Asian stocks up, China rallies on to upbeat PMI data. As business activity in the nation returned to pre-COVID levels, Chinese bourses led gains across Asian stock markets on Wednesday.

As business activity in the nation returned to pre-COVID tiers, Chinese bourses led gains across Asian stock markets on Wednesday.

Nation’s composite purchasing managers’ index (PMI), a crucial gauge of economic activity. Soared to an over-a-decade peak in Feb. China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes increased 1.4 percent and 0.9 percent.

Asian stocks led by China and Hong Kong

Strong factory and non-manufacturing PMIs showed that economic growth in the Asian giant was picking up steam after it relaxed most anti-COVID measures. The Shanghai Composite was almost at an 8 high.

The best performer in Asia was Hong Kong’s Hang Seng index, which increased 3.3 percent as confidence regarding China helped the indicator bounce back from an approximately 2 low.

A China recovery is encouraging for other Asian countries, which rely on China as a trading bloc. On Wednesday, stock indexes that are sensitive to China increased, with the Taiwan Weighted index increasing by 0.4 percent.

Asian stocks and exchanges still fear the US rate increases.

Most Asian stocks had suffered significant losses since Feb as worries about increasing U.S. interest rates battered local markets. On Wednesday, this attitude persisted and prevented advances in the majority of regional equity markets.

Australian and Japanese stocks rise

Japan’s Nikkei 225 index gained 0.2 percent. Statistics suggest the country’s manufacturing PMI stayed in contraction through Feb. Pointing to much more pressure on expansion over the next months.

Australia’s ASX 200 index rose 0.1%, as data revealed the country’s economic growth stalled drastically in the 4th quarter of 2022.

A post-COVID boom has run out of steam in Australia, leaving the nation grappling with rampant inflation and higher interest rates.

The Hang Seng move upward in China’s data

After Chinese PMI readings have been much better than anticipated, Hong Kong’s Hang Seng Index shot up amid hopes that the world’s 2nd-largest economy might spur global development.

Chinese manufacturing PMI for Feb came in at 52.6, exceeding prior expectations of 50.6 and 50.1. The best result since April 2012. The composite PMI was 56.4 compared to 52.9 earlier. The non-manufacturing PMI was 56.3 as opposed to the 54.9 anticipated.

A strong performance was also seen in the Caixin manufacturing PMI. A poll of smaller Chinese companies. Which came in at 51.6 as opposed to the predicted 50.7.

With the Nation People’s Congress set to start this weekend, the Hang Seng bears were relieved by today’s spin of more than 3.5 percent after losing 9.9 percent in Feb.

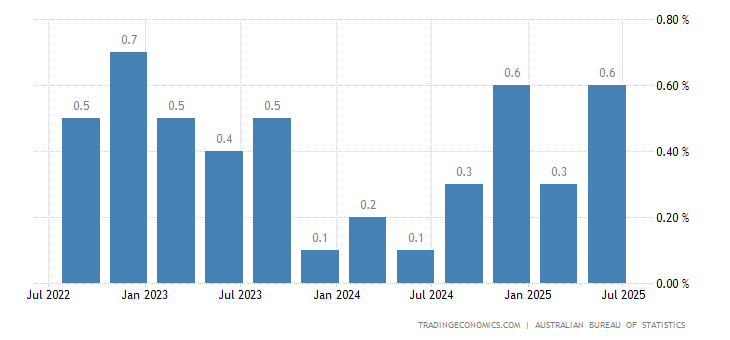

Australia’s Q4 GDP decreased against forecasts

Australian 4th quarter-on-quarter Growth came in at 0.5%, below the predicted 0.8 percentage points and the previously reported 0.7%, which was increased from 0.6 percent.

As predicted, the annual GDP for the month of December was 2.7%, showing further improvements from earlier months. 5.9 percent were viewed previously. The Australian dollar originally dropped below 67 cents before rising just after Chinese PMI statistics

Source: Australia BUREAU OF STATISTICS

After 4Q quarter-over-quarter GDP came in at 0.5 percent rather than the 0.8 percent predicted. Which was revised up from 0.6%. On robust Chinese statistics later in the day, the currency gained strength.

Source; Bloomberg

As expected, more upward revisions to earlier quarters led to annual GDP growth. The rate of 2.7% as of December. 5.9% were viewed previously.

RBA in View

Prior to the Reserve Bank of Australia’s meeting on monetary policy next Tuesday. Today’s GDP numbers are released. It is expected that they will raise their aim cash rate by 25 basis points, to 3.60%. It will be the tenth increase since the launch in May of last year if they succeed.

Futures suggest the beginning of the cash session. It is likely where they left off after Wall Street’s slightly lower-than-expected finish. Due to the US dollar’s easing during the Asian session, gold and petroleum oil have seen a slight increase once more.

Today’s data map is quite crowded, with several CPI and PMI numbers and ISM data for US manufacturing. Additionally, there will be many presenters from the ECB, BoE, and Fed to calm the agitated markets.

The so-called “mortgage cliff,” where fixed-rate debtors will see their repayment amounts increase by over 300 basis points, may make the situation worse.

All of this demonstrates the RBA’s difficult path ahead. The most recent data on jobless revealed that- despite a slight loosening, the labor market was still considered to be relatively tight by historical standards.

A 3.7% unemployment rate. Stagflation may worsen if price forces are restrained at a time when aggregate demand is softening.

Gold rebounds, but it may be short-lived

On Tuesday, gold prices rose for a second straight session and reached $1,835, Though, purchasing interest wasn’t particularly strong. Traders were still hesitant to increase their exposure to rate-sensitive assets due to the intensifying pressure on monetary policy.

Equities, on the other hand, were largely aimless. The S&P 500 fluctuated between modest rises and falls near the 3,990 mark, which was a clear indication of a lack of confidence on Wall Street.

TECHNICAL ANALYSIS OF GOLD

After a sharp sell-off earlier this month. Gold has started to bounce back and seems to have recovered its footing. But further gains may be limited if prices fail to overcome resistance at $1,840.

After a sharp sell-off earlier this month. Gold has started to bounce back and seems to have recovered its footing. But further gains may be limited if prices fail to overcome resistance at $1,840.

If so, sellers may come forward, sending the commodity back toward its Feb low points before a drop toward the 200-day simple moving average.