CAD reaches a new 2023 peak. Following the BoC interest rate increase, And, prospects of lower inflationary pressures in US

CAD (Canadian dollar) Key Points & Considerations

After the Bank of Canada decided to raise interest rates during its meeting on Wednesday, The CAD surged to new 2023 peaks vs the US dollar

The USD was hurt by weaker US inflation numbers released on Thursday, which helped CAD gain more ground.

USDCAD dropped to a challenging area of support close to about 1.3100, where it stopped on Friday.

CAD soars on US dollar Weakness

Friday saw an uptick in the Canadian Dollar (CAD) against the backdrop of the(USD). With the USDCAD cross slipping below the crucial 1.3100 support surface. As a result of an assortment of weaker US inflation data as well as (BoC) action to increase interest rates by 0.25 percent. While the US trading period begins on Friday, USDCAD continues to trade in a narrower 1.31 range.

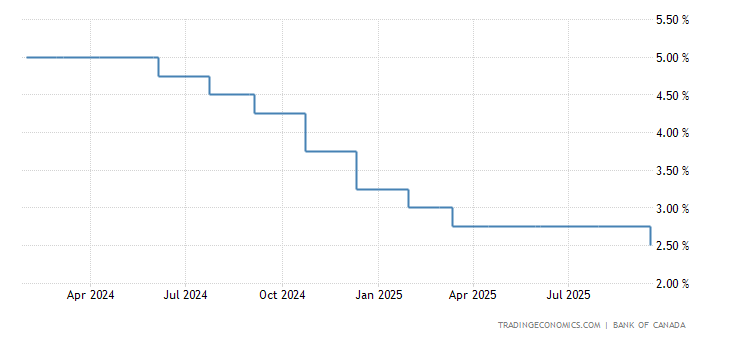

Source: TRADINGECONOMICS.COM

Key Market Moving Factors for CAD vs USD

After the US Bureau of Labor Statistics announced PPI figures for June and the findings were less positive than anticipated. The CAD trading at fresh so far this year peaks vs the dollar. The view started by Wednesday’s disappointing CPI figures is supported by the lower inflation figures.

The CME FedWatch Tool, which determines probability of potential rate moves by looking at the current value of Fed Funds Futures. Which concludes that the recent PPI figures supports the market’s belief that the Fed could just hike rates once. The idea that the Fed might be “a single and out” is having an impact on the USD (bad for USD). Due to higher interest rates are positive overall currencies as they will be drawing larger capital inflows.

Our Technical Perspective

On the weekly graph, USDCAD is still moving upward in spite of recent losses. A fresh pattern of decreasing spikes and drops having not yet established itself, And the value remains over the main derived by the 2021 low points. Considering the recent trend, the odds of a future ongoing somewhat support longs versus shorts sellers

The daily graph reveals that USDCAD has fallen during this week and has now surpassed the low point of June 27. Yet, the convergence of support (1.3117) is located precisely under the June lowest points. Consequently, the exchange rate will be hard to go down further. Just a clear breach under 1.3050 would defy this pattern and point to an even worse future for the pair in question

Bulls, in contrast, having their hands set out for themselves because the USDCAD upswing has to make an obvious move over the 50-day SMA around 1.3400. Although the bearish environment, the chances still prefer a potential rebound and a continuing upward. Giving bull traders a minor advantage. Nevertheless, critical points are in danger.