Gold pricing falls as traders support the US greenback amid a risk-off market sentiment. Stronger oil costs and fears about worldwide expansion drive the USD up.

GOLD FUNDAMENTAL PREDICTIONS

The prices of gold are facing a further decline as reflation worries are fueled by OPEC+. With Saudi Arabia as well as Russia anticipated to extend output cutbacks through the conclusion of the year. Whilst the extension of supply restrictions is partially expected, the length certainly unclear. That might maintain the US currency strong, given China’s and European economic worries fueling USD gains.

US ISM services PMI data is going to be issued late today. Since the United States is predominantly a service-based economy. The data provided has a greater impact compared to the manufacturing statistic. Calculations are expected to be somewhat fewer than the previous number. Though this shouldn’t put off a strong dollar except there is a huge overshoot.

Gold (XAUUSD) Key Points

The price of gold maintains a 2-day falling streak as speculators pour money towards the US greenback.

Worries of a recession in the US have subsided considerably as a result of lower price tensions and solid employment growth.

Markets are looking and evaluating for the August ISM Services PMI results from the United States for new direction.

| Calendar | GMT | Reference | Actual | Previous | Consensus | TEForecast | |

| 2023-08-01 | 02:00 PM | ISM Manufacturing PMI | Jul | 46.4 | 46 | 46.8 | 48 |

| 2023-09-01 | 02:00 PM | ISM Manufacturing PMI | Aug | 47.6 | 46.4 | 47 | 47 |

| 2023-10-02 | 02:00 PM | ISM Manufacturing PMI | Sep | 47.6 | 48.4 | ||

Simply put, the price of gold does not appear to be suffering as the jobless rate in the US increased abruptly to 3.8 percent. While wage increases halted in August. Traders are hoping that (Fed) has finished raising rates of interest. Fed’s Governor Christopher Waller agreed, noting the most recent set of economic statistics as giving the Fed greater leeway. Win determining if the cost of borrowing should be raised further.

US dollar benefitting from its Safe-Haven Status

On Wednesday, the gold price (XAUUSD) extended their -day falling run. After speculators continued to pour cash towards the US dollars in response to growing worldwide economic slump worries. Markets backed the US currency as a form of refuge as emerging nations face the scorn of higher rates of interest from Western monetary authorities. Along with possible upward dangers of recession in China.

After the DXY almost achieved high mark on Tuesday, the sights have been on 105.00 zone. Thus the DXY is just a few cents away from setting its latest annual peak for another occasion in a row. The next target is 105.23. The March 2022 top, that constitutes an eighteen-month peak. Should the index approach this point, a certain obstacle may emerge.

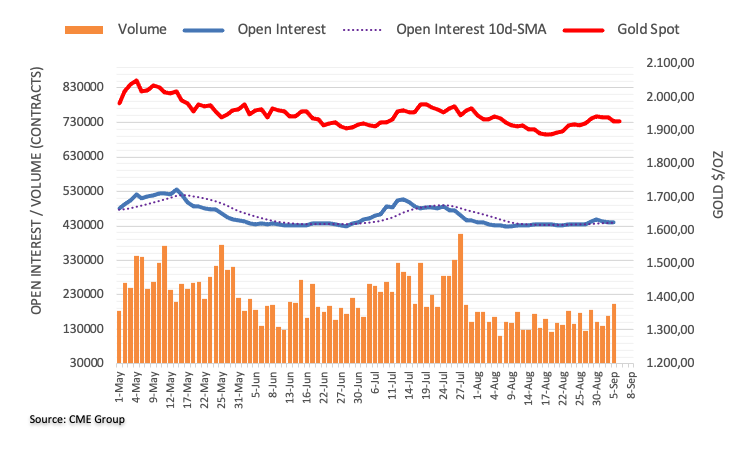

Gold Open Interest Figures

According to initial CME Group data, open interest for gold futures trading grew by simply 858 contracts. Following 2-straight daily drops on Tuesday. Volume swiftly followed the trend. Adding near 34.2K contracts to what was the prior daily construct.

Technical Analysis & Perspective: XAUUSD. The 200-day – SMA is expected to fall.

Prices for gold fell over another period in succession on Tuesday. Despite increased open interest as well as volume. Suggesting likely the gold may suffer more declines in the short future. However, the 200-day SMA near $1916 / ounce troy – currently appears to be the nearest support zone.

Gold price continues 2-day declining trend, falling under Tuesday’s bottom at $1,925.37 mark. While the US Greenback stays strong owing to risk-off sentiment. The value of gold has dropped beneath the 20 & 50-day (EMAs). Selling appetite for gold following a rebound advance to roughly $1,950.00 area. Shows that traders viewed the dip as a new selling potential. Gold bull traders will keep on to profit from the 200-day EMA’s solid support.

Major Technical Levels

Resistance levels:

- 1950.00

- Trendline resistance

- 50-day MA

Support levels:

- 1925.06

- 200-day MA

- 1900.00