European market futures are slightly higher. In advance of the release of the Federal Reserve’s preferred inflation measure Stocks are likely to be up on Friday on indications that the region’s economy is slowly recovering.

At 2:00 ET (07:00 GMT), the German DAX futures contract moved 0.2 percentage points stronger. The French CAC 40 futures contract was neutral, and the British FTSE 100 futures contract was up 0.3 percent.

European market futures are slightly higher; the 4th German GDP was lower.

According to information published earlier in the session, the GfK consumer confidence index increased by 7-points to minus 38 in Feb

Even though it was a 10-month top, it remains extremely near to the historically low levels brought on by the cost of living crisis.

The German GfK consumer climate indicator for the coming month increased from -33.8 to -30.5 in March.

Less encouraging growth statistics came from Germany, where the largest economy in the Eurozone experienced a 0.4 percentage-point decline in the fourth quarter of 2017 and only a 0.3 percent annual increase.

European markets looking for fresh information

With the release of the core personal consumption expenditures price index for Jan, the inflation indicator. The U.S. central bank carefully monitors, the magnitude of those difficulties that may become apparent in the U.S. The largest economy in the world, later in the session.

The indicator is projected to rise 4.3 percentage points from a year ago, down from 4.4 percent in the previous month, indicating that inflation will be difficult to control.

Corporate Earnings

The biggest chemical company in Europe, BASF (ETR: BASFN), revealed plans to cut 2,600 jobs, or about 2 percent of its global workforce, as it adapts to living without cheaper Russian gas.

Earlier, the Asian stock and Financial Markets were mixed

After Wall Street’s modest rally, driven by tech stocks, ended the market’s longest losing run since December. Shares in Asia were mixed on Friday.

In Seoul, Hong Kong, and Shanghai, benchmarks decreased while they increased in Tokyo and Sydney. U.S. futures moved slightly lower as oil costs increased.

Japan reported that in Jan, the increase in its core consumer price index—which excludes volatile perishable food. It was the highest in 41 years.

Japan reported that in Jan, the increase in its core consumer price index—which excludes volatile perishable food. It was the highest in 41 years. However, economist Kazuo Ueda. Who has been nominated to lead the country’s central bank, told the lawmakers he favors keeping Japan’s benchmark interest rate close to zero.

The BOJ is hesitant to change course due to concerns over a possible worldwide downturn. Citing the fact that wages in Japan have not kept up with price increases.

The S&P/ASX 200 in Australia rose 0.3 percentage points to 7,303.50, While the Nikkei 225 in Japan increased 1.1 percentage points to 27,390.09. The Index in India was up 0.3 percent at 59,814.70.

The Shanghai Composite index dropped by 0.7 percent to 3,264.58. While the Hang Seng index in Hong Kong dropped by 1.4 percent to 20,063.48. The Kospi in South Korea fell 0.7% to 2,423.56.

The S&P 500 added 0.5 percent on Thursday, finishing at 4,012.32 for its first increase in five days.

The Nasdaq index rose 0.7 percentage points to 11,590.40. While the Dow Jones Industrial Average rose 0.3 percentage points to 33,153,91.

Commodities Run down

The revelation of yet another increase in U.S. oil stocks has been overshadowed by this information. Despite figures from the Energy Information Administration indicating inventories rose for a ninth straight week. To their top level from May 2021.

By 2:00 ET, Brent oil futures were up 0.9 percentage points to $82.96 a barrel. While U.S. crude futures were 0.9 percent higher at $76.10 a barrel.

After recovering from their early severe losses, both contracts were trading down less than 0.5% each for the week.

The price of gold futures increased by 0.2% to $1,830.70/oz, and the EUR/USD price increased slightly to 1.0598.

FX Perspective Synopsis

The American dollar decreased from 134.70 Japanese yen to 134.68 yen. The euro increased from $1.0596 to $1.0600.

Despite this, the US Dollar held steady against its key competitors on Thursday. On the week’s final trading day, it appears to have lost its positive vigor.

The weekly rebound to levels last seen in Jan. continues as the dollar index rises for the fourth straight session.

The US yields across the curve have lost some of their upward impetus after the FOMC minutes. But the dollar has continued to march relentlessly high. This trend seems to be supported by the idea that the Fed may be able to maintain its current policy for long durations.

The terminal rate is predicted to be above the crucial 5.0 percentage-point mark. According to CME Group’s FedWatch Tool, which currently places the likelihood of a 25 bps rate increase at close to 72 percent.

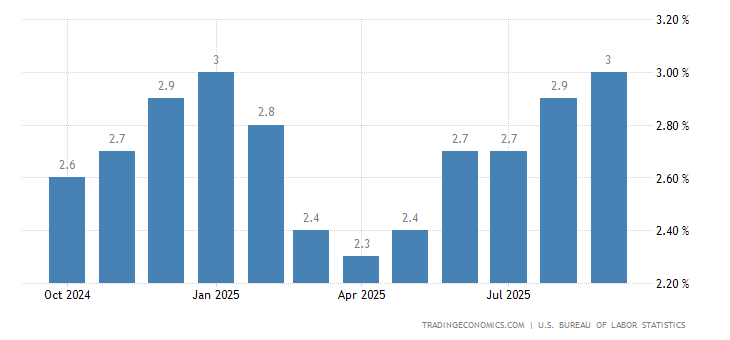

The US Federal Reserve’s favored inflation indicator, the Personal Consumption Expenditures Price Index numbers from the US Bureau of Economic Analysis (BEA). Will be highlighted in the US economic docket.

Alongside February’s estimates for personal income and spending. Market players will also be carefully monitoring the Jan New Home Sales data and Fedspeak.

Despite ending Thursday’s trading session in the red, the GBPUSD managed to stay above 1.2000. According to analysts, support levels at 1.1850/1950 are expected to persist over the coming weeks.

A successful week for UK statistics

Having followed the positive PMI release on Tuesday, today’s significant increase in GFK consumer confidence has given the UK forecast a further boost. This is now back to levels last seen in April of last year.

Currently, the US, the Eurozone, and the UK are all experiencing slightly improved growth prospects. Persistent inflation, and some additional monetary tightening. Suggesting that bilateral FX rates do not need to change significantly.

The Sterling Analytics

The expected volatility for the 3 GBPUSD rate has dipped below 10 percent. And, is likely to go for spot fluctuations that are more restrained. Support levels at 1.1850/1950, in our opinion, may hold for the foreseeable future.

Economic Activity Schedule