Market Analytics and Technical Considerations

Key Points

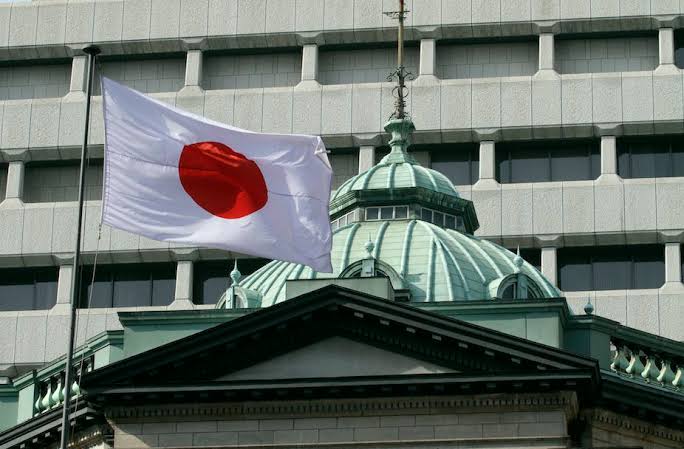

More than 90% of economists surveyed by Reuters predicted that the Bank of Japan’s next policy move would lessen rather than increase its massive monetary easing. However, the majority of those polled said the change was unlikely to occur before the second half of 2023.

More attention than usual is paid to the timing and direction of the BOJ’s next move. Not only does the BOJ stand out from other central banks that are tightening, but Haruhiko Kuroda, the governor who has led the BOJ’s long-running loose policy for ten years, will retire in April. Additionally, low Japanese interest rates have contributed to the weakening of the yen, which is one reason why inflation is at a 40-year high.

In the survey conducted between November 15 and November 25, 24 out of 26 economists predicted that the Bank of Japan would “unwind its ultra-easy monetary policy,” if any.

However, twenty of them stated that the BOJ would not act until at least the second half of 2023.Two respondents said the timing would be June 2023.One selected each of the previous choices: January and April.

Any early unwinding of easing would kill the chance of further recovery in Japan’s economy, which hasn’t fully recovered from the dip caused by the pandemic. In contrast to the U.S. and Europe, the BOJ has no reason to accelerate tightening because the yen’s weakening pace has slowed down and consumer inflation here remains modest when food and energy items are not counted.

13 of the 24 people who responded to a question that allowed for multiple choices said that if the BOJ were to reduce its easing, the most likely course of action would be to modify the language of its forward guidance.

The second most likely strategy, chosen by ten respondents, was to expand the controlled range of 10-year government bond yields from the current “around plus and minus 0.25 percent. Eight individuals chose to reduce the maturity of the yield target to less than ten years, and eight additional individuals believed that the BOJ would stop maintaining negative short-term interest rates.

When asked whether a 2013 joint statement between the Japanese government and the central bank needed to be revised, BOJ observers were almost evenly divided. The policy accord, which the central bank is required to meet “at the earliest date possible,” is widely known.

Twelve BOJ observers recommended that it be revised;13 ruled that it shouldn’t.

Seven of those who wanted a change called for more latitude in determining whether the inflation target was met. Leaders of the BOJ have stated that inflation must be “sustainable and stable” at 2%.One observer of the BOJ who called for change wanted the target for inflation to be lower, and another advocated for the BOJ’s mandate to be expanded to include focusing on employment or wage increases.

On Monday, the proposal to include wage growth as a new monetary policy objective was rejected by Prime Minister Fumio Kishida. According to the poll, the agreement should simply be dissolved.

WEAK YEN RISK REMAINS Another question asked how long the yen would be at risk of weakening against the U.S. dollar.

This was in contrast to the situation when policymakers drafted the agreement nine years ago, when Japan’s economy was in deflation. Twelve out of 26 economists predicted that it would continue until the end of this year, and eight of them predicted that the risk would persist “until the first half of 2023.

Even though many people in the market see a change in the trend, there is still a chance that the dollar will gain more, at least for the rest of the year. This is because there are uncertainties about inflation in the United States and the Fed’s outlook for rapid tightening. Only three people said there was no risk of the yen weakening any more. However, many people thought the currency would continue to face the risk of depreciating until the second half of 2023 or later.

In another part of the survey, a median estimate of 32 respondents showed that the Japanese economy expanded at an annualized rate of 3.1% between October and December. This was faster than the 2.0% predicted by the poll in October, which came after the third quarter saw an unexpected contraction.

However, the core consumer inflation rate for the same time period was slightly raised to 2.7% from 2.6%, and the economists’ forecast for Japan’s fiscal 2022 economic growth was reduced to 1.7% from 1.9% in the previous poll.