The Bureau of Labor Statistics is going to publish the US NFP statistics from the America on Friday – Today (Nov-8)

Key Points and Highlights

Following a 150K gain in Oct, non-farm employment numbers in the United States are expected to expand by 180 thousand in Nov.

The U.S dollar is looking for new lateral momentum from the main Payroll & Avg Hourly Wages figures.

What can we anticipate from the upcoming US NFP feedback?

The US employment market data is expected to reveal that the economy added 180,000 jobs this past month, rather than 150.000 in Oct. The rate of joblessness is expected to continue at 3.9 percent

The Average hourly earnings, an often regarded indicator of inflation in wages. Which are predicted to rise by 4.0 percent year on year through Nov. Slightly less than the 4.1 percent rise seen in Oct. Each month, Median Hour Wages are expected to grow by 0.3 percent in the reporting month, following a 0.2 percent gain in Oct.

The Current data is Critical for Next year Rate Calculations by Fed

The US job market statistics are critical to the US Fed’s (Fed) interest rate forecast for the year 2024. which in turn has a substantial influence on the price of the United States currency.

Investors are pricing the fact that the Fed has completed its raising phase. And a rate reduction expected as soon as March. Based on CME Group’s Fed-Watch Tool, the chance of a Mar Federal rate drop is presently sixty percent.

Federal Bank rate drop bets increased significantly when US Fed Bank Governor, Waller, a noted hardliner, hinted a policy shift, predicting disaster for the dollar and US government bond rates.

Should inflation remain to fall over a number of months we might begin to cut our interest rate. Since inflation is low’, Waller stated on the 28th of Nov.

The Oct Fundamental PCE figures also contributed to the US Fed’s softer outlook. The Federal Reserve’s favorite inflation index increased 3.5 percent year on year. Easing from a 3.7 percent figure but remaining considerably over the bank’s 2.0 percent objective.

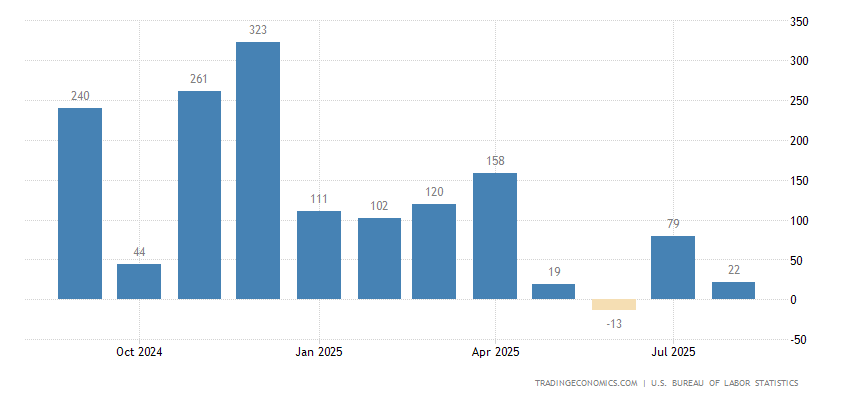

Source: TRDINGECINOICS.COM – US BLS

Jerome Powell, the chairman of the Federal Reserve, worked harder in his last public speech. To dispute forecasts of rate decreases for the coming year, yet investors did not believe such hardline tone. “That may be naive to say with certainty that we’ve have reached a suitably tight posture or even to conjecture about when policies could be relaxed,” Powell added.

US Treasury Yields

In order to preserve current marketplace dynamic patterns. And maintain the yields on treasuries and the US dollars biased smaller while upholding overall upward trend for risky investments and gold. The upcoming info must confirm excessively gentle projections for interest rates. Through demonstrating that economic growth is starting to contract rapidly.

Rate-reduction predictions have grown significantly in the past few weeks. It shows illustrates the expected yields on all 2024 Federal funds contracts for futures. Alongside speculators estimating over 100 bps of lowering by the latter part of the year 2024. Investors may be seeing problems ahead, or they could be completely incorrect.

Negative NFP data which surprises to the negative by a considerable border. on the contrary, can have a reverse impact on markets. Confirming fears over looming economic issues and boosting the argument for many lower interest rates in the months to come. This situation, which is anticipated to put a downward squeeze on rates and the nation’s currency, might benefit the price of gold as well as the Nasdaq 100. index.

The NFP Impact on EURUSD Pair (Likely)

An positive NFP main reading and rising inflation in wages might lead markets to rethink Federal rate reduction stakes. Giving wings to the USD’s current rise while driving EURUSD again towards 1.0700. If the information disappoints and confirms the Federal Reserve’s soft outlook. The United States dollar is projected to fall further. In this type of circumstance, EURUSD might conduct a significant rally towards 1.1000 zone.