Asian equities are quiet on conflicting Chinese trade statistics. Data on Chinese commerce indicated that consumer appetite is still sluggish.

Asian stocks muted on confused China economic indicators and US bank crisis

On Tuesday, most Asian markets maintained a narrow range as worries over a U.S. financial crisis subsided. However, disagreeing Chinese trade figures showed that demand in the largest economy in the area was still slow.

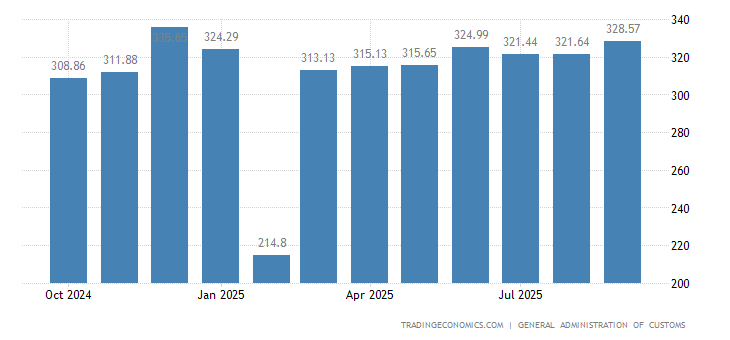

China Export Data Graph

Source: TRADINGECONOMICS.COM

Also, caution was taken ahead of important U.S. inflation statistics coming on Wednesday. Which would probably influence the Fed’s position on potential interest rate rises.

As BoJ Governor Kazuo Ueda dismissed hopes that monetary policy would tighten in the coming months. Japan’s Nikkei 225 index had the strongest performance for the day, rising 0.8% and approaching a one-year top.

BoJ stance and incoming Chinese economic data in focus

A recent rebound in Japanese markets has been fueled by dovish BOJ messages. Resulting in the Nikkei surpassing its international counterparts on the promise of supportive economic conditions.

The advances in industrial and shipping companies helped China’s Shanghai Shenzhen CSI 300 and Shanghai Composite index rise by roughly 0.4% apiece. As markets processed mixed trade data from the nation. While China’s exports were greater than anticipated, resulting in a significant trade surplus in April. And the larger-than-expected decline in imports revealed that domestic demand was still fragile. Which may hinder a faster economic rebound this year.

For Asian markets that rely on China as an export market, the likelihood of poor Chinese demand is not positive. Tuesday saw a 0.3% decline in the KOSPI in South Korea and a 0.4% decline in the Hang Seng in Hong Kong.

As losses in major mining firms were fueled by the dismal Chinese data on imports, Australia’s ASX 200 index dropped 0.2%. The largest bank in the nation, Commonwealth Bank of Australia (ASX: CBA), saw no change in its share price. As investors evaluated a good earnings report versus an alert about the country’s weakening credit conditions. The cautionary note from CBA prompted several other significant Australian bank equities to take some profits.

Statistics on Chinese inflation, which are due later this week, are anticipated to offer more hints about Asia’s biggest economy.

Concerns of a U.S. financial collapse were partially calmed. Following a Fed study revealed that the loan conditions were only little impacted by the failure of numerous U.S. banks this year.

While delayed talks over extending the U.S. debt ceiling still posed a danger to markets. Janet Yellen, the secretary of the Treasury, also stated that U.S. bank balances were recovering after a run earlier this year.

Asian Fx Markets Today

The GBP is hovering around a one-year high while the dollar is increasing on credit reports.

The British pound toyed with a one-year top in anticipation that the BoE will hike interest rates this week. While the dollar nudged higher on Tuesday after a poll revealed U.S. lending circumstances were less dire than predicted.

Statistics show that China’s exports expanded more slowly than in March while its imports fell dramatically from a year earlier and had no effect on currencies. Both the offshore and onshore yuan declined by almost 0.1% to 6.9282 and 6.9218 per dollar, respectively.

To $1.0991, the euro dropped 0.12%.

The U.S. dollar index, remained stable at around 101.44 on Tuesday, giving up some of its earlier gains. As traders anticipate a peak in U.S. interest rates, the index stayed close to previous lows.

As a result of remarks made by (BOJ) Governor Kazuo Ueda, the Japanese yen increased slightly to 134.92 per dollar. He said that whenever chances improved for inflation to sustainably reach the central bank’s 2% objective. The BOJ would terminate its yield curve control program and begin to reduce its balance sheet.

Ahead of Thursday’s central bank policy meeting, the GBP last traded at $1.2618, not far from the session’s a-year top of $1.2668.