The EURUSD duo keeps declining steadily entering Wednesday. With the announcement of hotter-than-projected inflation numbers from the U.S. Reducing the likelihood of a swift interest rate decrease by the U.S. Federal Reserve.

At the time of publishing, the pair’s price traded around the 1.0920s zone. Off from its previous significant top in the 1.0980 mark area last Friday.

Traders’ views have swung off of the probability of the US Fed reducing the rate of interest during May as they inch towards Jun.

Highlights

The EURUSD pair falls more on the previous day’s inflation in the US news.

The immediate upswing is currently in uncertainty, although the decline lacking strength.

Experts continue to anticipate the Federal Reserve to lower interest rates in Jun.

Since maintaining the rate of interest high for extended periods of time benefits the USD by attracting greater financial influxes. CPI publication has resulted in a rise for the majority of pairings, included the euro versus the USD

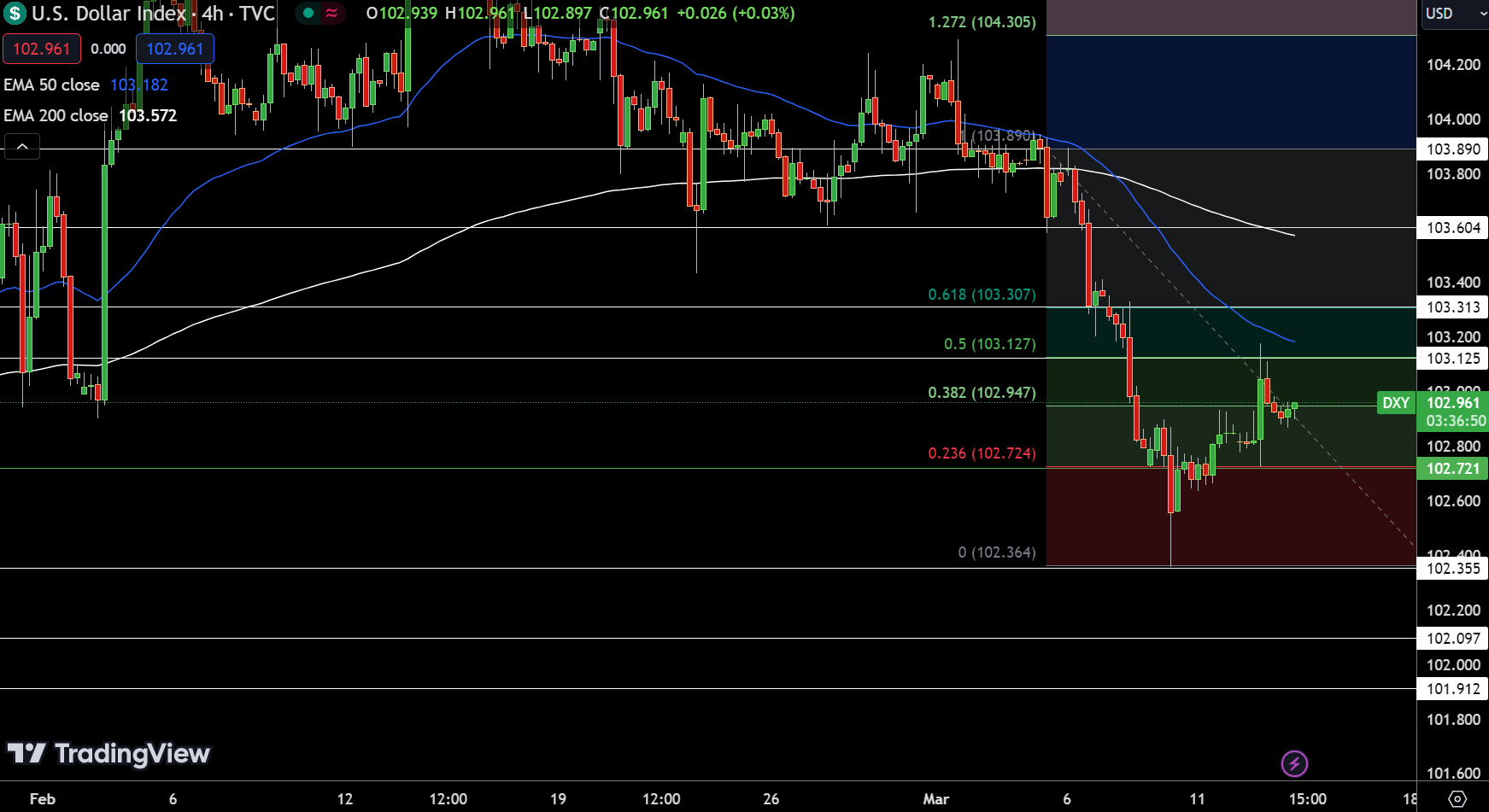

US dollar Index Analysis

The DXY, rose 0.06 percent to 102.98. The technical picture shows that the index’s value is now over its pivot value of 102.72. Implying an uptrend.

Nearby levels of resistance exist at 103.13, 103.31, then 103.60, that may limit additional advances. In contrast, the levels of support at 102.36, 102.10, & 101.91 give as a buffer from future drops. The 50 & 200 D-EMAs, around 103.18 & 103.57, accordingly, strengthen the positive attitude. But a fall under the pivot might trigger a negative move.

Source: TradingView

EURUSD Pair Analysis

The euro versus the dollar exchange fell by 0.04 percent to 1.09220 mark. The euro-dollar pair continues to trade over its pivot value of 1.09125. Showing positive prospects. The levels of resistance at 1.09449, 1.09803, then 1.10152 highlight probable obstacles to higher advance.

Supporting marks have been placed at 1.08723, 1.08443, then 1.07986 area. For offering a safety net in the event there is a downturn.

The 50 & 200 D-EMA, at 1.08991 & 1.08536, each, support a positive mood. But a decline beneath the pivot point may indicate a change in the trend. Underlining the significance for the 1.09125 area in the foreseeable motion.

Daily Technical Indicators & Signals

| Name | Value | Action |

| RSI(14) | 63.262 | Buy* Caution |

| STOCH(9,6) | 70.264 | Buy |

| STOCHRSI(14) | 78.841 | Overbought* Caution |

| MACD(12,26) | 0.002 | Buy* Caution |

| ADX(14) | 60.828 | Buy |

| Williams %R | -29.222 | Buy |

| Name | Value | Action |

| CCI(14) | 97.7144 | Buy |

| ATR(14) | 0.0047 | Less Volatility |

| Highs/Lows(14) | 0.0032 | Buy |

| Ultimate Oscillator | 58.010 | Buy* Caution |

| ROC | 0.961 | Buy |

| Bull/Bear Power(13) | 0.0093 | Buy |

Trend – Short-Term (Moderately Bullish)

Moving Averages-Daily

| Daily -Moving Averages | |||||

| EUR/USD

1.0927 |

Moving Averages: | Buy | Buy | Strong Buy | Buy |

| Indicators: | Neutral | Buy | Buy | Strong Buy | |

| Summary: | Neutral | Buy | Strong Buy | ||