Oct 30, 2022

VOT Research Desk

Market Insights, Considerations & Analytics

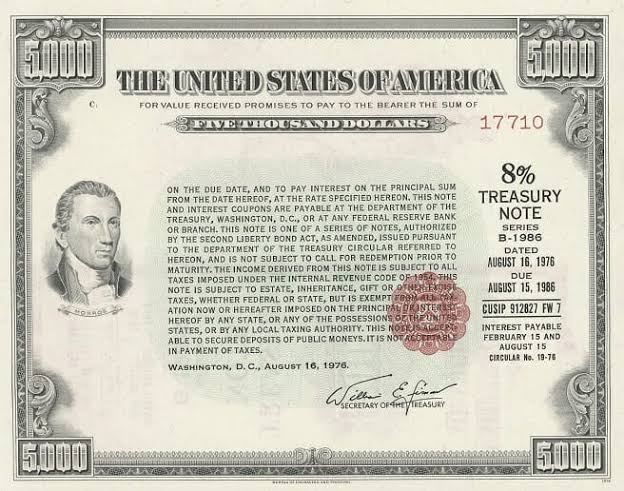

Now next crises for the Fed is already developing. In contrast to 2008, when “subprime mortgages” stopped counter-party trading as Lehman Brothers fell, it may only be the $27 trillion Treasury market in 2022.

Many people will recall 2022 as the year when nothing worked when researchers look back on it. This is much different from what people anticipated.

Throughout the year, the markets were dramatically whipsawed by rising interest rates, the Russian invasion of Ukraine, soaring oil prices, the greatest levels of inflation in 40 years, and the removal of liquidity from equities and bonds. Bonds have served as the de facto risk buffer since 1980. But in 2022, bonds saw their worst decline in more than a century, with such a 60/40 stock and bond portfolio returning an appalling -34.4%.

The most significant is the decline in bonds. The “mainstay” of the economy is the loan market. More than ever, the economy today depends on ever-rising debt levels to function. From businesses issuing debt for business and share repurchases to consumers taking on more debt to maintain their level of life. The government needs to keep issuing debt to pay for spending initiatives since social assistance and debt interest must be covered entirely by tax income.

For a clearer picture, consider that the economy today needs well over $70 trillion in debt to function. Prior to 1982, the economy expanded more quickly than that of the debt.

As long as there is a “customer” for the debt and interest rates are kept low enough to support consuming, debt generation is not a concern.

Insufficient Marginal Buyers

When interest rates increase, there is a concern. The number of willing borrowers declines as interest rates rise, while loan purchasers object to declining prices. The latter is most crucial. The capacity to issue debt to fund spending becomes more difficult when debt purchasers vanish. Janet Yellen, the Treasury Secretary, recently brought up this point.

We are concerned that the [bond] market won’t have enough liquidity.

The issue is that since 2019, the total amount of outstanding Treasury debt has increased by $7 trillion. The large financial institutions that function as the “principal dealers” are averse to acting as the primary buyers. One of the main causes of this is that for the past ten years, the Federal Reserve has been a ready buyer for the Treasuries that the banks and brokerages could sell to.

The term “crisis” is not exaggerated. The liquid is rapidly disappearing. There is a lot of volatility. Even demand at the government’s debt auctions, which was once unthinkable, is becoming a concern. After giving a speech in Washington on Wednesday, Treasury Secretary Janet Yellen said that her department is “worried about a loss of adequate liquidity” in the $23.7 trillion market for U.S. government securities. The circumstances are so alarming that she took the unusual step of expressing concern about the possibility of a breakdown in trading. There can be no doubt about it: if the Treasury market crashes, the global economy and financial system will face far more serious issues than rising inflation.

This has occurred before, and it will happen again. A “crisis scenario” occurred each time the Federal Reserve previously raised interest rates, attempted to end “monetary easing,” or did both. The Federal Reserve was required to respond immediately by implementing a “affiliative policy” in this case.

All of this is occurring as Bloomberg News reports that the largest, most influential purchasers of Treasuries, including foreign governments, American financial institutions, Japanese pension funds, and life insurance, are all reducing their purchases at the same time. Since federal reserve and banks as a whole are exiting stage left, we need to find a new marginal buyer of Treasury securities.

Although there are clear “warning indicators” of financial market frailty, they are insufficient to compel the Federal Reserve to alter its monetary policy. In the minutes of a recent meeting, the Fed made this point.

Many participants observed that it would be crucial to calibrate the pace of additional policy tightness with the aim of reducing the danger of severe negative consequences on the economic prospects, particularly in the current very uncertain global economic and financial environment.

Although the Fed is conscious of the risk, history indicates that a change in monetary policy won’t occur until “crisis levels” are reached.

Regrettably, the Federal Reserve has more than compressed monetary policy numerous times throughout history. The Fed will eventually give in to the selling avalanche as the markets protest against quantitative contraction. Both the equities and credit markets are in danger if the “wealth impact” is destroyed. We are already observing the first fractures in the markets for Treasury bonds and currencies, Also, volatility is increasing to a point where past “events” have happened.

The Fed’s major threat continues to be an economic or credit crisis, as stated in “Inflation Will Just become Stagflation.” It is obvious from history that the Fed is currently acting inefficiently once more. The Fed gets closer to the unwelcome “perimeter” with each rate increase.

The Fed will realize its error when the lag effect of monetary policy and rising economic deterioration converge.

There may be a considerably worse problem in the Treasury market than the Fed anticipates. For this reason, there are currently conceivable preparations for the government to intervene and repurchase bonds.

We didn’t anticipate Treasury repurchases to join the debt management discussion so suddenly when we issued our warning last week that they may. Although the Treasury’s interest in repurchases may have increased as a result of September’s liquidity issues, this is not merely a reflexive reaction to recent market occurrences.

If the Treasury market is experiencing a disruption, this might be a good opportunity to buy long-term Treasuries as well as stocks, according to the upcoming “Fed or Treasury Put” forecast.