Euro pair loses its previous gains and falls below the 1.0900 level. The next items on America’s agenda will be Fedspeak and housing numbers.

Euro Key Points to Watch

The Euro gives up its earlier gains against the US the US dollar, falling to 1.0930.

On Tuesday, European stocks maintained their daily advances.

The EURUSD is under pressure after testing 1.0930.

The USD Index recovers from its first loss to 103.00 zone/

During June, the EMU current accounts surplus increased.

Fedspeak with housing statistics shall be the next matters on the US agenda.

Euro loses vs US dollar on Tuesday in the European Session

Following previous multi-session high above 1.0930 on reversal Tuesday. The currency euro (EUR) dissipates the early excitement vs the US dollar. Which now causes EURUSD to drop back to the sub-1.0900 range.

The duo’s continued lurch coincides with modest rebound in the dollar. Following the USD Index tested the 103.00 region early in the trading session.

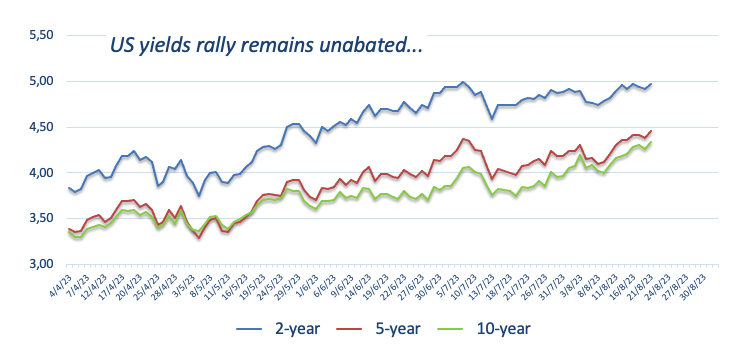

Meanwhile, fresh sell-offs on the US dollar coincides with a slight fall in US rates over several durations. On this respect, the short-term portion of the curve remains flirting close to the 5% barrier. While the 10-year benchmarks are hovering near values that were recorded in Nov 2007 outside the 4.30 percent threshold.

U.S. T- Yield Chart

In a larger sense, there seems to be an upsurge of debate over the Fed’s pledge of sustaining an additional restrictive stance. Over a protracted length of time. This fresh emphasis is in reaction to the US economy’s resiliency. Regardless of spite of current job market weakening and decreased inflation data.

Internal differences among (ECB) voting members have surfaced on the extension of tighter steps following the summer break. These tensions are adding to further weakening, which is harming the Euro.

Going into the future, market players are expected to be wary given the prospect of the impending Jackson Hole Symposium. Including Chairman Jerome Powell’s address in the second half of the course of the week.

EURUSD Moving Factors

Around 1.0930, the euro encounters its first barrier.

The US dollar’s recovery pushes EURUSD beneath 1.0900.

The desire towards the risk complexity is beginning to wane.

US 10-year rates exceed 4.30 percent for the first time in several years.

Investors are still focused on the upcoming Jackson Hole meeting.

Technical Perspective

If the rebound gains traction, EURUSD is projected to encounter an intermediate hurdle at the 55-day SMA at 1.0961area. Before reaching the psychological 1.1000 level & the August top of 1.1064. After clearing this last mark might target the weekly high of 1.1149. Should the duo move above this level, it may relieve part of the downside pressure. As well as reach the 2023 peak at 1.1275 in July 18). The 2022 peak stands at 1.1495 (Feb 10). And it is closely surpassed by the descending mark of 1.1500 zone in question. (Likely)

In addition, the EURUSD stays bullish as lengthy span the price holds over the critical 200-day Simple Moving Average (SMA)