Gold forecast: rally requires confirmation from $2,010 and US GDP, US Q1 GDP, and Core PCE Price Index declines may support Fed policy shift talks and fuel the XAUUSD bulls.

Gold’s price declines from its intraday peak and loses its week’s starting recovery.

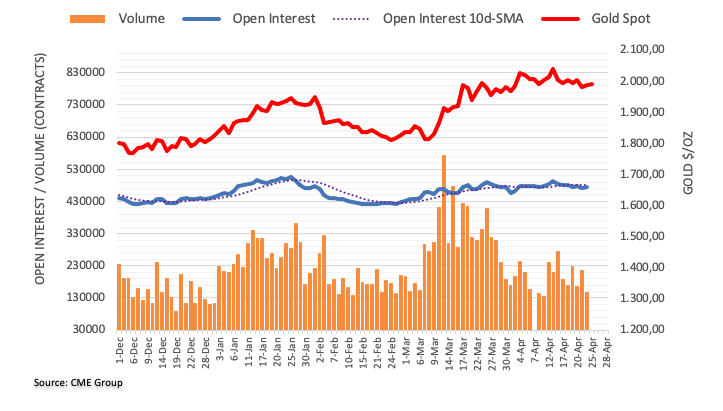

As the market mood deteriorates amidst a light schedule, the price of gold (XAUUSD) solidifies the previous two weeks’ losses. Allowing investors to get ready for the US Q1 GDP and Core PCE Price Index. The Fed’s preferred inflation indicator.

It’s important to keep in mind, though, that while traders grapple with US debt limit fears and pre-Fed preparations. The price’s corrective rebound requires validation from the $2,000 psychological barrier. And the earlier mentioned vital US data. In spite of the US Dollar’s potential to halt the further decline of the greenback. The Gold Price is still stronger despite the negative attitude and pre-data/event stabilization.

Continuing on, the value of gold is still headed north despite widespread US Dollar weakness. Although its potential upside has to be confirmed by the dismal US Q1 GDP and the Fed’s preferred inflation indicator.

Observe key levels for the price of gold

According to our technical measure, the value of gold is moving away from the intersection of the Bollinger on the one-day and Pivot. Near the psychological threshold of $2,000 per ounce.

The next major resistance mark for the value of gold is $2,010. Which contains the pivot point for the previous week’s R1 and the prior monthly top.

The possibility of seeing a rally to the monthly high above $2,050 cannot be ruled out. If the Gold price stays stronger than $2,010.

In contrast, $1,987 is highlighted as the imminent major support of roughly $1,987 by Fibonacci 38.2% in a single week. And 23.6 percent on one day combined.

The Fibonacci 61.8% on a day and 23.6% on a week will emphasize $1,980 as the last line of defense for the XAUUSD bulls. If the gold price continues to decline beyond $1,987.