The majority of cryptocurrencies are highly volatile, and some will see value increases, making them a fantastic asset class for long-term trading or investing. A unique feature of the cryptocurrency Tether (USDT) is that 1 USDT is always exactly equivalent to 1 USD.

Why does tether always have the same value as one dollar? What is the application of tether, and is it a wise investment in the conventional sense? Read this article to learn more.

Key conclusions

- A stablecoin, or cryptocurrency whose value is tied to an outside asset, is Tether (USDT).Given that

- and USD are tied at a 1:1 ratio, 1 USDT is equivalent to 1 USD.Although the U.S. Dollar anchored USDT token still commands the majority of the market cap,

- Tether now issues tokens that are linked to other currencies, like the Euro, Chinese Yuan, Mexican Peso, and more.

What is Tether (USDT)?

Tether is a stablecoin, which means that its price is tied to the value of the US dollar, as opposed to bitcoin and ether. For the Euro and Japanese Yen, separate versions of tether are available under the names “euro tether” and “yen tether,” respectively.

However, since USDT is the most often used kind of tether, this essay will only concentrate on it.

How does Tether work?

Because Tether Limited, the private corporation that created the cryptocurrency, always exchanges tether for dollars at a 1:1 ratio, tether is able to keep its peg to the dollar. Customers that purchase Tether will be required to make a 1:1 deposit of US dollars into Tether’s reserves.

Tether is therefore immune to market speculation. Because nearly no buyer will take it, whether in a P2P transaction or through an exchange, anyone who wants to sell tethers at a price that deviates too much from this 1:1 ratio will fail to sell.

It is significant to highlight that the only location where tethers may be exchanged for dollars is Bitfinex. For circumstances when retail investors seek to ‘cash out’ their USDT for U.S. dollars, Bitfinex has been the main liquidity provider for numerous exchanges throughout the world.

Who would require the use of Tether?

Tether first entered the market in January 2015 via the cryptocurrency exchange Bitfinex. Prior to that, the majority of dealers traded cryptocurrencies in terms of bitcoin. To trade crypto pairs like LTC/BTC and XRP/BTC, for instance, a cryptocurrency trader would first convert US dollars into bitcoin.

Of course, since bitcoin itself was (and still is) unstable, keeping track of profits or losses in bitcoin doesn’t necessarily correspond to actual profits or losses in US dollars. After all, we frequently refer to cryptocurrency pricing in US dollars.

Why, then, should traders initially convert US dollars into bitcoin? Was it possible to purchase or sell cryptocurrencies using American dollars? Though technically feasible, it is not realistic. Each time a trader “buys in” or “cashes out” in US dollars via a bank transfer, there will be an extra charge.

With USDT, a crypto trader can assess their performance in U.S. dollars without needlessly interacting with fiat currencies. A trader may be more profitable if they use another cryptocurrency.

What supports the value of USDT?

Tether Ltd. technically supports the issued tokens with real money and assets. But ultimately what supports the price of Tether at or near $1 US is the market’s confidence in it.

Throughout the stablecoin’s history, this belief in tether hasn’t always remained constant. People first believed in the fundamental promise made in the whitepaper that, based on routine audit, tethers will be fully backed 1:1 by U.S. dollars in cash and equivalent, and that the website had said that tethers may be exchanged for dollars at any moment.

However, in 2017, the inability of the corporation to process withdrawal requests caused people to lose confidence in tether. When Tether Ltd. severed ties with Friedman LLP, its auditing firm, in 2018, concerns about the company’s openness had already started to surface.

This generated questions about the specifics of how U.S. funds are used to underpin the tether tokens. Tether’s price briefly dropped below the 1 U.S. dollar peg and at one point even touched 93 cents.

A “positive” market correction was nevertheless anticipated as stablecoin arbitrageurs seized the chance to purchase tether at a discount in order to sell it at its “fundamental price,” maintaining the $1:1 USDT ratio.

Letitia James, the attorney general of New York, launched a lawsuit against Tether Ltd. and Bitfinex in 2019 for allegedly concealing $850 million in losses with actual U.S. cash invested.

To cut a long story short, it has been determined that Tether’s claim that each tether is 100% backed by the U.S. dollar is false due to its inability to fulfil withdrawal requests, the fact that it has not hired an auditing partner since Friedman LLP, and its lack of transparency regarding the precise details of what was backing up the USDT.

Tether is it always $1?

Although Tether’s assertion that the stablecoin is backed is technically accurate, there are several misunderstandings over how this is accomplished. Many individuals believe that Bitfinex and Tether Ltd. fully back the stablecoins with ready-to-withdraw cash or its equivalent.

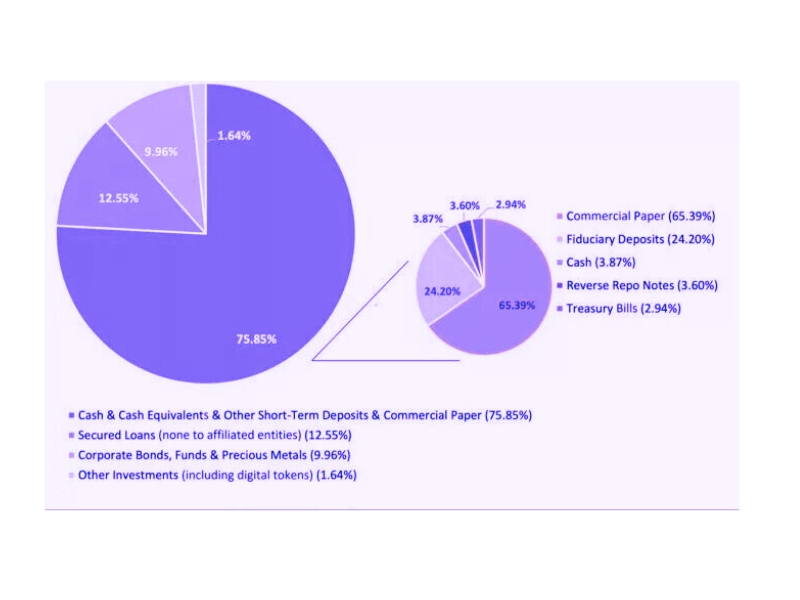

However, there is disagreement around the true solvency of the tether suppliers. We now have information on the breakdown of Tether’s U.S. dollar reserve as of March 31, 2021, the date on which the business paid a fine to resolve the litigation.

As you can see, cash accounts for just 3.87% of Tether’s reserves. This, though, shouldn’t cause worry. Stuart Hoegner, general counsel at Tether, discusses why just a small amount of the reserve is made up of currency. “Readers should not confuse items not in ‘actual cash’ with a lack of liquidity,” he said.

Putting all of your attention on money could be deceptive. Even though the money is kept by a third-party bank or agent, fiduciary deposits are theoretically still made in cash. No of how the funds are used, Tether Ltd. is granted the power to liquidate by the fiduciary.

Since it is guaranteed by the issuing bank or corporation and matures in less than a year, short-term debt, such as commercial paper used as a cash counterpart, has medium liquidity. Holding short-term credits granted to other organisations (like receivables) is actually a widespread practise for businesses.

Because cryptocurrency exchanges are by necessity responsible for finding liquidity sources in order to operate efficiently, retail traders who now possess the USD Tether shouldn’t be overly concerned about the solvency of Tether Ltd.

The fact that Tether Ltd. and Bitfinex are multimillion dollar businesses means that they will aim to protect their market share by making sure that the tethers that are circulating are backed by assets with a value equal to their dollar worth.

In actuality, Tether Ltd. is supporting USDT more than enough given the corporate balance sheet. On their Transparency website, you can see exactly how much tether is being transferred between different blockchains.

In order to boost market confidence, use Tether on Polkadot.

Like other types of stablecoins, fiat-backed ones are a relatively new phenomenon that will take some time to win over users’ trust. I previously stated that in order to prevent the stablecoin from losing value, market confidence in it is just as crucial as the facts supplied by the auditors.

Retail investors and exchanges can get assurance from Tether’s balance sheet through quantitative data. Network effects are one other method that the market could come to believe in Tether even more.

Whether you like it or not, tether is likely to be used in many MORE exchanges, whether they are central or decentralised, and in more and more blockchain networks.

The first blockchain to ensure the safe ownership of USDT was Bitcoin; Ethereum quickly followed to support tether as an ERC-20 token.

Additionally, USDT has been active on more recent blockchains, including Tron, EOS, Algorand, and Solana, to mention a few. Polkadot will be the most recent blockchain to permit the unrestricted transfer of USDT for diverse uses.

Polkadot’s capacity to connect to up to 100 other blockchains is huge for the entire cryptocurrency ecosystem since it creates more chances for using the USDT to conveniently and securely transact in, store, and convert assets using blockchain technology.

How to buy Tether (USDT)?

Although Tether’s value might not rise in line with other cryptocurrencies, its importance to blockchain ecosystems cannot be overstated. Its value being linked to a fiat currency has made investment simpler than before.

Since most traders and investors would only hang on to tether for a short time anyhow because it is equal to the fiat U.S. dollar, even if the stablecoin is not entirely backed by cash, it shouldn’t be a problem for most people.

The stability of Tether is ultimately determined by the strong network effect of multiple blockchain ecosystems that employ USDT. Tether Ltd.’s balance sheet may be a reliable indicator that the stablecoin is genuinely supported by real-world assets.

The USD Tether won’t go too far from its dollar peg in the future, as it is the most extensively used stablecoin.

Having said all of that, purchasing and adding Tether (USDT) to your cryptocurrency wallet is simple. Simply create an account with any wallet provider, place a buy order.