Gold gained during the factory PMI data release as the market’s mood improved. The gold price comes out of a descending parallel channel. The ISM Manufacturing and Services PMI releases are still anticipated for a new jolt to the XAUUSD.

Gold price rose in the first part of the trading week

Following an unexpectedly strong US Nonfarm Payrolls report. The Gold prices have risen in the first half of the trading week. Breaking out of a bearish trend that had driven XAUUSD price action for most of Feb.

The 4 percent solid resistance that US 10-year Treasury bond yields encountered recently has effectively placed a floor under further US Dollar rises over the earlier trading days. Gold price bulls should prevail while US 10-year T-bond yields are unable to breach beyond this level.

Gold benefits from A combination of weak US statistics and rising Chinese PMI, and USD

Today, the price of gold futures traded at its lowest level, reaching an hourly low of $1810.80. This is after the prior lowest low of $1812 from yesterday.

Moreover, gold ended stronger than it had the day before and above its opening price both yesterday and today.

Such a turnaround might well look if gold continues to rise in the coming days. Even today’s green candle with an elevated high doesn’t by itself verify a finding to the correction. We discussed the significance of $1815 as a key price point to consider for possible support.

The XAUUSD value today reached an intraday low for gold futures.

The CB Consumer Confidence report, which was released on Tuesday, contained some soft data from the United States. Including declining inflation expectations, which led to some profit-taking on long positions in the US dollar.

Purchasing Managers Index (PMI) readings in China that were better than anticipated early on Wed improved the mood of the Asian market.

Purchasing Managers Index (PMI) readings in China that were better than anticipated early on Wed improved the mood of the Asian market. Numerous PMI surveys are likely to be released worldwide on the initial trading day of the month, which should give gold price movement a new impetus.

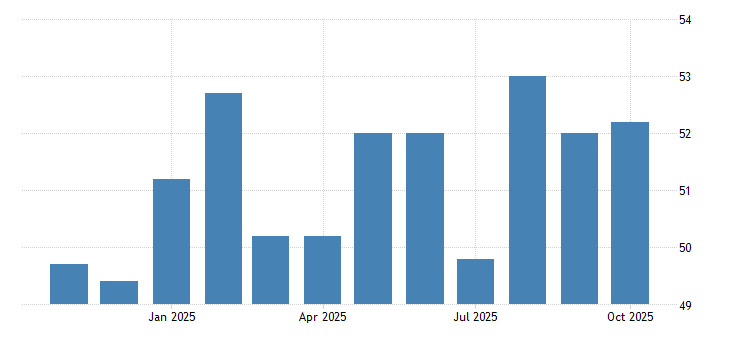

Source: Trading economics

There will soon be US Industrial and Services PMIs.

The US dollar is likely to maintain its position against Gold if the ISM Services PMI data confirms that rising wage costs are fueling rising price pressures in the sector. Therefore, market players will pay careful attention to the Prices Paid Index component.

Although the CME Group FedWatch Tool indicates that markets have completely priced in at a minimum two more 25 basis point Federal Reserve rate hikes in March and May. It is important to note. Furthermore, there is a 25percentage probability that the Fed will keep its policy rate in June.

Until the Feb jobs data and inflation statistics confirm or disprove one more 25-bps hike in June, At least, the US Dollar does not have much room to rise, according to the market turnaround.

The element of US Government bonds

Traders are currently keeping an eye on the rates on US Treasury bonds. The 10-year US T-bond yield aligns with 4 percent as critical resistance, and if that level holds, there may be a technical correction.

That situation. Because of the inverse relationship between gold’s price and US Treasury rates, gold could move up instead of down.

Technical indicators for the gold market point to further gains.

The price of gold continues to resist the 3 bearish channels after recovering from the 200-day EMA the day before. The approaching bull cross on the MACD and the RSI’s (14) return from oversold territory both support the recovery moves.

Impact of the Federal Reserve on gold prices

The Federal Reserve’s monetary policy choices are not new to the gold price. In an effort to combat extremely high inflation rates, the US central bank has been on a mission to raise interest rates since March 2022.

In an effort to combat extremely high inflation rates, the US central bank has been on a mission to raise interest rates since March 2022.

The US Dollar has profited the most from this decision, as traders increased the value of the global reserve currency as cash became more difficult to acquire. In turn, this causes commodities like gold that are valued in US dollars to depreciate.