The index of the US dollar looks to keep up its uptrend for another day in a row. Moving a bit higher at 102.40, prior dropping during Thursday’s European afternoon. The rise in US Treasury yields may have fueled the US dollar gain. Based of the most recent revision, the 2-years and the ten-year rates on US treasury coupons were 4.37 percent and 3.86% percent, correspondingly.

US dollar (DXY) Highlights

The DXY rises as American Treasury rates rise.

The US the dollar was impacted by anticipation about the Federal Reserve’s soft attitude.

Rate decreases in the initial quarter year 2024 were disregarded by US Fed policymakers.

The improving US economic data bolstered the Currency.

| Dollar Index | 102.010 | -0.030 | -0.03% |

US Fed Member’s Notions

Nevertheless, the US dollar was squeezed because to market concerns over the Fed’s dovish prognosis for raising interest rates in the Q1 year 2024. Many Bank officials have brushed off early anticipation about rates decreases occurring any moment near. The NY Fed President Williams has flatly rejected the concept, whilst Mary Daly, the president of the San Francisco Fed, believes policy projections are inappropriate. The Chicago Federal president Goolsbee has an identical attitude. Warning that the financial system’s eagerness for rates decreases could surpass reasonable projections.

A rebound in current residential sales and a large increase in confidence among consumers. Both are beneficial signs regarding the USA economy which may have aided the US Greenback. The Nov US Current Housing Sales Movement reported a notable monthly gain of 0.8 percent. Representing a significant comeback following a previous loss of 4.1 percent. The CB Consumer Sentiment Index increased dramatically, reaching its highest level until the beginning of 2021, rising from 101.0 reaching 110.07 mark.

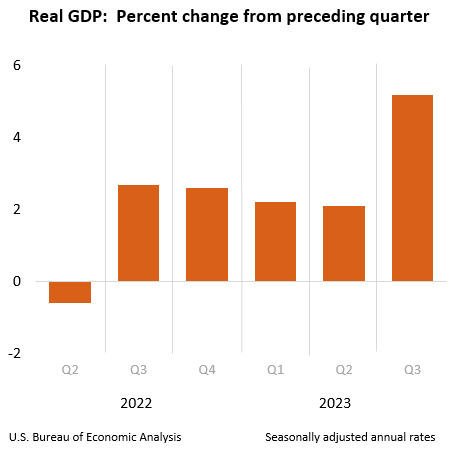

Traders are expecting to pay special attention to key data announcements throughout the Americas period. As a way to acquire a better understanding of the status of the United States economy. Amongst these are the United States GDP Annualized (Q3), Preliminary Jobless Claims, & the Philadelphia Fed Manufacturers Report.

DXY Support and Resistance Levels

S3 99.1 S2 101.376 S1 101.376 R1 103.911 R2 106.759 R3 106.954

Last modified: December 21, 2023

Technical Summary

Moving Averages: BUY Buy (9) Sell (3)

Technical Indicators: BUY Buy (4) Sell (2)

Pivot Points

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

| Classic | 101.846 | 101.914 | 101.964 | 102.032 | 102.082 | 102.150 | 102.200 |

| Fibonacci | 101.914 | 101.959 | 101.987 | 102.032 | 102.077 | 102.105 | 102.150 |

| Camarilla | 101.983 | 101.993 | 102.004 | 102.032 | 102.026 | 102.037 | 102.047 |

| Woodie’s | 101.838 | 101.910 | 101.956 | 102.028 | 102.074 | 102.146 | 102.192 |

| DeMark’s | – | – | 101.940 | 102.020 | 102.057 | – |