AUD at Important Turning Moment Following FOMC minutes. Following yesterday’s U.S. dollar surge following the meeting minutes. AUD at an Important turning moment following Fed meeting minutes. Following yesterday’s U.S. dollar surge following the minutes. Aussie partially recovers

The minutes then took on an almost predictable aggressive slant with no discussion of disinflation, adding to the ongoing restrictive monetary climate.

AUD Fundamental Review

Following yesterday’s increase in the US dollar after the FOMC minutes The Australian dollar has recouped some of its missed advances.

Without mentioning disinflation, the minutes then took on an almost expected aggressive tone. They were aggravating the already tightening money landscape.

Additionally, some FOMC members chose to raise interest rates by 50 basis points. Which has caused an increase in money market pricing for the March meeting (+/- 30 basis points at the moment).

AUD looking to the upcoming data

Australian capital expenditure data beat estimates across the board (reaching its highest level since Q4 2021). Showing optimism in these sectors and the increase in capital inflows has driven up the demand for the AUD this morning.

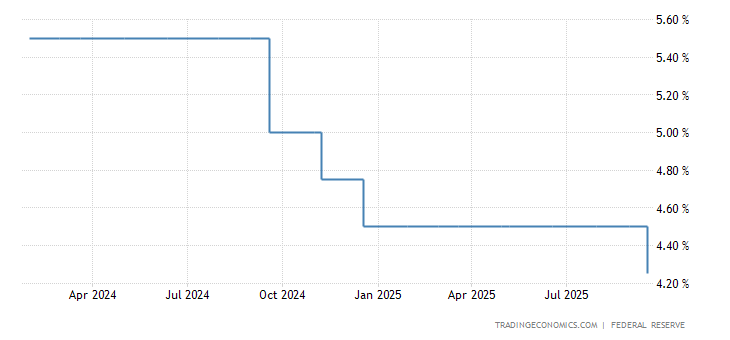

US Interest Rate Chart

Source: Federal Reserve

Looking ahead, markets will be focused on the US GDP and the accompanying labor market data in the form of jobless claims. US GDP is expected to come in marginally weaker than the previous read. While we look to round off the trading day with the Fed’s Bostic for further guidance.

Economic Activity Schedule in focus

Aussie in Technical Perspective

AUDUSD is declining for a second consecutive day and is currently trading near the monthly low. On the graph, it can be seen that it slightly recovered from the 200 SMA’s slight bearishness.

The duo also deepened its slide beneath the 20 SMA, which is now bearish and supports a downward extension.

Technical signs, still in negative territory and at multi-month lows, also indicate that lower lows are imminent.

Analytical Review and Indications

Daily price movement for the AUDUSD currency pair continues to move within the falling wedge chart pattern. Which typically denotes a positive breakthrough.

Bulls have defended the 0.6800 psychological support mark and the 200-day SMA. But the falling wedge could be invalidated if a daily candle closes underneath this critical turning point.

From a bullish standpoint, a breach above wedge opposition/50-day SMA/0.6900 could signal a continuation forward into additional resistance areas.

Key Major Technical Levels to Watch

If selling pressure increases even more, the duo might fall back to retest the 200-day SMA.

If selling pressure increases even more, the duo might fall back to retest the 200-day SMA. If prices fall below that level. The bears may shoot for the Jan bottom of 0.6687 before focusing on the Dec bottom of 0.6628.

Even lesser, the 0.6546 resistance level may serve as a stopgap for further declines.

On the other hand, bullish moves could initially run into opposition at the 0.6920 obstacles. By breaking through this barrier. The duo may rise forward into or above 0.7030. And, test the most recent trend rejection point of 0.7157.

If that barrier fails, the June peak of 0.7282 might be visible on the radar.

Major resistance levels:

- 0.7000

- 0.6916

- 0.6900/Wedge resistance/50-day SMA

Major support levels:

- 0.6800/Wedge support/200-day SMA

- 0.6700