Gold’s value is able to stay higher on Monday morning, despite the fact that the US dollar is trading a slightly lower in the Euro session

Gold (XAUUSD) Key Points

After reversing a month\s decline, the gold price remains protective over a crucial support intersection.

Investors of XAUUSD are hesitant in advance of highest-ranking US employment and inflation indicators.

The combination of China-stirred confidence, a drop in US Treasury bond rates, and the US greenback placed a barrier beneath the price of gold.

Following the Fed’s emphasis on data reliance, the Core PCE Price Index in the US and the NFP will prove crucial.

GOLD FUNDAMENTAL FRAMEWORK FOR XAUUSD

The prices of gold were able to stay high on Monday morning, amid the fact that the US currency is trading a bit less. Whilst Fed Chair Jerome Powell along with other policymakers (Mr. Mester) hinted at the possibility of more monetary adjustment if required. The ongoing trend of economic indicators suggests that rates could stay stagnant for a while before being slashed. The financial markets currently anticipate the initial wave of reductions in rates in June-July, rather than May before Jackson Hole Summit.

Other than that, China unveiled another step to boost economic activity. Although conflicting worries regarding US-China trade relations, Includung fears of a weaker revival in among the world’s biggest Gold clients push the XAUUSD bull investors.

Continuing on, gold dealers are going to watching the latest China output statistics. With the Sino-American discussions in Beijing any definitive guidance. The Fed’s preferred inflation indicator, the Core (PCE) for July, including monthly job data for August are all going to be noteworthy.

Technical Perspective

The Technical Convergence signal suggests the gold price is safely stronger over the $1,910 major backing. Despite recent investor reluctance. Nonetheless, the indicated support conjunction comprises the 5-DMA, Fib 23.6 percent on a single day & 38.2% of the on single-week. In addition to the low Bollinger band over the hour timescale.

Prior of this, the middle point part of the Bollinger band on the 4 -hour chart meets the Fib 61.8 percent a single day & 23.6 percent 1-week to limit instant XAUUSD declines at $1,915 level.

In the meantime, a confluence of the preceding weekly peak and Pivot Points – a single day R1, near $1,923-24, protects the spot gold Price’s quick rebound.

The 50-day moving average then combines the Pivot Factor a single day R2 with 1-week R1 to suggest $1,933 mark. Being the primary obstacle for The exchange rate for bullish traders.

Futures Trader’s Contract Positioning

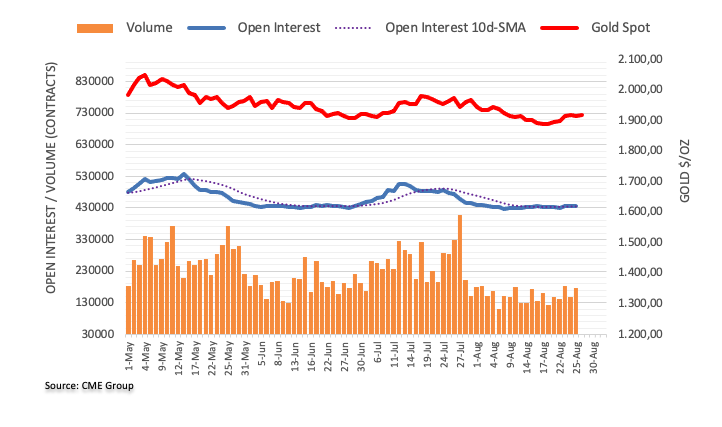

According to CME Group’s futures for gold flash statistics. The investors cut the number of open interest holdings by 575 lots on Friday. Extending to the prior day’s loss. Rather, volume inverted the prior daily decline and climbed by approximately 31K contracts. Retaining the volatile activity over the moment

An uptrend over the 200-day simple moving average

Gold prices fell slightly on Friday due to a little decline in open interest, indicating a potential short-term comeback. Meanwhile, the bullion may go positive whenever it winds the 200-day simple moving average ($1910) convincingly.