Euro limits the price movement. Spectrum might go on for a little while further. nonetheless, seeing the bounce as the beginning of a fresh leg upward might be excessive.

Euro did better this month – But, it’s early to uphold this notion

Considering the (ECB) hardline increase in rates in May amid oversold circumstances. The euro (EUR) has risen versus other currencies in June. Additional potential in the EUR, especially relative to the USD, seems constrained. Though, until macroeconomic indicators for the euro zone begins to show improvement. – Or the US employment report comes in below expectations.

Euro Currency Key Considerations

Just over 1.0900, the euro begins to deteriorate against the US dollar.

Wednesday is a “the ocean of red” for European stocks.

With risk patterns fluctuating, the EURUSD traded in a limited range.

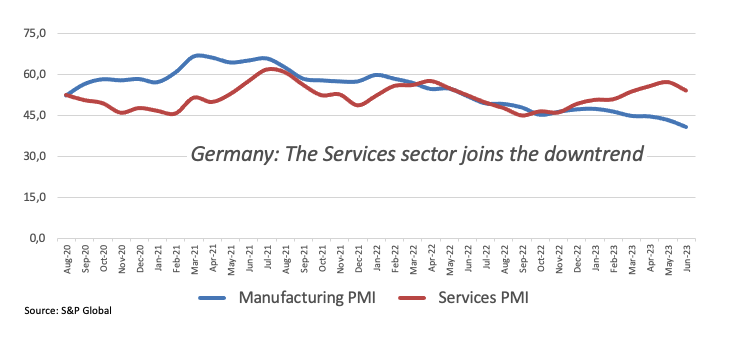

During June, the final EMU Services PMI for Germany decreased.

US stock markets gradually resume routine trading.

We think that there have been no significant changes to the pace of monetary policy. Nor- market sentiment for a 0.25% rate hike from the (Fed). The (ECB) in their corresponding forthcoming sessions in the coming weeks stay steady.

Statistics released on Monday revealed that production in the euro zone shrank more quickly than anticipated during June. Whereas the US ISM manufacturing PMI fell to its lowest reading since mid-2020. The economy’s shock score indicates that, except from manufacturing statistics at the beginning this month. US macro indicators have typically been stronger than anticipated. However, macro-economic figures for the Euro region have disappointed, providing the USD with a slight growth edge.

The Central Banks Still Debating on Interest Rate Fixing Cycle

As fears of a recession on both ends of the Atlantic rise, the nation’s central banks’ attempts to fight rising prices and regulate their interest rate hikes are still being debated.

As we turn our attention to the Euro Region, the most recent numbers show that the HCOB Service PMI in Germany was 54.1. While the entire Europe was 52.0 in June. Furthermore, cost of production for the euro zone fell 1.9% on monthly basis in May and 1.5 percent. Compared to the comparable period in 2022.

Source: S&P Global

Visco of the ECB: Raising rates isn’t the sole strategy for reducing inflation.

Due to his dual function as governor of the Bank of Italy, Visco may be a little prejudiced in this situation. In the event that you noticed it, Meloni spoke on this subject this past week. However, the ECB is beginning to show some disagreement upon some issues. Meaning the Sept resolution has not yet reached a certain conclusion.

That makes it abundantly plain that he opposes the notion of raising interest rates past July. – As well as perhaps the very July move either. He claims it’s because he fails to accept his peers’ position that taking the chance of tight excessively. In his view, it is preferable to taking the danger of tight lightly.

Technical Perspective of Euro Currency

Following Wednesday’s positive effort, the EURUSD is still in danger and there is still a chance for a quick pullback. To lessen the present selling tendency, the euro’s spot price has to surpass the peak from June, that was about 1.1010.

On the other hand, a break through the week’s bottom at 1.0835 (June 30). It would open the door for a probe on the lagging 100-day SMA at 1.0823 zone. The collapse before the last one ought to happen before the 1.0635 dip in May 31. Prior to the 1.0516 bottom in March 15. then 1.0481 dip in Jan of 2023.

The EURUSD remains in risk after Wednesday’s successful exertion, while there is also a risk for a brief drop. The present spot value of the euro has risen higher than the June top. Which was around 1.1010, to mitigate the current selling trend.

A decline past the week’s low at 1.0835 at June 30, on the contrary side. It might make it possible to investigate the lagged 100-day SMA in the 1.0823 region. The previous fall should occur prior to a 1.0635 decline on May 31. Preceding to the drop at 1.0481 in January 2023 and its 1.0516 low in March of this year.

The EURUSD remains in a bullish trend as long as it performs over the important 200-day SMA, which is now at 1.0608 mark.