S&P 500 Broaden Losses as April Consumer Confidence Misses Visualizations

April 26, 2022 7:40 PM +05:00

Customer CONFIDENCE KEY POINTS:

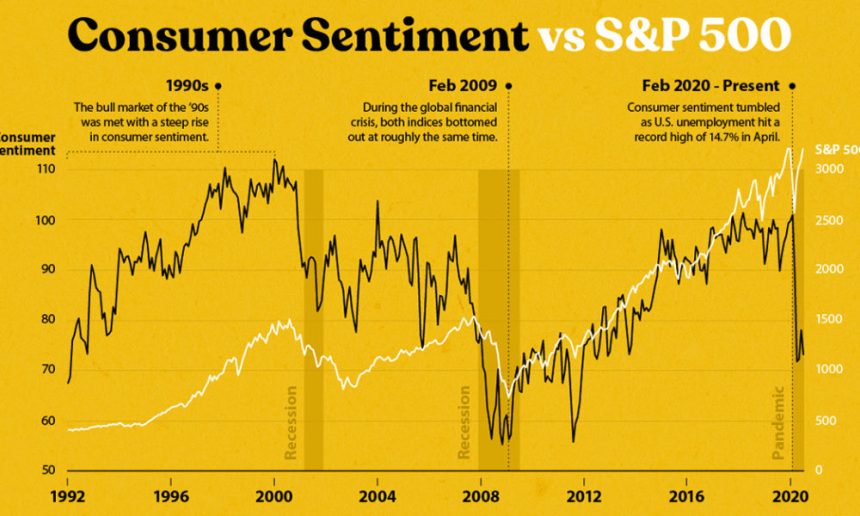

April customer certainty tumbles to 107.3 from 107.6 in March, disheartening agreement assumptions

The decrease in opinion is incited by a pullback experiencing the same thing file

S&P 500 expands misfortunes following study results as disintegrating feeling might burden future family spending and, consequently, corporate income

Customer certainty out of the blue declined toward the beginning of the new quarter, as taking off inflationary tensions kept on crushing family spending plans. As per the Conference Board, its Consumer Confidence Index turned around a portion of its March gain and dropped to 107.03 from 107.6, frustrating assumptions for a perusing of 108.00, a sign that negativity in the more extensive economy isn’t disappearing.

Diving into the study results, the current circumstance measure, in light of Americans’ evaluation of current business and employing conditions, tumbled to 152.6 from 153.8 in the past period. The gentle crumbling in this marker recommends that the strength of the work market isn’t doing what’s necessary to support compensation and individual monetary assumptions, a putting improvement for future utilization, the country’s essential driver of financial development down.

Somewhere else, the Expectations Index bounced back and ticked up to 77.2 from 76.7 per month prior, however the recuperation was unobtrusive in the midst of vulnerability about the business climate and individual budgets, with the average cost for most everyday items at its most significant level in over 40 years and the conflict in Ukraine hauling for over two months.

With opinion on a more fragile balance, family spending might falter in the close to term, restricting financial development in the subsequent quarter, following a generally delicate extension during the initial three months of the year. Nonetheless, focusing one point: brokers shouldn’t solely utilize review inferred shopper certainty results as an intermediary or to gauge family use, as delicate information has become progressively problematic lately, especially after the COVID-19 pandemic is significant.

MARKET RESPONSE

Buyer certainty information delivered today built up Wall Street’s negative tone, with the S&P 500 broadening its decay and falling over 1.3% after the study results crossed the wires. Looking forward, it is vital to continue watching the continuous income season, as quarterly numbers and direction might offer understanding into the future in the midst of increasing apprehensions that the U.S. economy is set out toward a hard arriving in light of the Fed’s forceful fixing cycle.

All things considered, brokers ought to screen corporate outcomes from Uber covers Microsoft and Alphabet this evening after the end chime. MSFT and GOOGL’s monetary exhibition and forward-looking critique will be key for the tech area and could establish the vibe for the more extensive market.