US dollar’s value is bracing for a rise in instability following the release of main NFP & Median Hourly Wages figures. EURUSD Impact?

US Non-Farm Payroll Expectations

Non-farm employment numbers in the United States are expected to expand by 170,000 during Sep, contrary to 187,000 in July.

The US dollar is bracing for a rise in uncertainty following the release of main NFP along with median Wage Earnings statistics.

In September of this year, the rate of joblessness was reported to be 3.7 percent

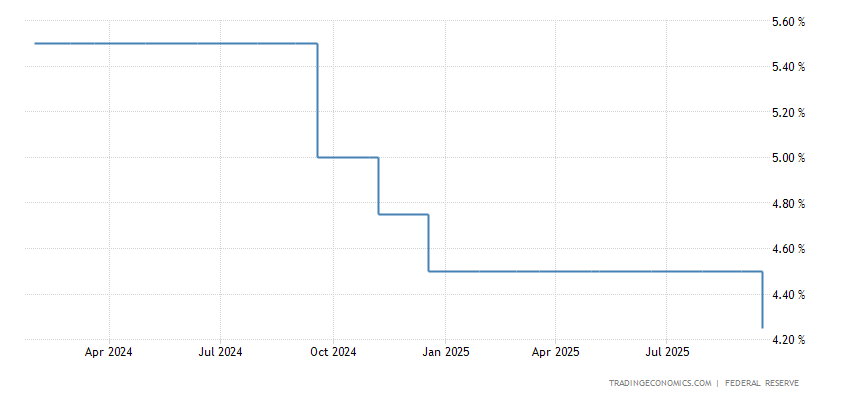

Forecasts of a last interest-rate increase by the US Fed during the fourth quarter were bolstered when the number of job postings in the USA. Surprisingly increased by the greatest in nearly 2-years in the month of August, hitting 9.610 million. The JOLTS Job Openings report indicated a continuously tighter job market in America. Which may give the Fed an opportunity to tighten up further.

After the last month’s policy gathering, numerous Fed members endorsed the pitch of ‘elevated interest rates for extended’. while the US economy shown hopeful indications of recovery.

The DXY benefited from the Fed’s aggressive language, reaching an eleven-month record high of 107.00. whilst the US Treasury note rates approached sixteen-year peaks.

Source: RRADINGECONOMICS.COM

Nevertheless, after disappointing US labor market numbers on Wed caused a long-overdue pullback in the USD. With US Treasury debt rates, the probability of a Bank rate rise in Nov fell to 23 percent versus around 31 percent.

According to the most recent (ADP) findings, the U.S. private sector created only 89K jobs in the month of September. Below compared to an upwards adjusted 180K in Aug and well short of the 153K projection. However, it met forecasts, the US (ISM) PMI declined from 54.5 – 53.6 in Sept.

The Probable Effect of NFP data on Euro vs US dollar Exchange Rate

Case 1 – EURUSD

A positive NFP headlines reading and sizzling wages inflation figures would increase investor bets for another Fed rate rise. Adding fuel to the US dollar’s current rally. EURUSD might go beneath 1.0400 area.

Case 2 – EURUSD

On the contrary side, should the report hints to softening job markets and dashes chances for another rate rise from the Fed this year. The U.S. Currency might experience a strong fall. In this scenario. The pair might post a strong comeback towards 1.0650 zone.