Market Analytics and Considerations

Key Notes

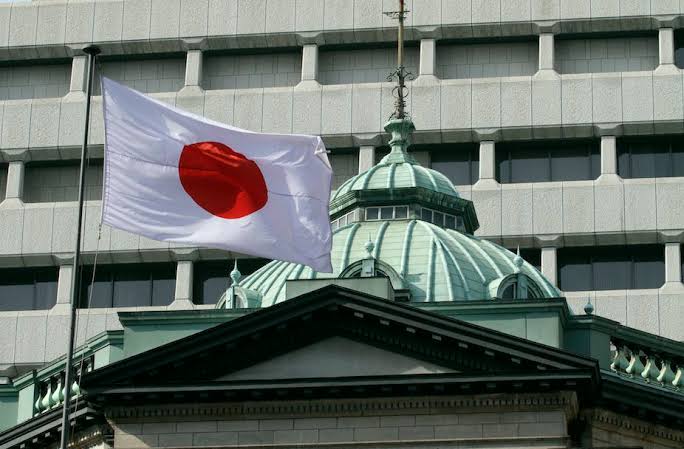

According to a Nikkei article on Saturday, the Bank of Japan (BOJ) is considering revising its inflation projections for January to reflect price inflation approaching its 2% objective in the upcoming fiscal years 2023 and 2024.

This month, the BOJ shocked the markets by expanding the range of its 10-year yield limit, a step that was intended to correct bond market inefficiencies but was viewed by some experts as a sign that the ultra-loose monetary easing policy was about to end.

Improvements to the BOJ’s inflationary projection would feed this rumor even further, as Governor Haruhiko Kuroda has stated that the central bank may contemplate a withdrawal if its 2percentage inflation objective is achieved along with wage increases.

Nikkei reported that the suggested modifications would result in the core consumer price index increasing by around 3percentage points in fiscal 2022, around 1.6% to 2% in fiscal 2023, and almost 2% in fiscal 2024.

The prior projections, which were made public in October, were in the range of 2.9%, 1.6%, and 1.6%.

According to government figures released this week, Japan’s primary customer pricing, which do not include fresh food products, increased 3.7percentage points in November, the most since 1981.

However, Kuroda has ruled out the possibility of an interest rate increase in the nearish term, claiming that current price increases were caused by one-time increase in costs of raw materials rather than by growing appetite.

Following its subsequent meeting held on January 17–18, the BOJ will announce the most latest quarterly growth and price projections.

Experts looking for any hints on a change in financial regulation are also watching to see if initial price negotiations will result in significant pay increases or if Kuroda’s 10-year term coming to an end in April prompts any changes to a 2013 policy agreement here between BOJ as well as the government.