Asian stocks are up on Wall Street. Fed decreases Just after Wall Street’s deepest one-day fall in 2 months, stock markets in Asia increased on Thursday. According to meeting minutes, Federal Reserve officials plan to keep interest rates elevated in the U.S. to combat persistent inflation.

Asian stocks markets gained mostly

The Hang Seng in Hong Kong increased by 0.5 percentage points to 20,524.60 while the Shanghai Composite Index increased by 0.1 percent to 3,294.68.

While Sydney’s S&P-ASX 200 fell 0.3 percentage points to 7,289.70, the Kospi in Seoul gained 1.2 percentage points to 2,447.70.

Singapore fell, while Jakarta and New Zealand gained.

Asian stocks in Australia higher on earnings

Despite data showing that private firms’ capital expenditure increased more than anticipated in the Q4

Despite data showing that private firms’ capital expenditure increased more than anticipated in Q4 In spite of its challenges with high inflation and slowing growth. The statistics show some strength in the Australian economy.

Markets eyes on the US next Fed move

Due to vacation in Japan, Asian trading volumes were also somewhat subdued.

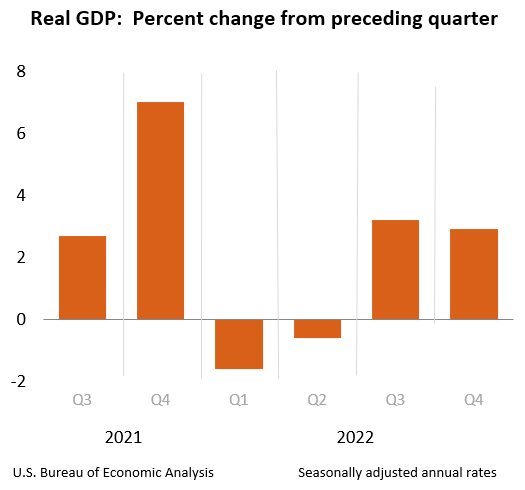

The final quarter of the US gross domestic product will be revised later today. And the Federal Reserve’s favored inflation indicator, the Personal Consumption Expenditures index, will be issued on Friday.

Better PMI data this week support the idea that the U.S. economy is robust enough to allow the Fed to maintain raising interest rates.

Technology stocks are still subdued

The prognosis for technology stocks is still limited. Particularly given that U.S. interest rates are expected to increase further. Chipmakers may see a slowdown in demand this year as international businesses cut their tech expenditure out of concern for a global recession.

Asian Forex Markets

Eastern currencies in general rose, while the dollar experienced some profit-taking. While declining by about 0.2 percent each, the dollar index and dollar index contracts stayed close to 7-week tops.

While risky Southeast Asian currencies increased by approximately 0.1 percent and 0.4%. The Chinese yuan and the Japanese yen each gained 0.1 percent

The Taiwan dollar increased by 0.6%. Traders attributed the shift to some government meddling in the currency markets. On the back of a worsening economic prognosis for Taiwan, the currency has fallen recently.

US fed meeting minutes, good or bad for Asian Forex

According to the minutes of the FOMC‘s February meeting minutes. The majority of the committee members asked for further interest rate increases. Though at a slower rate, on Wednesday.

However, given that data published after the meeting showed that U.S. inflation stayed steady in Jan. Fed members may call for a return to larger interest rate rises in the months to come.

With the difference between high-risk and low-risk loans getting smaller, rising interest rates are bad news for Asian currencies. Even though the majority of regional central banks increased their interest rates to keep up with the Fed. Their individual currencies still struggled vs. a strong U.S. dollar.

The US dollar fell after the FOMC minutes release

The Federal Open Market Committee (FOMC) meeting minutes showed a unanimous board that backed the 25 basis point move at the gathering earlier this month, which caused the US Dollar to retreat from overnight advances.

The minutes confirmed that any rate drops are far off and that the Fed is committed to bringing inflation under wraps.

They have frequently expressed this. Though, it’s possible that markets haven’t completely understood it. The market will be closely watching US GDP figures after Euro-wide CPI.