Gold prices battle to take advantage on small daily advances as the United States ISM PMI with Fed Chair Powell awaits.

Key points & Considerations

On Friday, the spot gold price attracted new investors and received backing due to softer US Fed predictions.

Fears over a worldwide economic slump are adding to the gold’s appeal.

Its risk-on environment could restrict rises prior to the USA’s ISM PMI & Fed Chairman Powell’s address.

Treasury rates in the United States recovered on Thursday. Following San Francisco Fed Daly said it is early to declare success over price increases. Since officials are still considering lowering the price of borrowing.

Powell may go out swaying, promising to remain on track and preserve a tight posture for a long time. So to avoid additional relaxation of financial illnesses that could hinder efforts at regaining pricing stably. This outlook has the potential to derail the recent strong trend in the stock market and the gold group.

Gold Fights for Small Gains

The gold price (XAUUSD) receives fresh offers on Friday. As it maintains its minor intraday advances into the morning European period. But there is little execution. The price of gold is still within the reach of its best value until the fifth of May. Which was reached on Wed, which is presently trading in the $2,041 to $2042 range, gaining 0.25 percent on the trading day. The US macroeconomic statistics issued on Thursday showed fresh evidence of diminishing price pressures as well as a stalling job market. Such reaffirmed predictions expecting the Fed would leave rates stable and maybe begin decreasing rates in the year 2024. Benefiting the gold.

Additionally, contradictory economic indications from the Chinese mainland, the globe’s second-biggest economy. Impact on traders’ morale and serve as a positive force for the safer-haven Bullion price. However, NY Fed President Williams, together with San Francisco Fed’s Daly, resisted hopes for a swift shift to rate decreases. But leaving the door open for additional tightness if inflation momentum stalled. This helps US the dollar maintain the rebounding wins from two days earlier and limits the XAUUSD. Investors are presently searching at a few stimuli prior to Powell’s address in the United States.

Technical Analysis & Perspective

Based on a technical standpoint, anything following rally is expected to encounter a certain obstacle at the $2,052 level. Given oscillations on the daily graph easily in the positive range. A few follow-up procuring could be noticed providing a new induce for positive investors. Allowing the metal’s price to rise more to trying the all times top, which was reached on May within the $2,079 to 2,080 region.

On the other hand, the previous night’s swinging bottom at $2,030 might serve as right away assistance short from the $2,020 area. With the $2,010 to $2,008/oz significant horizontal barrier threshold. The last one could serve as a crucial critical point, and should it be cracked, may trigger further technical reselling. Dragging the metal’s price deeper under the $2,000/oz psychological level, to the subsequent appropriate support level that is the $1,990 zone.

Open Interest and Trader’s Positioning

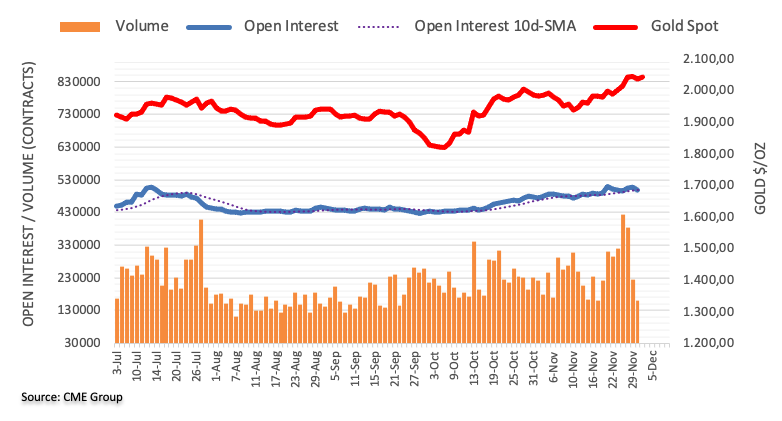

According to initial CME Group data, open interest for gold contract markets fell by about 8700 units. Following 2 straight daily gains on Thurs. Volumes trailed the trend, declining for the 3rd consecutive period, falling down around 65,000 deals.

Technical Indicators (5- hour Time Frame)

| Name | Value | Action |

| RSI(14) | 68.125 | Buy |

| STOCH(9,6) | 48.513 | Neutral |

| STOCHRSI(14) | 31.049 | Sell |

| MACD(12,26) | 9.680 | Buy |

| ADX(14) | 38.737 | Buy |

| Williams %R | -15.409 | Overbought |

| Name | Value | Action |

| CCI(14) | 96.4350 | Buy |

| ATR(14) | 8.7286 | Less Volatility |

| Highs/Lows(14) | 0.7893 | Buy |

| Ultimate Oscillator | 52.367 | Buy |

| ROC | 1.254 | Buy |

| Bull/Bear Power(13) | 11.7600 | Buy |