USD Index is under siege. beneath 103.00 mark. DXY started the week feeble, falling down from the peaks of the prior week.

USD Index Key Considerations

The US dollar index opens the week just a little bit under 103.00.

The risk factor has improved, which affects the value of the dollar.

On Monday, there will just be one release: the latest Dallas Fed Manufacturing Index report.

USD index on Monday (Today)

The US Dollar Index (DXY), which tracks the exchange rate of the dollar vs an array of its main competitors. Started the week on a lower note on Monday, falling down from the peaks reached the week before above the 103.00 mark.

USD Index examines risk patterns and ECB

The index is presently under a little selling stress, forcing its to drop to the 102.70 stage. While market players grab profits following the 2-day robust bounce at the beginning of the workweek. This is due to some fair rebound within the risk-linked marketplace.

Markets continue to expect the Fed to raise rates by 25 basis points at its meeting on July 26. Meanwhile, the nation’s bond market is seeing some stabilization in yields along the curve after present high.

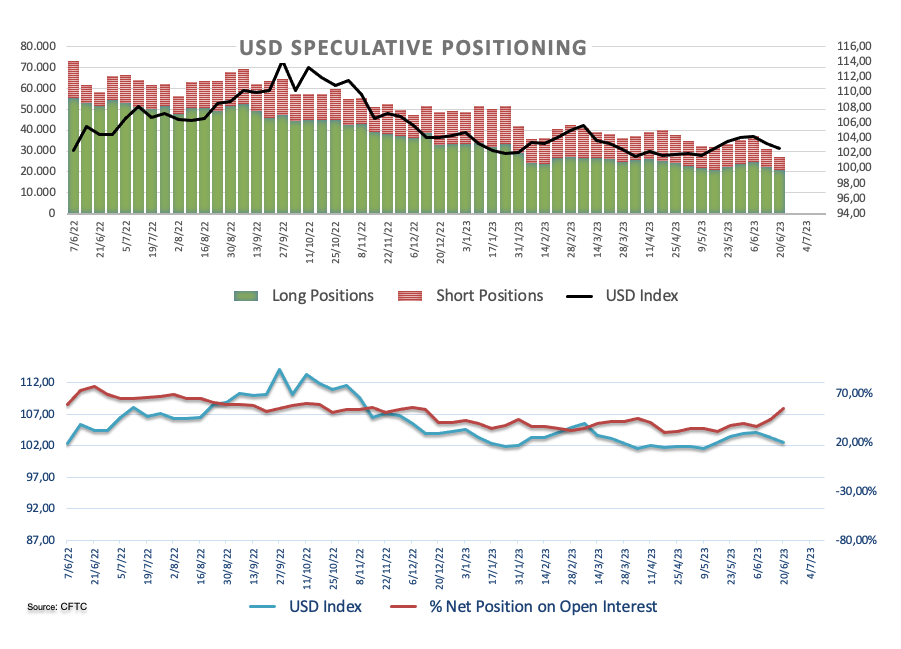

On a different front, after investors processed the FOMC meeting on the 14th June. Speculating gross longs in the USD increased to values previously recorded in the final days of January. based on the most recent CFTC Positions Data.

Speculative positions in US dollar Graph

Source: CFTC

The Dallas Fed Manufacturing Index för June will serve as the lone publication during the NA recess, but the initial part of the workweek will also be dominated with the ECB Summit in Sintra, Portugal.

What should we expect from the US dollar?

During the start of this week, the index surrenders some of its most recent advances and dips again under the crucial 103.00 level. The ongoing resilience of crucial US fundamentals, including jobs and costs, supports the possibility of a further 25 bps raise at the Fed’s forthcoming session in July.

This opinion was strengthened by remarks made by Fed Chairman Powell during the June FOMC occasion. During which he described to the July session as “live.” He stated that the majority of the Panel is ready to begin the rate hike drive as soon as the following month.

Important problems at the rear end

The US economy’s gentle or rough touchdown is a topic of ongoing discussion. Projection of rate reduction in late 2023 or the start of 2024 contrasts with the final rate of interest at its highest. Fed’s reversal. Political bubbling in relation to both China and Russia. US-China trading dispute.

Technical Levels to Watch

The dollar index is currently down 0.15% on 102.71 & meets resistance around 101.92 (the month bottom from Jun 16). And, 100.78 (the 2023 bottom from Apr 14), then ultimately 100.00 (rounded mark). On the contrary if 103.16 (the weekly top from Jun 23) were to pull out, it would result in 104.69 (the month peak from May 31). subsequently 105.07 (which is the 200-day SMA level.