US Debt Ceiling Situations and its economic effects, rundown. The United States is reportedly getting closer to the “X-date,” often known as the point when the government would no longer be able to pay its dues

US Debt ceiling and what is it?

New studies from the Congressional Budget Office and the U.S. Department of the Treasury indicate that the “X-date. Or the time when the government will not be able to pay its debts, is swiftly nearing in the US

Historically, it shows that just coming near to a going over the U.S. debt ceiling might result in serious financial market disruptions. That would harm the financial situation that both families and corporations are in.

The following real-time information indicates that markets have begun to raise premiums for risks. Which reflect political bluffs associated to a federal government bankruptcy.

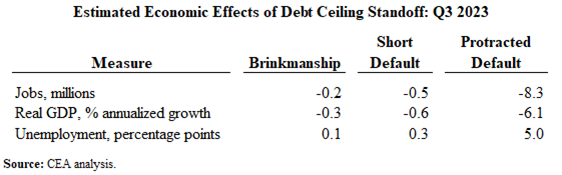

The U.S. economy would undoubtedly suffer serious harm from a real default on the debt ceiling. Analysis by CEA and independent academics shows that the economy would immediately go into reversal. If the U.S. government fell behind on its commitments, either to creditors, contractors, or people.

Table 1: Estimated Economic Effects of Debt Ceiling Standoff: Q3 2023

Table 1: Estimated Economic Effects of Debt Ceiling Standoff: Q3 2023

The positivity of a balanced economy

That is to say, if our government defaults on its debt, it could undo the historic economic progress that has been made. Since the president took office, Such as the employment of 12.6 million jobs, a near-50-year low jobless rate, and robust consumer spending. Which has regularly triggered a strong, dependable expansion engines. Backed by wages to a robust job market as well as healthy family financial statements.

In a broken-induced a downturn, the federal government would find itself powerless to implement anti-cyclical policies. And there would be few available policy alternatives to assist soften the impact on individuals and companies.

Interest rates on financial instruments used by families and companies, such as Treasury bonds, loans, and rates on credit cards. Will rise due to the dangers brought on by the default.

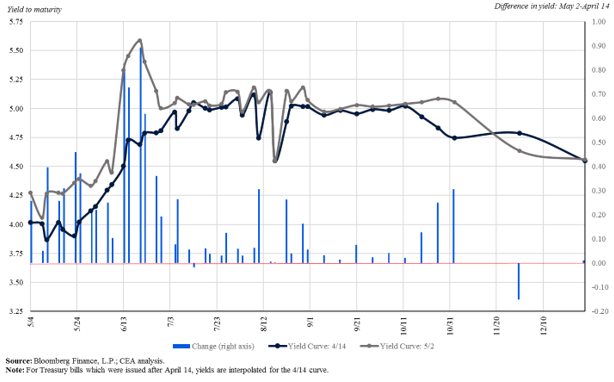

US Treasuries are offering very high yields

In reality, there is now proof that major market volatility linked to concerns over the debt ceiling. Treasury notes with maturities around the X-date are now offering much higher yields. Which immediately raises the expense of borrows for the federal government. And, consequently, for taxpayers as well.

Figure 1: Treasury bill yield curve

Figure 1: Treasury bill yield curve

Treasury bill yield curve graphical representation

The price of insuring U.S. debt has also grown significantly, reaching a record-breaking high as a consequence of growing concerns about a U.S. default. In reality, the insurance rates for U.S. debt insurance, known as credit default swap (CDS) spreads, began to rise sharply in April.

Threats of a temporary default

The damage to the economy if we exceeded the debt ceiling would probably be seen right away. Even with a temporary default, a “crisis, marked by spiked interest rates and falling prices for stocks, would be ignited.” Says Mark Zandi, Chief Economist of Moody’s Analytics. Markets for near-term financing, which are crucial for the availability of credit.

Moody’s estimates that even a brief violation of the debt ceiling may result in a drop in GDP as a whole. A reduction of about 2 million jobs, and a rise in the rate of joblessness to almost 5 percent from the current rate of 3.5 percent. Additionally, Moody’s warns that even a brief default on the debt ceiling might result in steadily rising interest rates.

Long-term dangers of default

A prolonged bankruptcy would result in much higher expenditures. The impact of a lengthy default depicts an abrupt, immediate contraction on par with the massive contraction. Pension plans will be impacted by the stock market’s 45 percent decline in 2023 Q3. The first full quarter of the modeled debt limit violation. Whereas consumer and corporate confidence suffers significantly.

Federal and state governments would be limited in the capacity to respond to this crisis. As well as to protect families from the effects if they were forced to spend on anti-cyclical programs like prolonged job insurance. Since the rate of interest rates on financial tools used by both customers and businesses will go higher than those for private sector borrowing. Consumers would also not be able to make loans.