Asian stocks slide on China’s increasing losses in Chinese trade statistics. Data on Chinese commerce indicated that consumer demand and consumption are weak

Asian stocks plummet on China economic worries and Pre inflation data today

On Wednesday, several Asian equities fell as investors braced themselves for important US CPI data inflation data later in the day. Chinese stock markets fell for a second consecutive day as a result of weak trade figures.

Source: TRADINGECONOMICS.COM

The Composite and Shanghai Shenzhen CSI 300 indices in China decreased by 1.2% and 0.8%, each. In response to weaker-than-anticipated import statistics that raised concerns that the nation’s economic recovery was slowing down.

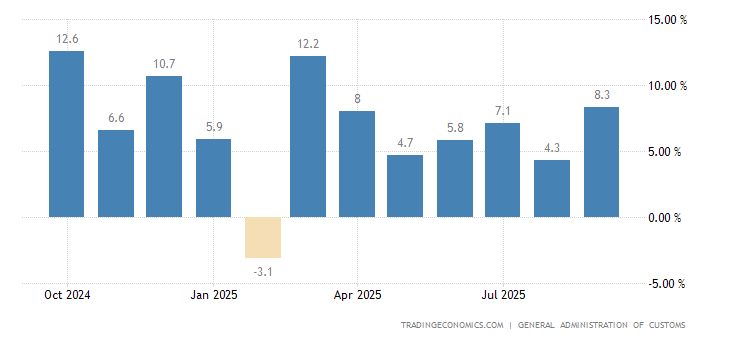

Exports from China have slowed

Chinese exports also increased more slowly than in the previous month Signaling that the country’s enormous manufacturing sector is still under pressure. As China emerges from three years of anti-COVID regulations. A slew of dismal economic statistics has caused investors to doubt the scope of a Chinese economic rebound this year.

Losses in China spread to markets with significant trade exposure, with the Hang Seng index down 0.6%, Taiwan’s Weighted Index dropping 0.8%, and South Korea’s KOSPI lower 0.1%.

This idea also caused the ASX 200 index in Australia to drop 0.3% as mining firms with a China sensitivity suffered losses.

As traders utilized the risk-off mood to lock in a good run of earlier profits. Japan’s Nikkei 225 index dropped 0.4% from a peak that was over nine months old. The Nikkei was one of the top-performing Asian markets in April. As a result of an outstanding run over the prior month that was driven by strong corporate profits. And expectations of welcoming monetary policy.

The BoJ is projected to retain its ultra-dovish monetary stance in the foreseeable future. Which will allow the Nikkei to rise during the next few days.

Most Asian stock markets followed the Wall Street spillover effect

In response to a disappointing lead-in from Wall Street. Broader Asian markets declined as investors were wary ahead of CPI data that is expected later on Wednesday.

The figure is anticipated to show that inflation decreased more in April. Yet remained much higher than the Fed‘s 2% annualized target, which might encourage the central bank to take more aggressive action.

Asian Session Fx Market

The dollar is weaker due to the ongoing US debt ceiling situation and inflation data. The debt limit situation was not resolved between U.S. President Joe Biden and key lawmakers on Wednesday. Leading to a general decline in the value of the greenback. However, currency movements were minimal due to investor restraint prior to U.S. inflation data later on the day.

Following discussions on Tuesday, Biden and Kevin McCarthy were still at odds over lifting the $31.4 trillion debt ceiling. There are now just a few weeks left till the country would be compelled into a historic default.

However, they decided to continue talking and asked their assistants to consider potential points of agreement every day. On Friday, Biden, McCarthy, and the other three senior legislative figures are scheduled to meet once again.

Morning Asian trading saw a decline in the dollar, while the euro increased by 0.11% to $1.0971. And the GPB increased by 0.1 percent to $1.2634. the Kiwi rose 0.05%.

The U.S. dollar index yesterday fell 0.07 percent to 101.55 against a basket of currencies.

Investors were also concerned about U.S. inflation statistics since experts surveyed by Reuters. Predicted that core consumer prices would rise 5.5% in April compared to the same month last year.

A better-than-expected number might cause problems for the Federal Reserve. Which only last week hinted that its aggressive tightening cycle might be coming to a halt. Following ten straight rate increases since March 20.

The Japanese yen gained 0.1% elsewhere to reach 135.11 per dollar.

The Australian dollar most recently increased by 0.08% to $0.67675.

As a result of robust employment growth and record mining earnings. Australia’s Labor government on Tuesday announced its first fiscal surplus in fifteen years.