Germany CPI cooled to 2.0% year-over-year in June, marking a slight decline from 2.1% in May, according to a flash estimate by Destatis. This brings Europe’s largest economy in line with the European Central Bank’s inflation goal, reinforcing expectations that price pressures across the euro area are under control.

The latest data comes as the ECB closely monitors inflation for signs of persistence or a clear path toward its target. The drop in Germany’s CPI, though modest, adds weight to the argument for continued monetary easing.

Monthly Germany CPI Flat, Disappointing Expectations

While annual inflation slowed, Germamy monthly CPI showed no increase (0.0%), missing the market forecast of a 0.2% rise. The subdued reading suggests minimal price momentum, with falling energy prices and weak consumer demand likely contributing.

HICP Also Slows

The Harmonized Index of Consumer Prices (HICP), which the ECB uses to assess inflation trends across the euro area, also declined to 2.0%, down from 2.1% in May. Importantly, this figure came in below the consensus estimate of 2.2%, reinforcing that inflation is easing faster than expected.

ECB May Welcome Soft Print

The ECB delivered a 25 bps rate cut in June, its first in years, and signaled that more easing could follow depending on inflation trends. With Germany—the bloc’s largest economy—now reaching the 2% threshold, further cuts in Q3 or Q4 look increasingly likely.

Still, ECB officials are likely to remain cautious. Sticky core inflation and wage growth in the services sector could delay any aggressive action.

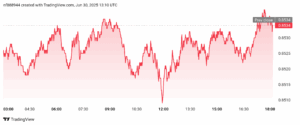

EURUSD Holds Steady

Markets reacted calmly to the data. The EURUSD pair stayed slightly above 1.1700, with traders largely expecting disinflation. The muted move reflects focus on broader eurozone trends and upcoming key events like Eurozone CPI, US ISM data, and Fed commentary.

Broader Eurozone Context

Germany’s CPI print aligns with a broader eurozone disinflation trend. Other member states, including Spain and France, have also seen falling inflation, suggesting a region-wide cooling in price pressures.

Technical Outlook

Technically, EURUSD is consolidating. Support is seen near 1.1680, while resistance lies around 1.1750. A breakout could hinge on Eurozone inflation data and upcoming Fed remarks.

Disclaimer

This blog is for informational purposes only and does not consitute Financial Advice. Always conduct your own research and consult a professional advisor before making investment Decissions.

[sc_fs_multi_faq headline-0="h2" question-0="What is the latest CPI reading in Germany?" answer-0="Germany’s annual CPI came in at 2.0% in June 2025, down from 2.1% in May." image-0="" headline-1="h2" question-1="What is the Harmonized Index of Consumer Prices (HICP)?" answer-1="HICP is the ECB’s preferred measure of inflation, allowing cross-country comparison in the eurozone." image-1="" headline-2="h2" question-2="Will the ECB cut rates again soon?" answer-2="With inflation easing, especially in Germany, markets expect the ECB could deliver another rate cut in Q3 or Q4 2025." image-2="" count="3" html="true" css_class=""]