Gold price maintains its significant intraday increases, but the attention focuses on the US the level of PCE Price Index.

Gold Key Points and Considerations

The gold price gained significant upward momentum, snapping a -day declining trend and reaching an almost 7-month bottom.

Falling US bond rates pull the US dollar off from its ten-month elevation providing support for the gold

As investors anticipate the U.S. Core PCE Inflation Index, speculations on another Fed rate rise in 2023 may limit increases.

Gold modestly rebound on present US dollar weakness

The gold price (XAUUSD) began drifting downward from the start of this week, Reaching its lowest price point before the 10th of March in the $1,858-1,857 range yesterday. However, falling US government bond rates push the (USD) down for another consecutive day. Down from its YTD top reached on Wednesday afternoon. Which helps the metal recover a bit of impetus on Friday, Snapping a -day negative run. The US dollar’s decline might also be linked to certain trade rebalancing before the USA’s PCE Price Survey.

By 0820 GMT, spot gold had risen 0.4 percent to $1,872.79 / ounce, although it was anticipated to fall 3.5 percent in Sept. the weakest month in 7. Rates are dropped 2.5 percent year on year.

Gold futures in the United States rose 0.6 percent to $1,889.50 mark

The US currency fell from ten-month peaks, while baseline ten-year Treasury rates fell below a 16-year high levels. Boosting XAU’s attractiveness, although each remained on track for the strongest quarters in the past four years.

On Thursday, Richmond Fed President, Barkin stated that it is uncertain if additional fiscal policy adjustments might be required in the months to come.

Rising rates of interest increase the prospect for keeping gold, since is sold in dollar & pays no interest at all. According to figures released on Thursday, the United States economy kept a pretty steady rate for expansion in Q2

Gold Investors Cautious before US PCE data

The Federal Reserve’s selected inflation indicator, its primary gauge, will affect anticipation regarding the upcoming policy shift. That will impact the Dollar and offer a new direct push towards the no-interest Bullion price. Meanwhile, the upcoming federal government shut on October 1st, that presents a danger for the economy. In addition to lingering concerns about China’s struggling building field, gives extra backing to gold.

To battle the value back to $1,900, bullion needs a weakened dollar and lower bond rates. That “might need an especially dismal number of inflation numbers as well as bullish Fed views to have to be pulled out.”

Gold Technical Analysis

Technically, the (RSI) on the day’s graph is indicating exhausted situations, prompting investors to reduce the short bets. However, it would be advisable to hold off until there is follow-up purchasing above the nighttime swinging top. Which is expected to be near $1,880, before setting for additional rises. The gold vs dollar may then pick up speed and attempt to recapture its $1,900 level. The previously stated level ought to act as a solid obstacle, if it’s broken, it suggests the recent decline has ended.

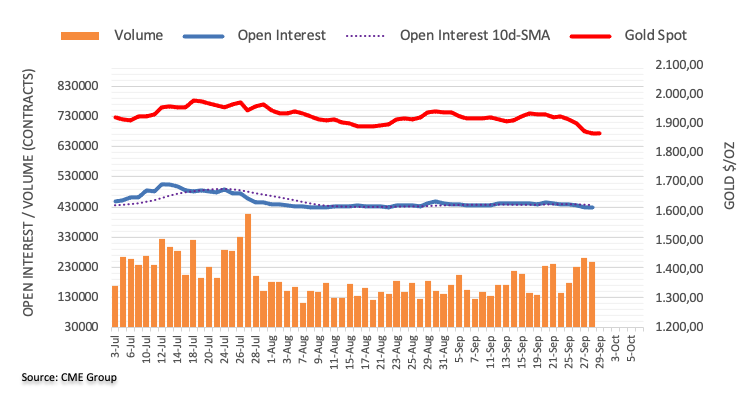

Open Interest

Based on initial CME Group assessments, open interest for gold futures exchanges continued the downturn for another day on yesterday. Extending it by over three thousand contracts. Following 3 continious daily increases, volume dropped by roughly 15.200 futures contract deals.