US Dollar Prediction: SVB Crisis poses risks, but still can rally. Forecast for the US dollar: SVB Collapse Pose Risks, but Inflation Statistics Could Rekindle Rally.

US dollar as represented by the DXY indicator ends the week lower. As U.S. Treasury rates begin to decline

Following Powell’s hardline remarks on Tue and Wed, the US dollar, as measured by the DXY index, was expected to have a good week. However, a rapid decline in Treasury rates on Thursday and Friday turned the tables. Causing the currency benchmark to give up gains and end the 5 periods roughly flat.

US dollar got impacted as, despite positive U.S. job market data, bond yields tumble, probably due to worries.

Government bond yields plunged the most since 2008 as the weekend drew near. Traders have seen repricing the Fed’s raise path low despite the upbeat Feb U.S. job results.

To put things in perspective, the U.S. economy added 311,000 jobs in Feb, which was significantly more than consensus estimates. But average hourly wages were weaker than expected, coming in at 0.2 percent monthly and 4.6% Y to Y basis. Which is a 1/10 of a point below Wall Street estimates.

Wage increase slowing down

Although a slowing in wage growth is positive, this indicator has recently been very volatile and subject to frequent revisions. Suggesting that it may not be accurate as an indication of a turnaround or as a measure of less labor market tightness.

As evidenced by the graph following table, which predicts an FOMC terminal rate of 5.28% as opposed to 5.70% on Wed, Expectations regarding the outlook for monetary policy have changed to a more subdued manner over the past 48 hours.

IMPLIED YIELD FOR FED FUNDS FUTURES FOR 2023

Source: TradingView

Focus on SVB breakdown

Recent trends in the bond market may be related to the stress in the banking industry brought on by Silicon Valley Bank’s (SVB) meltdown. The failure of this entity, which was shut down by regulators on Friday to safeguard depositors. It has heightened concerns about wider financial shocks and exposed associated risks in the sector. Also, it’s susceptible to the current climate of fast-rising borrowing rates.

The majority of large banks are still well-capitalized despite losses in their long-term investment portfolios. Suggesting that the SVB’s problems have not yet reached a systemic level. Despite the fact that concerns about liquidity have been growing in the wake of the FOMC’s aggressive tightening campaign. As a result, the negative adjustment in yields may be overstated and only temporary.

Upcoming CPI is critical

Regarding the CPI data due out the following week, the annual headline index is anticipated to decline to 6.0 percent from 6.4%. While the core measure is anticipated to ease to 5.5 percent from 5.6%. In terms of potential outcomes, weaker-than-expected figures may reduce bets on a 1/2 FOMC rate increase in March and more firmly shift expectations in support of a quarter-point increase.

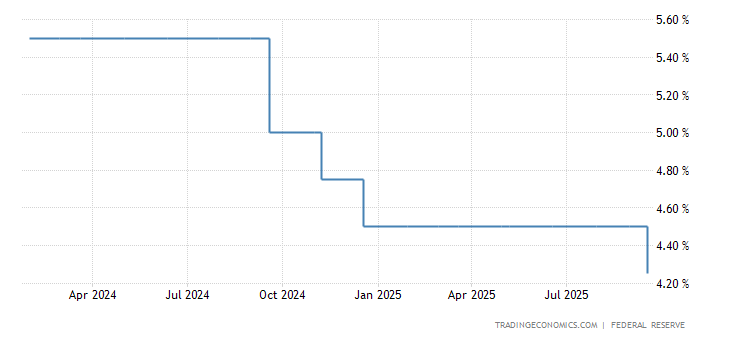

US Interest Rates

Source: TRADINGECONOMICS.COM

On the other hand, redder outcomes might pave the way for the tightening cycle to happen more quickly, which would raise the terminal rate. At this moment, the latter scenario seems more likely.

The US dollar may have a chance to recover

In terms of the US dollar, the current decline might not last long. The dollar is expected to quickly resume its revival if rates reprice higher on the strength of fresh data.

Risk aversion and the rush to shelter may provide support if the turbulence worsens. The U.S. currency will only continue to decline if the Fed capitulates, but recent remarks from Chairman Powell indicate that policymakers need not intend to slow down quite yet.

| Crosses | Price | Day | Year | Date | ||

|---|---|---|---|---|---|---|

| DXY | 104.5760 | -0.7330 | -0.70% | 5.50% | Mar/10 |

CURRENT US TREASURYS RATES

| TICKER | COMPANY | YIELD | CHANGE | %CHANGE |

| US1M | U.S. 1 Month Treasury | 4.737 | 0.013 | 0 |

| US3M | U.S. 3-Month Treasury | 4.948 | -0.062 | 0 |

| US6M | U.S. 6-Month Treasury | 5.135 | -0.149 | 0 |

| US1Y | U.S. 1-Year Treasury | 4.871 | -0.311 | 0 |

| US2Y | U.S. 2-Year Treasury | 4.593 | -0.307 | 0 |

| US10Y | U.S. 10-Year Treasury | 3.704 | -0.219 | 0 |

| US30Y | U.S. 30-Year Treasury | 3.712 | -0.158 | 0 |

Source: CNBC

Synopsis and outlook

The coming week is highlighted by 3 key activities. On March 14, the US Feb CPI will be released. On March 15, the UK Chancellor of the Exchequer Hunt will present the spring budget. The next day, the ECB convenes.

Not only is a 50 bp increase downplayed for this meeting, but that is also the opinion for the May meeting. The US interest rate correction that started in early Feb (backed by solid gains in the service ISM and employment figures) Which supported the dollar’s revival appears to be finished.