WTI Crude Oil is hovering at a multi-week trough and is susceptible beneath the middle-$75.00s band. Loses upside momentum – short-term

Crude US WTI Oil prices struggled to make any major gains on Thursday. Being broadly retreat for the 3rd day in a row. The oil is trading at $75.45, lower almost 0.15 percent on the trading day. Yet remaining over its lowest value as of the 20th of July, which was reached on Wed.

Key Points and Considerations

WTI is expected to consolidate its current decline to its lowest price around the 20th of July on yesterday

Issues regarding supply problems in the region of the Middle East have been alleviated, but demand issues remain.

The underlying background supports the continuation of a 3-week-old falling pattern.

Fears about anticipated supply interruptions from the eastern Mediterranean region. Driven by the Gaza war, and fears about decreasing demand in the globe’s major buyers, the United States and China. keep weighing on the price of oil. According to the (API), US oil stocks grew by 11.9 million barrels during the week ending the 3rd of November. Assuming true, this would constitute the largest week build before the month of February, indicating a drop in need.

Source: EIA

Furthermore, figures issued a few days ago revealed that China’s crude import remained solid in Oct. Despite the fact that the deteriorating economic picture is likely to dampen gasoline consumption. Concerns arose as China’s newest inflation numbers revealed continuing deflationary effects as a result of poor leisure spending and corporate activity. That follows on the heels of news that the Russian oil shipments touched an almost four-month peak in the previous month. Easing worries regarding global supply constraints.

The above-mentioned fundamental background appears to be stacked towards negative investors. Implying that the course of most resistance over Crude Oil’s price is to the lower values. However, oscillations on the daily graph are about to enter depressed zone. This suggests that negative investors ought to wait for any short-term stability. Or a moderate rally prior preparing for a continuation of the current widely recognized downtrend seen during the last 3 weeks or more.

The OPEC Factor

At this point, OPEC maintains its belief in the strength of oil consumption. That is, however, little beyond what one would anticipate to hear from an oil-producer group. Consequently, it is unimportant in and of itself. It is significant in light of OPEC with its OPEC+ allies making up roughly forty percent of world oil output.

Perhaps Saudi Arabia is concerned regarding demand, which is why it has prolonged its output cuts. Perhaps this was since Saudis desires further more expensive oil. To ensure it can continue to develop its great $500 billion Neom scheme. It makes no difference. What important is that Saudi can withdraw additional volumes from marketplaces when necessary.

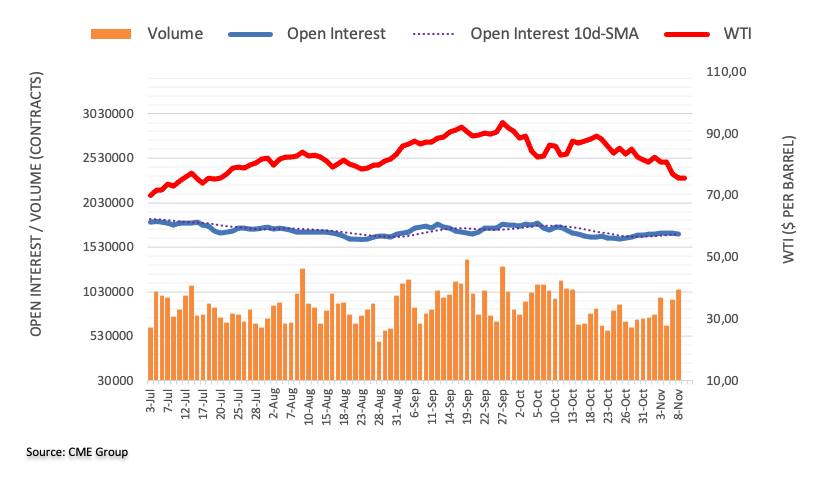

Trader’s Open Interest Positions & Analysis

According to CME Group’s flashing statistics for the crude oil futures exchanges, Investors reduced the number of open interest holdings for a 3rd day in succession on yesterday. by near 15.5K units. The quantity, on the contrary, it increased about 109.6K deals to the preceding daily construct.

WTI prices fell on Wed with declining open interest, suggesting that a further decrease isn’t likely in the short future. However, rare rebound efforts could encounter early obstacles near the crucial 200-day accounting through the SMA which is now near $78.11 mark.

Support & Resistance Levels

S3 66.937 S2 74.901 S1 74.901 R1 89.757 R2 94.238 R3 94.238

Recently modified: November 9, 2023