Euro rises by ECB CPI and Christine Lagarde. German CPI emphasizes the need for ongoing inflation control and management. The head of the ECB Christine and the US NFP will speak later today.

Euro Foundation Landscape

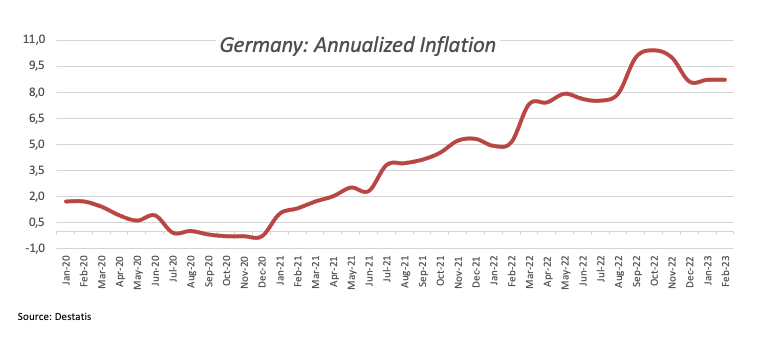

This Friday morning’s improved German CPI figures and, a slightly weaker USD provided some support for the euro. (economic calendar).

Even though actual numbers came in line with projections, the 8.7% figure emphasizes Germany’s rising and ongoing inflationary pressures. Given that Germany has the biggest economy in the eurozone. The inflation report is a proxy for the entire region. Supporting the European Central Bank’s hawkish bias (ECB).

Economic Activity Schedule

Euro investors cautious before NFP

Today’s focus is US Nonfarm Payrolls (NFP) data estimated at $205,000. If the past year is any indication, we can easily spot a higher number. Open the door to a more aggressive rebalancing and potentially secure a 50 basis point rate hike at the next Fed meeting.

Rates are currently fixed at 36.60 basis points with no clear trend. March ECB meeting looks safe at 50 basis points. Although Fed rates are still undecided, this increases interest in the next NFP report.

Unemployment and wages data, with wages having a major impact on rising service sector inflation, are the other two key indicators in the NFP report. ECB’s Christine Lagarde is expected to take the floor to close the session from EURUSD’s perspective. And it could try to confirm the need to curb inflation given today’s German statistics.

Technical Perspective

As markets get ready for NFP statistics, the daily EURUSD price action does not yet indicate a breach above the June 2022 swing top at 1.0615. Through periods of time, we don’t expect any significant movements and anticipate range-bound behavior.

The duo may test 1.0500 once more if the NFP release is skipped. While anything stronger may cause traders to take into account the 1.0700 psychological resistance mark.

Key Resistance levels:

- 1.0700

- 1.0615

Key Support levels:

- 1.0500

EURUSD Candlestick pattern (completed)

A long black candlestick during a downtrend reinforces the bearish tendency in the market. The second candlestick ends at or very close to its open and trades in a narrow range.

This situation typically indicates the possibility of a rally because so many positions have been altered. The white third candlestick provides evidence of the pattern reversal. The Morning Doji Star is a bullish Doji Star pattern that has completely developed.

It serves as a crucial reversal indication.