UK CPI positive unexpected suggests a potential 50 basis point increase by the BoE. More bad news is revealed in the UK’s latest May CPI facts.

UK CPI and GBP. Growth worries could limit the sterling’s advances.

More adverse news is contained in the UK’s just released May CPI data, where the MoM rise in the CPI was 0.7% rather than the anticipated 0.4%. As a result, rather than falling to 8.4% as expected, the yearly rate stays the same at 8.7%. Which is worst is that this surprise increase is being driven by basic price pressures.

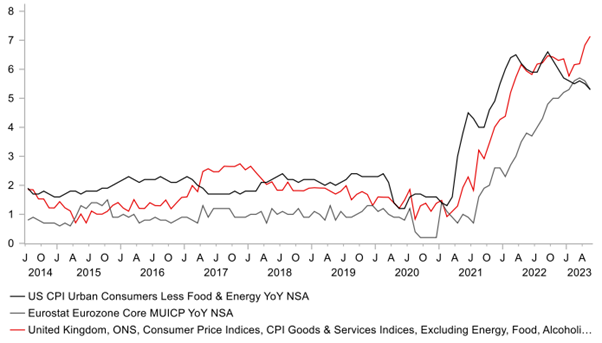

With the core CPI year-over-year rate hitting an all- time cyclical peak of 7.1 percent. higher than 6.8%. Conversely, lower YoY rate of growth in deeper inflation have begun to be seen in other advanced nations. Considering that the (BoE) had forecasted a YoY growth at 8.22% for Q2 2023 within its May predictions. This result is alarming. It looks like the Q2 YoY rate of inflation will be considerably greater than anticipated except that is a large adverse shock based on June report.

UK Inflationary Statistics

Looking more closely at the specifics reveals that Household costs increased by 1.1% MoM. Whereas Apparel & Footwear had a significant 1.3% MoM jump. Hotels and restaurants climbed by 1.0%, Recreation by 0.7%, and Communications by a mere 0.9% The inflation rate in food and beverages without alcohol decreased from 19.1% – 18.4%. Which is in accordance with other data sets. Which indicate the inflation of food peaked already, The BoE is concerned because services inflation increased from 6.9% – 7.4%. An enormous and disturbing rise at this level of tightness.

The estimations indicate that for the BoE to hit its Q2 objective, the monthly rate of inflation would need to modestly decline. Given the BoE’s projection of 8.22 percent for Q2 2023. With the successive findings of 8.7%. The OIS market displayed a price of around 30 (bps) towards tighter today in reaction to these facts. The amount has already increased dramatically at 37 bps, so it is probable this will do so for remainder of the day.

UK Core CPI sets a fresh cyclical peak alone

Source: Bloomberg & Macrobond

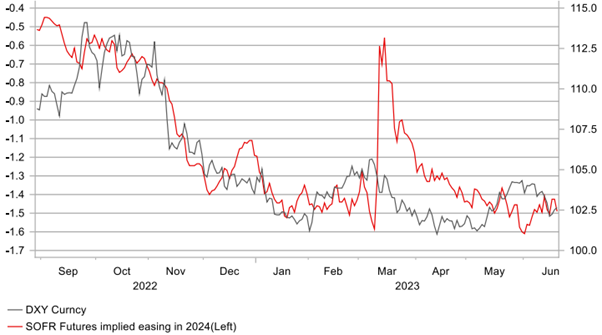

US Fed rate drop projections for 2024 played a role to the dollar’s decline.

Source: Macrobond

We can’t firmly predict whether the FOMC will abstain from raising. Since there is just one NFP and CPI data before the July conference. Nevertheless, in September, we’ll likely have a lot more concrete evidence that indicates the FOMC’s hike phase is over. By then, this will be clear that the American economy isn’t as resilient as FOMC officials have claimed.