US Q2 GDP growth tops expectations, lifting yields and dollar. During the Q2, the US economy increased with a yearly pace of 2.4 percent.

US second quarter GDP major considerations

In the 2nd quarter, the US economy gained at a yearly velocity of two percent, above predictions of 1.8 percent.

PCE, the primary engine of economic growth, slowed to 1.6 percent yet stayed high by historical norms.

Better than predicted numbers drove up US Treasury rates, supporting the US currency.

US GDP Outlook and What is it? – Analysis

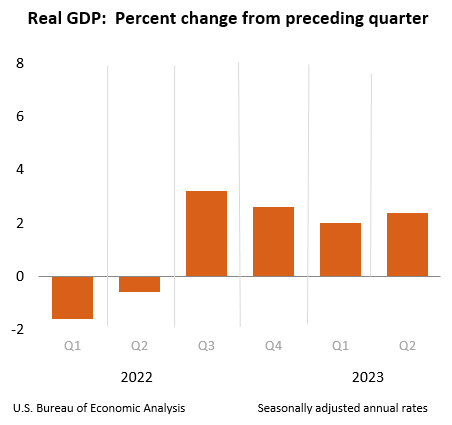

Based to the future- projection, GDP in real terms rose at a yearly rate of 2.4% in the 2nd quarter of 2023. The real GDP climbed by 2 % in the Q1. Q2 gain was mainly due to improvements in spending by consumers and investment by businesses. And was somewhat countered by a decline in export. Imported goods, which constitute a deduction in the GDP estimation, fell.

US 2nd Quarter Graphical Representation

Despite exceptionally high central bank interest rates, which are presently at their highest level in more than two decades, the US economy gained pace and expanded far above its long-term trend over the last three months, buoyed by consumer resilience and solid capex investment.

As reported by the U.S. Department of Commerce, – The US GDP’s which includes all of the nation’s output of goods as well as services. Cultivated at an annualized rate of 2.4 percent in the 2nd quarter. Far excess of projections of 1.8 percent – An encouraging sign which may alleviate inflated worries about a recession.

Overall, the robust GDP numbers imply show the economy is still in excellent form, Amid the FOMC‘s vigorous steps to limit output in order to combat inflation. Terminal sales of local manufacturers increased considerably at a pace of 2.3 percent (4.3% real). Confirming this estimate and indicating that domestic demand has held up very well.

Treasury rates rose shortly after the US Bureau of Economic Analysis announced the GDP estimate, Supporting the dollar. If expansion fails to slow, the Fed might be forced to raise rates more in the future. These hypotheses might keep yields skewed towards upside, particularly if incoming CPI & Core PCE data indicate price rigidity.

| Calendar | GMT | Reference | Actual | Previous | Consensus | Forecast | |

|---|---|---|---|---|---|---|---|

| 2023-06-29 | 12:30 PM | PCE Prices QoQ Final | Q1 | 4.1% | 3.7% | 4.2% | 4.2% |

| 2023-07-27 | 12:30 PM | PCE Prices QoQ Adv | Q2 | 2.6% | 4.1% | 3.8% | |

| 2023-08-30 | 12:30 PM | PCE Prices QoQ 2nd Est | Q2 | 4.1% | 2.6% | ||

Source: TRADING ECONOMICS