Crude oil executed before Fed rate decision. WTI drops. Concern over a US economic slowdown has kept crude oil prices down.

Crude Oil, USD, Gold, Treasuries, Fed, FOMC, CAD, Discussion Points:

Concern over a US economic downturn has kept crude oil prices down.

US banks continue to be a target, and some established names are being pumped

Due to the US Dollar‘s overall weakness as we head into Wednesday Crude oil fell Tuesday during the North American period and has since stabilized during Asian trading. While the Brent contract has an asking price of US$ 75 bbl, the WTI futures contract is still beneath US$ 72 bbl.

As sentiment grew gloomier due to concerns regarding whether there may be other US banks with fragile balance sheets. The risk assets fell out of favor while gold and Treasuries rose.

Following disappointing US factory orders and jobs data. Concerns about a recession seem to be on the rise prior to the Fed’s rate decision afterward today.

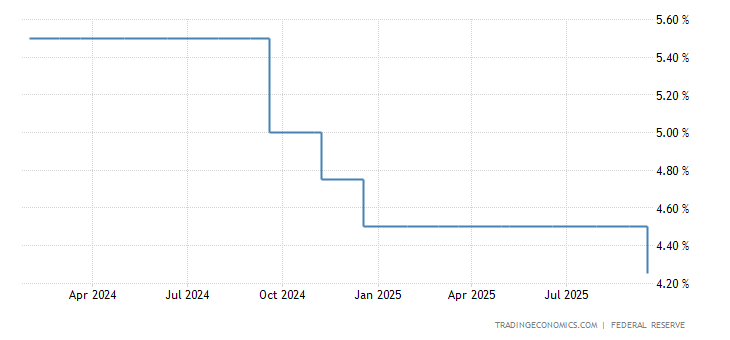

Source: TRADINGECONOMICS.COM/FED

Gold, Treasuries, and Wall Street View

Whereas the yield on the benchmark 2-year Treasury note is once again under 4%. Gold is aiming for US$2,020 per ounce.

The worst-hit regional banks were PacWest Bancorp and Western Alliance Bancorp. Which ended the year down -27.8% and 15.1%, accordingly.

In the cash period, the Dow Jones, S&P 500, and Nasdaq all had declines in excess of 1%. But, thus far today, they have been stable.

The technical analysis of WTI crude oil

WTI has continued to decline after filling in the void left by the OPEC+ output cut statement. Price is trading under all daily Simple Moving Averages (SMA) for the periods. Which may indicate that negative momentum is developing.

Support may be found around 68.46. Which is the mark of the 78.6% Fibonacci retracement of the movement from 64.36 to 83.53. Support may be found lower down at the prior lows of

Resistance on the upswing might be found at the close breaks in the range of 72.25 to 72.46, in front of 73.93.

All of today’s open APAC equities markets are down. Tracking the lead set by Wall Street. Japan and the Chinese mainland are among those on vacation.

Icahn Enterprises’ share price fell 20% after activist investor Hindenburg published a study casting doubt on its financial stability.