US dollar index (DXY) the greenback deepens its rebound. Index has risen to 2-week triumphs exceeding 101.00 mark on Monday today

US dollar Index Key Points

The index maintains the trend of rising over 101.00.

On Monday, the euro suffered from lower-than-expected PMIs.

Following these are flash PMIs and the Chicago Fed National Activity Index.

US dollar Index (DXY), continues its bounce farther towards 101.00, the number at the outset of this week.

US dollar Index evaluates facts, and the FOMC

On Monday, the index is up for the 5th successive session and aims to maintain the current breakthrough of the important 101.00 barrier. Under a backdrop of more selling interest across the risk component.

On the contrary, bad advanced PMI readings in the Eurozone undermine riskier asset perception. Giving further wings to the dollar at the start of the week, Despite an ongoing lack of progress in US rates in all durations.

In terms of the overall economic situation, the Fed is due to meet later this week. Along with is projected to raise interest rates by 25 basis points. Nevertheless, traders’ focus is anticipated to be on the Federal Reserve’s future moves in its normality plan. Rather than markets’ belief that its July rate hike was the penultimate.

Beyond the ocean, the Chicago Fed National Activity Index, as well as flash Manufacturing and Services PMIs for July, are scheduled.

US dollar index – what to watch for?

On Monday, the index sustains its sense of security over the 101.00 level despite increased sluggishness in the risk-related environment.

Given continued recessionary forces with an ongoing strong job market. There has been little change in the view whether the Fed will begin its hiking cycle late this month.

This perspective was strengthened further by remarks by Fed Chairman Powell during a June FOMC occasion. In which he described to the July session as “live” & showed that the majority of the Panel is ready to begin the rate hike drive as soon as the following month.

Some thoughts and views

Recent inflation numbers for the United States indicate some indications of slowing. Nevertheless, considering that inflation is already greatly over its objective. the Federal Reserve isn’t going to be totally satisfied that it will not go up again during the autumn. More information shall be required by the Fed to ensure that the moderating tendency is not just transitory. Monetary policy actions have a period of latency, needing a ‘sit back & watch strategy to detect their long-term implications.

Technical Outlook

Over the back burner: the ongoing discussion about whether the US economy will have an easy or harsh touchdown. Rates of interest are nearing their high, despite predictions of rate reduction at the end of 2023/ & start of 2024. Geopolitical bubbling in relation to China and Russia. Trade war between the United States and China.

Key USD Index levels

The index is currently higher 0.21% at 101.30, with a breach of 102.61 (55-day SMA) opening the way to 103.54 (on a week’s peak of June 30). Then eventually 104.00 – 200-day SMA. On the negative side, 99.57 (2023 bottom July 13) appears as quick support, then 97.68 (weekly bottom of the 30th March) & 95.17 (month’s bottom on Feb 10, 2022).

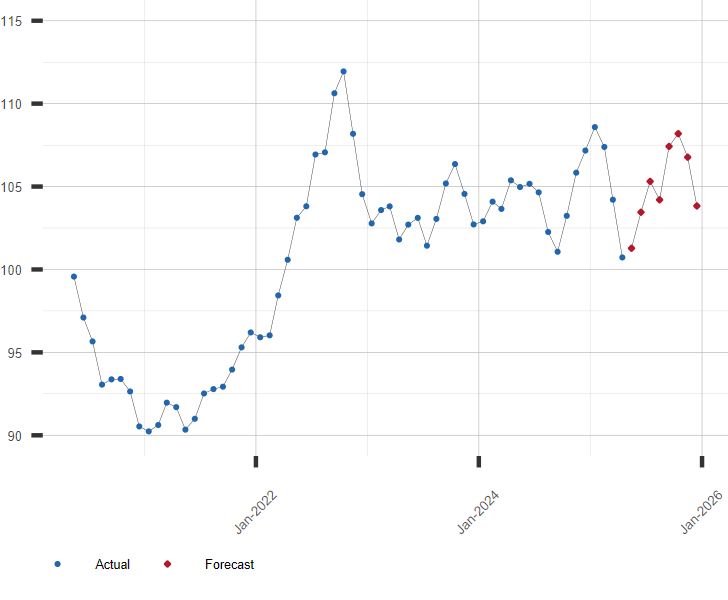

| Month | Date | Forecast Value | Avg Error |

|---|---|---|---|

| 0 | Jun 2023 | 103.11 | ±0.00 |

| 1 | Jul 2023 | 103.4 | ±0.6 |

| 2 | Aug 2023 | 103.7 | ±0.7 |

| 3 | Sep 2023 | 104.9 | ±0.7 |

DXY Graph & Present Projections

Source: Financial Forecast Center