WTI Crude oil is stable over the-$84.00 level while the Middle East situation maintains to provide encouragement.

WTI crude oil Key Points

Over the session WTI finds some upward momentum but lacked strong confidence.

Reassuring investors about anticipated supply interruptions caused by the M. East conflict.

Concerns over limited supply worldwide with a weaker US dollar continues to be a drag on the price of oil.

WTI Crude Oil rates rose slightly over the Asian period on Wed despite diminishing fears regarding possible supply interruption. The crude is now trading within the $84.65-$84.70 range, rising little more than 0.10 percent currently.

Market investors are still unsure over the long-term implications of the conflict. Yet they are persuaded that the dispute must be expanded to include the rest of the region in order for oil prices to rise. Which in consequently, prevents investors from making new bullish stakes. Resulting in range-limited price movements for a second consecutive day. At the same time, US authorities continue to be referring to Iran’s complicity with the Gaza strike on Israel. But they haven’t provided any serious proof.

In addition, major Iraqi as well as Yemeni military groups associated with Iran have pledged to use drones and missiles to strike US targets. Should Us steps in to help Israel, that also raises the potential of aggravation in the region’s ongoing conflict. And, concerns over decreasing worldwide petroleum supplies might keep to serve as a drag on oil’s prices. In reality, the oil officials of 6 Arab countries underlined their willingness to take extra actions to maintain market equilibrium at any point in time.

The latter, together with the persistent selling tendency in the US dollars, might keep to offer some assistance to the US $-specific commodities. Many Fed members’ latest gentle assertions have driven down towards investor projections for additional interest rate rises. This causes US government bond rates to fall more, and it together with a largely bullish mood in the stock market. Which drives the secure haven dollar to an almost 2-week trough.

Source: EIA

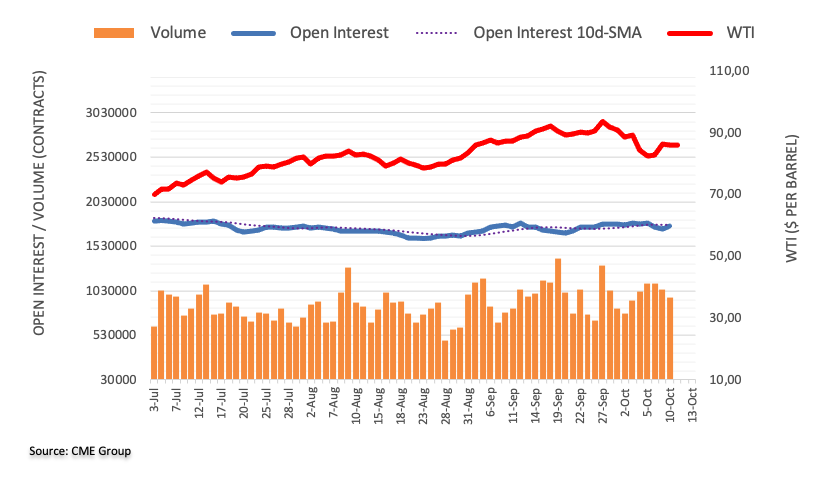

Crude oil Trader’s Open Interest Positioning

Taking updated CME Group data for the oil futures exchanges into account, open interest recovered 2 successive daily declines and climbed by roughly 27,600 deals on yesterday. Volume, a factor on the contrary h, fell for another consecutive period, at this point by approximately 95,000 entries.

Key Support and Resistance Levels

Pivot Point 84.57. Supports S1 83.78 S2 82.99 S3 82.21. Resistance R3 86.93 R2 86.14 R1 85.36