Crude WTI Price Evaluation: The oil loses two straight days. For the first time in three weeks, oil reverses prior weekly increases.

Crude (WTI) oil Key Considerations

Following its first down day in four, WTI crude oil accepts bids for a new intraday bottom.

The value of oil retreats from a two-week-old resistance level while the RSI is almost stretched.

Energy buyers are encouraged by bullish MACD indicators higher than the weekly support area and 1.5-month’s horizontal supports.

Crude (WTI) Analysis and Outlook

First weekly loss in three weeks for WTI crude oil because it restores session bottom at $71.30 to break a 2-day rally that began Monday.

The oil does this as the RSI (14), which is almost overbought, turns from a falling resistance level that has been in place for two weeks. The 200-SMA, which was at $71.30., With the positive MACD indications, yet, pose difficulties for the oil bear traders.

Nonetheless must be highlighted with an obvious breakout of the 200-SMA is unlikely to be hesitant to stir up the $70.00 level. And that the 50% Fibonacci retracement of the May 03–24 up-swing, near $69.50, may challenge the energy baseline bearish later.

A 7-day rising support line & a horizontal region consisting of repeated lows noted from early May. Namely between $69.30 & $67.20-67.00, are going to be in the limelight. if current WTI crude oil price stays negative above $69.50 zone

Contrarily, oil’s rebound requires confirmation above the previously mentioned resistance level at approximately $72.00. A breach of which might point oil bulls towards the many obstacles identified around $73.50 level.

However, unless the quotation continues below the late May swing high of about $74.70, the WTI rebound is still elusive.

WTI: Near-term resistance appears above $72.00 zone

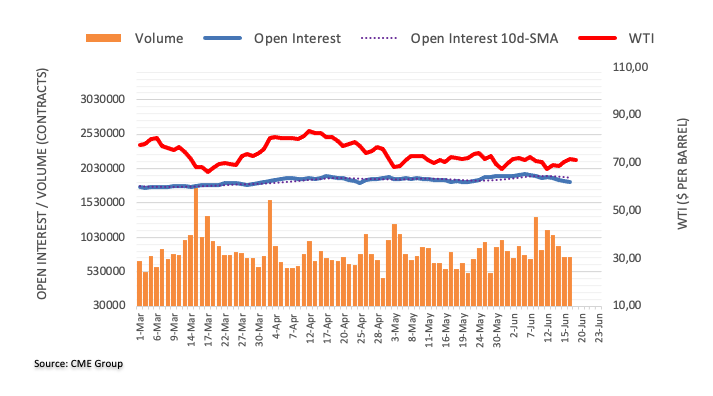

Last Friday, WTI prices continued its weekly gain. But the action was followed by falling open interest & volume, which allowed for the possibility of a short-term adjustment. Meanwhile, a first resistance area around $72.00 / barrel appears.

Fundamental Points

The FOMC those involved suggested an additional mild pace of tightening would be suitable right now.The the fund’s rate remains nearer to its probable highest point, Which has investors reading a pace, even though the dot plot. Which did point to the likelihood of a couple additional hikes in rates — a cautious disbelief for markets as a whole