2.5 percent last month, highest most as back end of 2021. Although that was due to unusually high demand.

The likelihood of a “no landing” scenario being the same

As data in the next days are anticipated to indicate a resilient consumer and pricing concerns. Who are on the rise and up, a “no landing” prospect Would likely continue infiltrate discussions about the economy’s prognosis.

The Fed haven’t got enough luck lately, but this week’s events might not be very encouraging for them either.

US news story as we prepare for a good retail sales figure, CPI inflation is projected to increase. Core inflation is anticipated to be stable. And, markets might need to reconsider how they hastily binned the US consumer at the beginning of the year.