WTI Crude oil rises to $75.80 due to further USD weakening. Oil prices rose to a 10-week high amid the US dollar collapsed on mediocre US inflation.

WTI Crude Oil Key Points

Crude oil is still rising, this time supported by a declining Greenback.

The Fed’s strategy has been rumored to alter as inflation concerns subsided once more in June. WTI crude oil is surging towards $76, a record high since May.

The lower US inflation numbers gave oil speculators optimism.

The possible increase in the cost of crude oil might be limited by the heightened friction involving the US and China.

WTI soared on Sustained US dollar slide and Global Supply Concerns

The benchmark for US crude oil, (WTI), plays with $76 per barrel first the first time as of May. And is now trading at around $75.78 on Thursday d. The general dollar’s decline, brought on by Wednesday’s weaker US (CPI), is helping WTI crude oil.

According to data released on Wed by the US Bureau of Labor Statistics (BLS). The (CPI) decreased from 4 percent in May to 3 percent during June. This result fell short of the market’s forecast of 3.1%. The dollar index fell to its weakest daily finish in a year’s time of 100.50 as a result of weaker inflation data.

The stockpile report may have prevented the surge for petroleum. The (EIA) said this morning that US stocks increased by 5.946 million barrels during the seven days ending July 7. It was significantly more than the projected rise of 0.483 million bpd.

The EIA data was consistent with the American Petroleum Institute (API) storage data from the day before That indicated an increase of 3.026 mil barrels over the same week. The increase represented a reversal from the previous week’s decrease of 4.382 million barrels.

WTI Foundations in Focus

Markets are worried over the Fed raising interest rates, which could hinder economic development and reduce interest in oil. The US inflation figures gave rise to optimism that the (Fed) session on July 25–26. Would be the final one before the Fed raises rates once more for the remainder of the year. The US Pound suffered significantly from the Fed’s dovish stance.

After the unfavorable June (PPI) & (CPI) for China. The second-biggest economy in the globe, China, is experiencing an economic downturn, which has investors worried.

In a press release released early on Thursday regarding the US-China news, China’s consulate claimed that in order to gradually repair cooperation among the two countries including their forces. The US will meet China midway. Oil dealers will attentively monitor this story in case it gives the price of WTI a further boost. The possible increase in the cost of oil might be limited by the raised tensions among the US and China.

Since Saudi Arabia expanded its voluntarily 1 million bpd oil supply reduction over a second month till August. The WTI has recently increased. Production will drop to 9 million barrels / day, which was the lowest figure in previous years, as a result of the cut.

There is an impending oil supply shortfall, but investors might care less.

The remainder of this year will see a narrowing of oil supplies, according to predictions from OPEC. The US EIA and the (IEA).

The most recent Commodity Outlook from Standard Chartered Bank reveals that the worldwide crude market is currently in shortage.

While analysts continue to concentrate on macroeconomic worries like China’s economic growth and U.S. inflation interest rates. Investors’ response is still mostly subdued.

The US Producer Price Index (PPI) & UoM initial Consumer Sentiment numbers will be made public later this week. which might have a substantial influence on the value of WTI priced in USD. Trading possibilities will be centered d upon WTI crude oil as energy investors closely monitor this info.

Open Interest and Technical Perspective

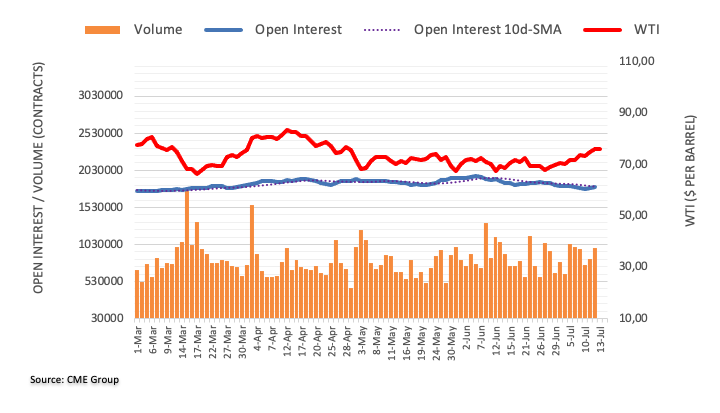

Based on initial reading from CME Group, the amount of interest in the oil futures exchanges jumped over another period in succession on Wed. Again increasing by roughly 10K contracts. Following the trend, volume increased by approximately 151.1K contracts.

WTI is presently examining the 200-day SMA.

WTI prices continued to rise on Thursday, surpassing the $75.70 per barrel level as a result of rising open interest & volumes. Despite this, the oil may try to test the important 200-day SMA, which is now at about $77.20 mark.

Technical Indicators (WTI-Daily)

| Name | Value | Action |

|---|---|---|

| RSI(14) | 63.769 | Buy |

| STOCH(9,6) | 77.404 | Buy |

| STOCHRSI(14) | 100.000 | Overbought |

| MACD(12,26) | 1.110 | Buy |

| ADX(14) | 41.828 | Buy |

| Williams %R | -2.528 | Overbought |

| Name | Value | Action |

|---|---|---|

| CCI(14) | 168.0037 | Buy |

| ATR(14) | 1.8593 | Less Volatility |

| Highs/Lows(14) | 3.4521 | Buy |

| Ultimate Oscillator | 69.930 | Buy |

| ROC | 9.774 | Buy |

| Bull/Bear Power(13) | 6.0540 | Buy |

| Buy:9 | Sell:0 | Neutral:0 | Summary:Strong |